Users keep faith in Ethereum despite market ebbs and flows

- On a YTD basis, ETH’s non-zero address count pumped 13%.

- Staking could be one of the main catalysts behind increased retail adoption.

Ethereum [ETH], the second-largest crypto asset on the planet and the biggest network for non-fungible tokens (NFT) and decentralized finance (DeFi) applications, remains a force to be reckoned with in the ever-changing crypto landscape.

Is your portfolio green? Check out the Ethereum Profit Calculator

As per data from on-chain analysis firm Glassnode, the number of addresses holding a positive number of ETH tokens surged past 104 million, marking a robust growth trajectory since its launch nearly eight years ago.

While the market weathered ebbs and flows over the years, the appetite for the largest altcoin remained unscathed. The crypto winter of 2002 did make investors cautious about the risks associated with digital assets. However, the robust recovery of 2o23 helped dispel the negative sentiment to a great degree.

On a year-to-date (YTD) basis, ETH’s non-zero address count has pumped 13%.

Individual investors see growth potential

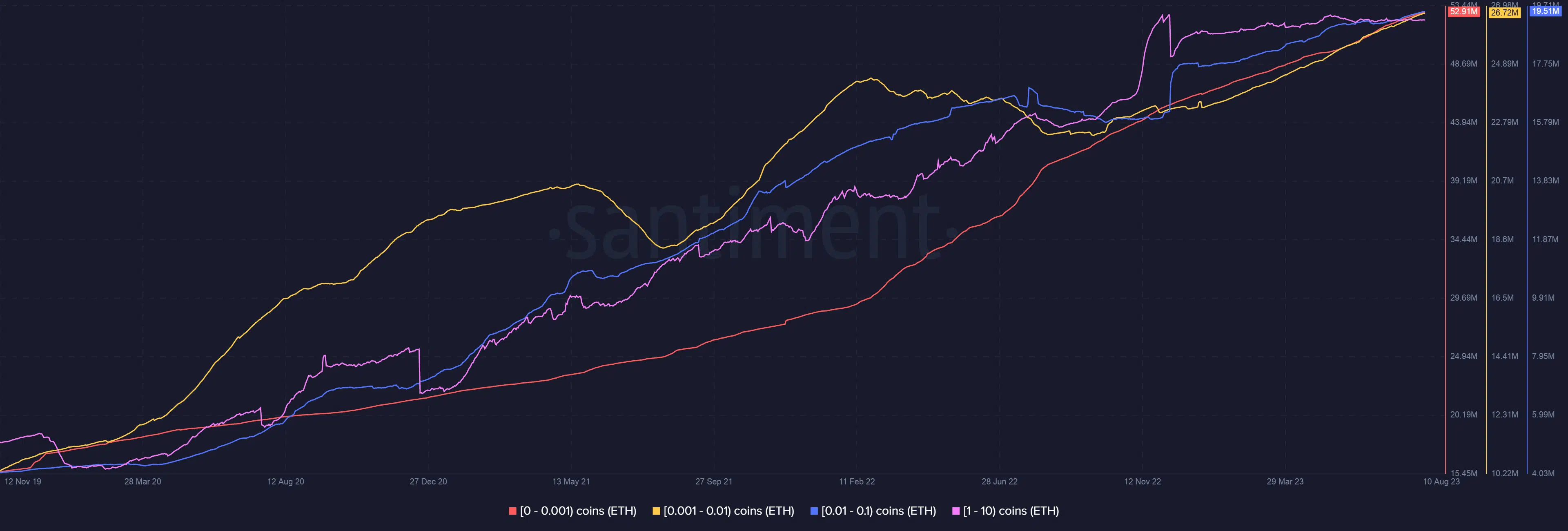

Interestingly, retail investors exhibited significant interest in ETH’s long-term prospects. Data from Santiment highlighted that the supply amassed by wallets who held between 0-10 ETH grew considerably over the last four years.

Often, individual crypto user trends are drowned out by the cacophony of whales and big investors. However, if crypto assets intend to become a preferred form of savings and a transaction medium, it’s imperative that they get accepted by the general public.

Staking plays its part

Staking, which allows users to lock their ETH holdings in the hopes of earning yields, could be one of the main catalysts behind increased retail adoption. Since the execution of two major events – the Merge and the Shapella upgrade – staking has become lucrative with staked value in ETH consistently hitting new all-time highs (ATH).

? #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 27,181,897 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/Bd0fFXW81V

— glassnode alerts (@glassnodealerts) August 10, 2023

DeFi activity bounces back

Keeping the promising growth in non-zero addresses aside, Ethereum’s decentralized finance (DeFi) landscape also showed signs of recovery. According to IntoTheBlock, the total value locked (TVL) in Ethereum bounced back from last week’s lows to $41.5 billion as of 9 August.

Read Ethereum’s [ETH] Price Prediction 2023-24

The increasing interest demonstrated by DeFi investors, however, was not mirrored by ETH’s price activity. The altcoin’s bulls have struggled to lift the price beyond $1870 since the start of August.

At the time of writing, ETH exchanged hands at $1,856.66, data from CoinMarketCap revealed.