Crypto now more stable than oil: Decoding this turn of events

- The lack of external catalysts forced top cryptos to stay glued to their narrow ranges.

- Experts said that the silent phase could be utilized for innovations in the industry.

The fiercest critics of cryptocurrencies’ high volatility may be finding it hard to stomach the ongoing dynamics of the market. For the uninitiated, the crypto market was exhibiting more stability than the oil market as of 16 August.

??#BTC and #ETH 90-day #volatility just dropped to multi-year lows at 35% & 37% each, making them less volatile than oil at 41%.??️ pic.twitter.com/VMfTW53goG

— Kaiko (@KaikoData) August 16, 2023

Are your BTC holdings flashing green? Check out the Bitcoin Profit Calculator

According to digital assets data provider Kaiko, the 90-day annualized volatility for Bitcoin [BTC] and Ethereum [ETH] plummeted to multi-year lows of 35% and 37%, respectively. This made them less volatile than the ‘Black Gold,’ which was at 41%.

Digital Gold vs Black Gold

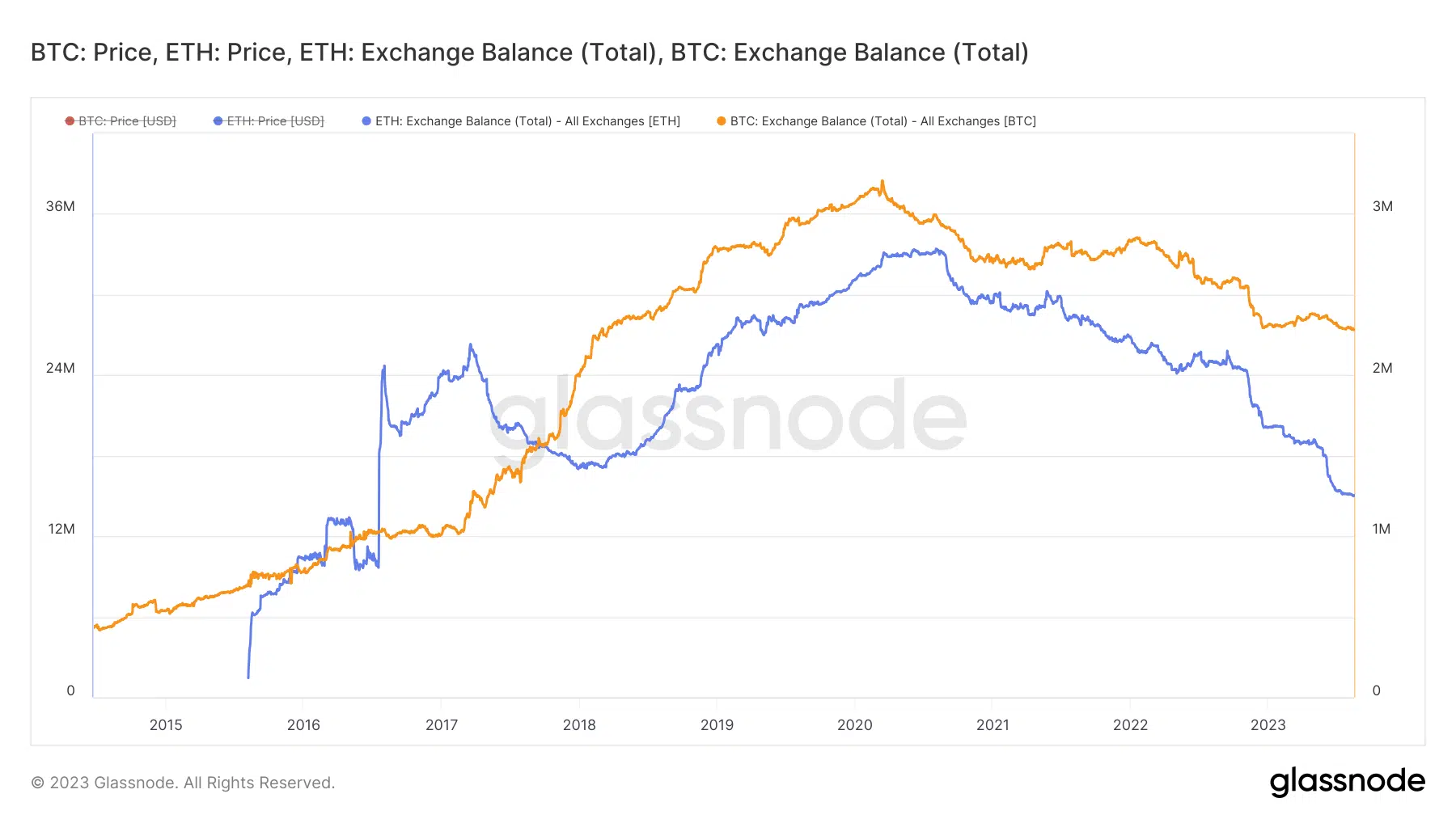

The two largest cryptos by market cap have remained glued to narrow trading ranges, with no directional breakout from the gains earned through the last meaningful rally in June, per Glassnode.

The June rally was built on the hype around TradFi interest in digital assets. However, things haven’t moved faster since then. The U.S. Securities and Exchange Commission (SEC) pushed back the deadlines for several spot ETF approvals to 2024, as the regulator subjects the crypto instruments to stringent examination.

The delay triggered anxieties among participants with both BTC and ETH recording week-to-date (WTD) losses of more than 3%.

