How MakerDAO’s strategies have galvanized demand for DAI, MKR

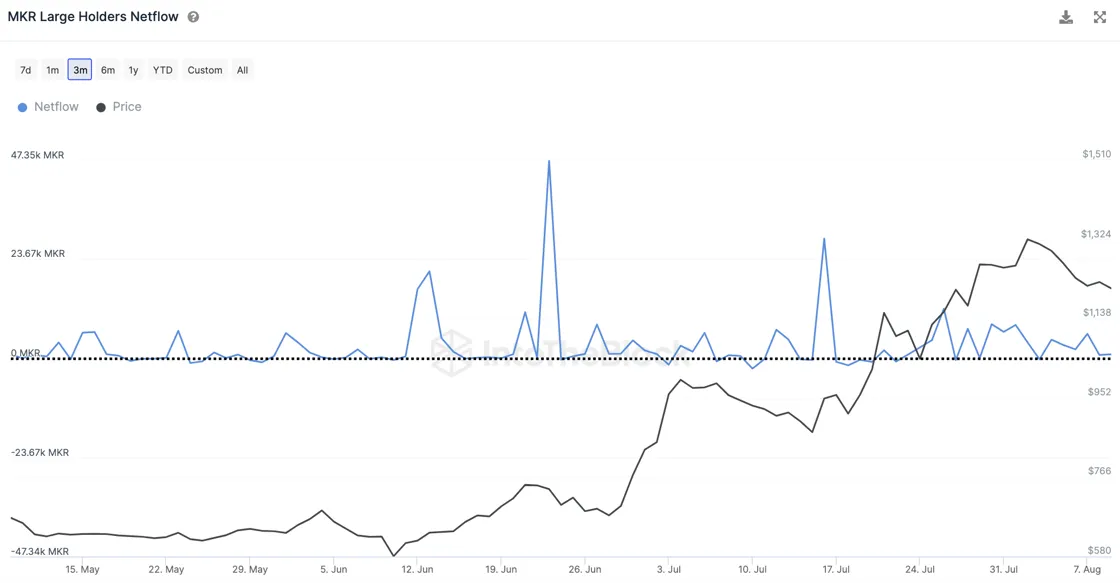

- Over the last two months, MKR supply sent to exchanges has steadily pushed higher

- DAI’s circulating supply registered the highest growth since March’s banking crisis

MakerDAO [MKR], popularly referred to as the decentralized central bank, has risen in prominence over the last few months with carefully calibrated business moves.

By effectively controlling the supply and demand dynamics of its popular stablecoin offering, DAI, the lending protocol has attracted users back to its fold. A expected, the native utility token MKR has been one of the biggest beneficiaries.

Read Maker’s [MKR] Price Prediction 2023-2024

‘Maker’ of fortunes

According to data from on-chain research firm IntoTheBlock, MKR has been one of the best performing crypto-tokens in the market of late, nearly doubling its value over the last three months. At the time of publication, MKR exchanged hands at $1,228 with its market cap having breached the $1 billion ceiling.

The data also revealed significant inflows into the wallets of large investors, indicating that the appetite for MKR has begun to build.

This price appreciation pushed these investors to offload their bags for gains. As a result, over the last two months, MKR supply sent to exchanges has steadily pushed higher while the illiquid supply has fallen.

MakerDAO’s recent efforts to boost DAI demand are at the foundation of MKR’s growth. But then the question arises – What value MKR derives from DAI’s adoption?

MKR hinges on DAI’s adoption

As is well known, MakerDAO offers lending services through its crypto-collateralized stablecoin DAI. Users lock up crypto assets in smart contracts, also called as collateralized debt positions (CDPs). Subsequently, new DAI tokens are released to them in exchange for the collateral.

Like conventional banks, Maker charges an interest, called stability fee, which users need to repay when they withdraw locked collateral. This is where MKR’s utility comes into play.

The stability charge may only be paid in MKR tokens, and once paid, the MKR is destroyed, removing it from circulation. This effectively means that if the adoption and demand for DAI increases, the demand for MKR will also grow. Needless to say, scarcity contributes significantly in boosting the growth of MKR.

