Maker’s DSR reduction opens up the exit door for whales- Here’s how

- Whales, including Justin Sun, pulled funds out of the DSR pool.

- Maker’s TVL and active addresses decreased.

Maker’s [MKR] recent reduction in the Dai Savings Rate (DSR) has resulted in some consequences that may not sit well with the project. The DSR, which is the interest rate paid to Dai holders, plays a crucial role in maintaining the stability of the Maker protocol.

How much are 1,10, 100 MKRs worth today?

And since Maker lowered it from 8% to 5%, whales have been withdrawing their assets from the DSR pool. The DSR pool operates similarly to centralized trading with the order book. But the difference is that the DSR interacts with smart contracts while regular trading on CEXes does not.

Whales get DAI’s out of the way

According to Arkham Intelligence, whales like Tron [TRX] founder Justin Sun redeemed 206 million in DAI from the pool. Sun, making use of another of his wallets, redeemed 235,556 WSTETH from the pool.

Previously, Maker experienced an influx of liquidity into the DSR following a hike of the rate to 8%. Thus, by lowering the DSR, Maker may have opened up the overall health of its ecosystem to risks due to the potential impact on borrowing demand.

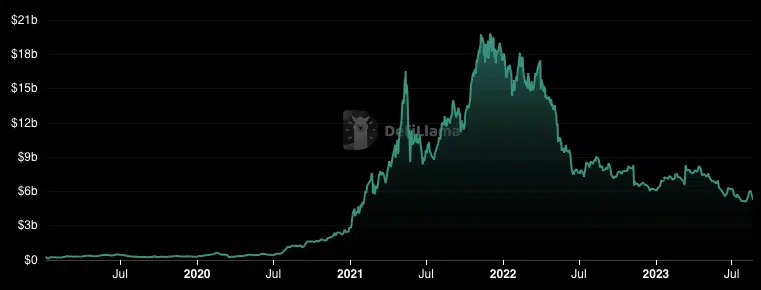

But has there been any impact on the Total Value Locked (TVL)?

The TVL measures the total value of assets locked or staked in a protocol. The higher the TVL, the more trustworthy the protocol is perceived to be, and otherwise.

Well, DefiLlama’s data revealed that Maker had lost 8.41% of its TVL in the last 24 hours. This decline also ensured that the metric seven-day performance was a 13.26% decrease.

Protocol activity falls

Therefore, the decline in TVL suggests that investors may have identified some red flags in the Maker protocol. And, in turn, were restricting deploying more liquidity.

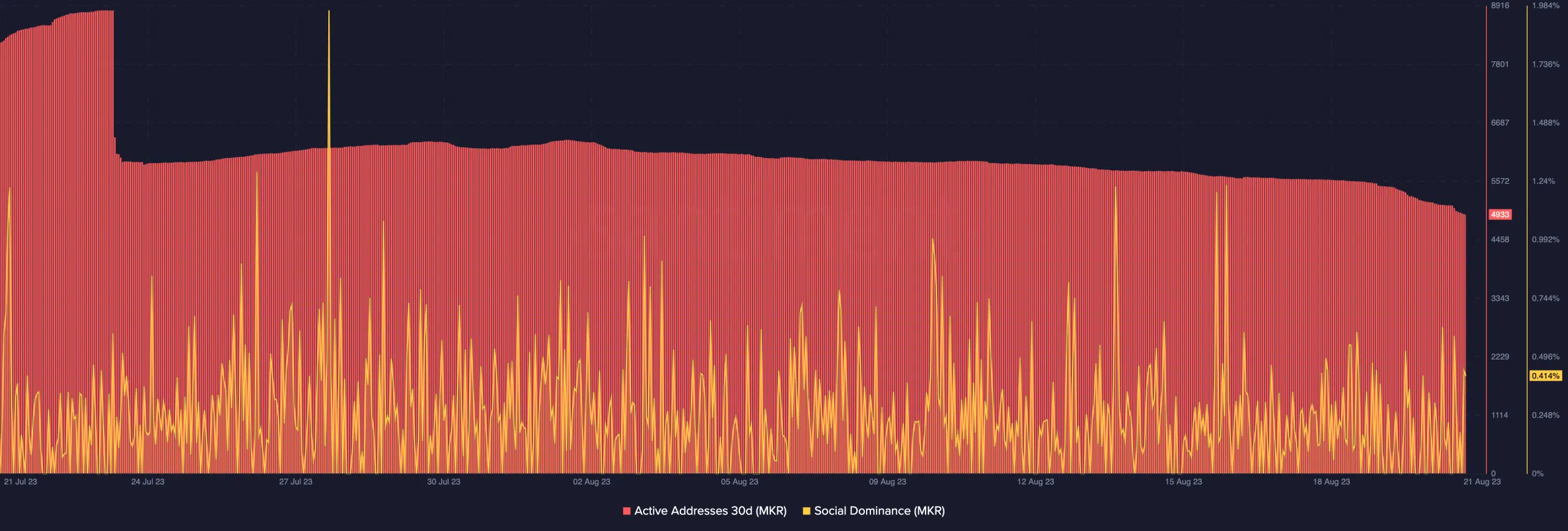

The exits by whales may have also affected other parts of the Maker ecosystem. For instance, the active addresses which maintained almost the same number since July fell.

Active addresses serve as a good indicator of daily users over a blockchain. And an address is considered active once it becomes a sender or receiver in a transaction. Therefore, the decline in the metric suggests that MKR transactions have been lower than in the aforementioned period.

Is your portfolio green? Check the Maker Profit Calculator

In terms of social dominance, Santiment showed that Maker rose to 0.41%. Social dominance shows the share of the discussions in crypto media that is referring to a particular asset or phrase.

So, the hike in social dominance means that the market may rebound, regardless of the whales’ exit. And Maker could benefit from the recovery.