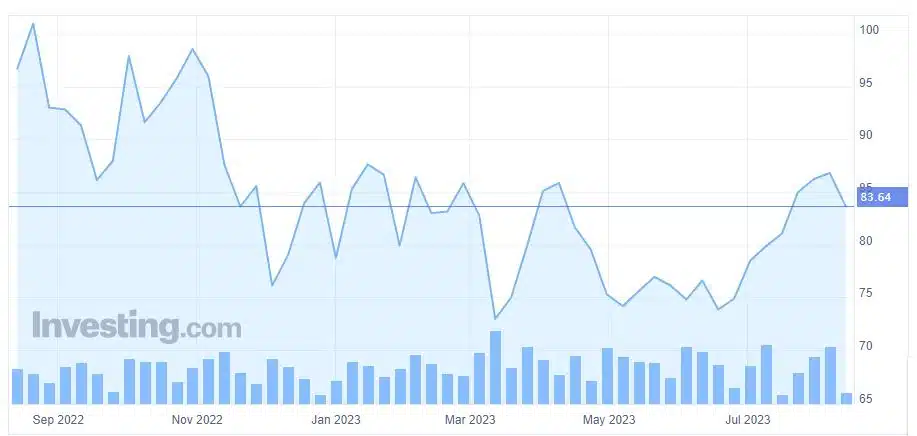

On the other hand, continuous supply curbs have sent crude oil benchmark indices like the Brent Crude and West Texas Intermediate (WTI) soaring. Since mid-June, Brent Crude has shot up by more than 12% until the press time value of $83.61, according to Investing.com.

WTI was up 15% in the same time period.

The dip in crypto assets’ volatility could be attributed to shrinking liquid supply, i.e. the number of tokens available for buying and selling. BTC and ETH reserves on exchanges hit multi-year lows at the time of writing.

Is your portfolio green? Check out the Ethereum Profit Calculator

What does low volatility mean for the market?

Gracy Chen, Managing Director at crypto exchange Bitget, said that the drop in volatility could have severe ramifications for the crypto industry, saying:

“Lower user demand leads the entire industry to tighten profit margins, resulting in layoffs of employees and blockchain workers’ transition to other industries. The inflow of off-site capital slows down significantly, and the industry enters a period of decline.”

However, she added that the calm phase presents an opportunity for further innovation in the industry as developers could better focus on building products as per market needs.

Her views were echoed by Iakov Levin, co-founder of decentralized asset management platform Locus Finance. He stated that the market was in a sort of rebuilding phase after the bloodbath of 2022, acknowledging:

“Right now is the time when the industry focuses on building and laying the foundation for the next few years while enjoying silent times. It is not an interesting period, but the most important in the development of the industry.”