Now that the link between the two ecosystem tokens is firmly understood, it’s important to analyze the major event which gave a fillip to DAI over the past week.

DAI back in action

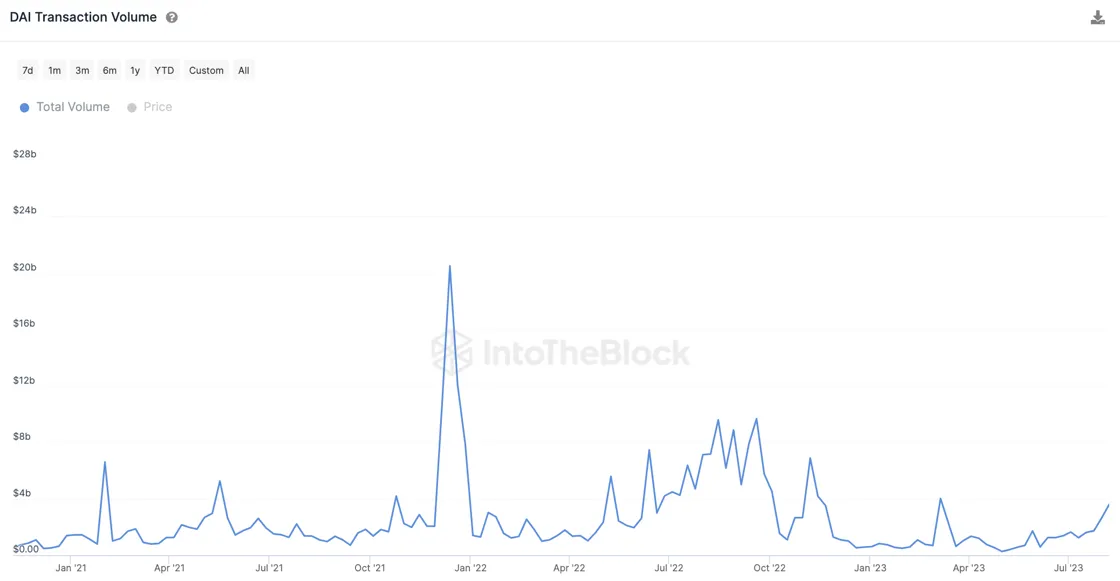

According to IntoTheBlock, DAI transaction volumes hit its highest figures since the unfortunate de-pegging episode in March, during which its value slipped to as low as 97 cents.

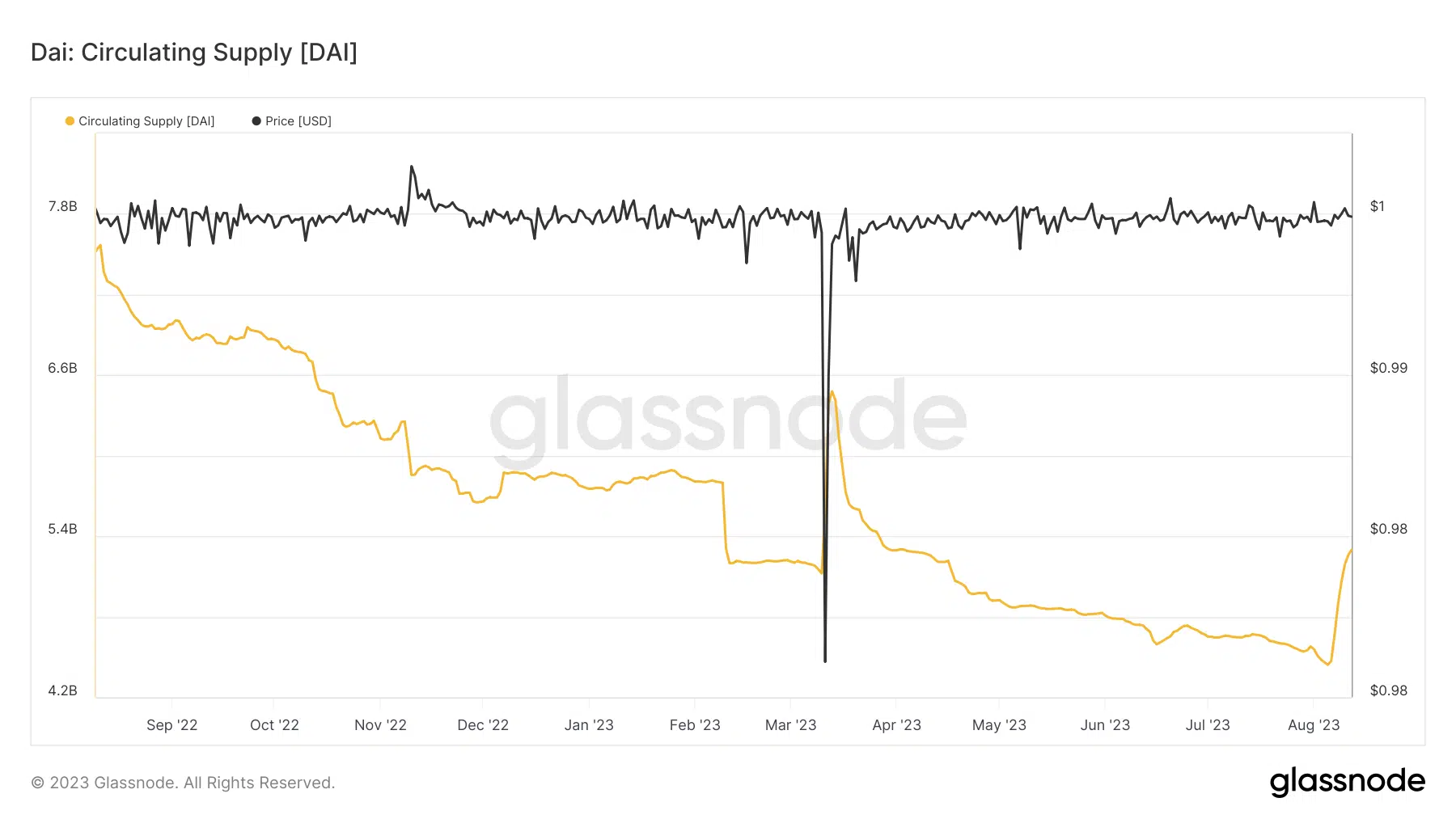

Recall that the de-peg resulted after USD Coin [USDC], which formed a substantial amount of DAI’s collateral reserves, was caught in the whirlwind of the U.S. banking crisis. Notice how DAI’s circulating supply shrank as investors scrambled to redeem their DAI holdings, as per data from Glassnode.

However, cut to the present and we can see a sharp uptick. Ergo, the question – What has energized DAI?

MakerDAO allows depositors to earn interest on the DAI they keep in the DAO’s bank. Based on the DAI savings rate (DSR), tokens continuously accrue value. Thus, DSR acts as a potent monetary policy tool for Maker to influence the demand and supply of DAI.

MakerDAO recently hiked the DSR to 8%, incentivizing users to lock their DAI holdings for better rewards. The results were immediate. The amount of DAI being sent to the DSR contract surged by $1 billion over the past week.

How much are 1,10,100 MKRs worth today

The broader impact on DeFi landscape

The prospect of a yield-bearing stablecoin could help in unlocking new avenues of DeFi growth. Popular lending protocol Aave [AAVE] recently floated a proposal to list liquid DSR deposit tokens (sDAI) as collateral. This could offer users the dual benefit of earning DSR yield while utilizing their assets as collateral.

Most of the yield was funded through the protocol’s revenues. Additionally, according to data from Makerburn, Maker’s annualized fee revenue hit $165 million at the time of publication, representing a 236% growth over the last three months.

A big chunk of the revenue was earned through U.S. Treasury bonds too.

Of late, Maker has tried to give real-world assets (RWAs) a bigger role in DAI’s collateral reserves, evidenced by proposals to increase holdings of U.S. treasury bonds. These strategic steps are intended to avoid the hazards linked with crypto-reserves that surfaced during the USDC crisis.