Aave’s GHO unable to reach $1 peg: What now?

- At the time of publication, GHO was worth $0. 96.

- Aave undertook measures like hiking borrowing rates and launching GSM to correct the peg.

Stablecoins are seen as the oasis of stability in the turbulent world of cryptocurrencies. However, their utility lasts as long as they maintain their peg to the underlying asset, whether it is fiat currencies like the U.S. dollar (USD), or a crypto asset.

Read Aave’s [AAVE] Price Prediction 2023-24

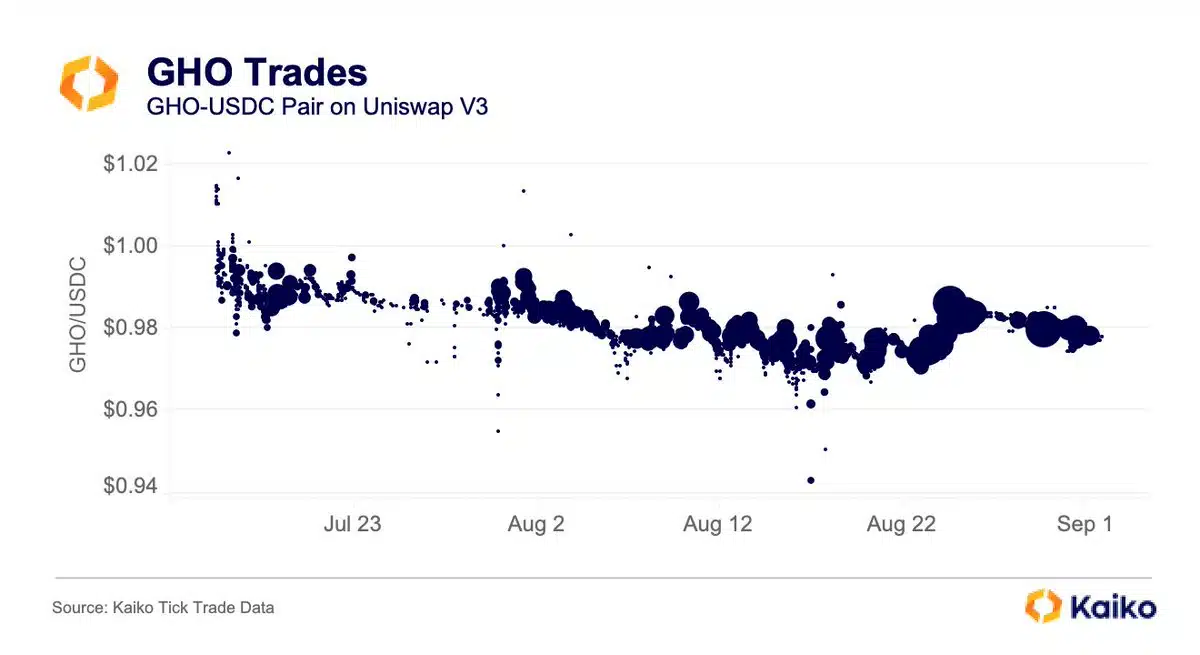

According to a recent post by digital assets’ data provider Kaiko, lending protocol Aave’s [AAVE] stablecoin, GHO, has failed to reach the ideal $1 peg since its launch in mid-July. At the time of publication, the stablecoin was worth $0.96.

Not enough demand for GHO

The algorithmic stablecoin was launched on the Ethereum [ETH] blockchain, with Aave users getting the option to borrow it by depositing crypto collateral worth more than the GHO being borrowed.

The initial response was promising, and the stablecoin soared to a circulating supply of more than 21 million within a month of its launch, data from DeFiLlama revealed. The attractive lending rates of 1.5% played a major part in boosting GHO’s market cap.

However, while supply has increased, insufficient demand has stopped GHO from reaching its peg.

Kaiko noted in an earlier report:

“Currently, there are few use cases for GHO, meaning that many who minted GHO immediately sold it for another stablecoin.”

Will this solution work?

Spotting the root of the problem, Aave governance floated a proposal to hike the borrowing rate from 1.5% to 2.5%. The rationale behind the raise was that borrowers would be tempted to buy back GHO and repay their loans.

While this may lower the token’s market supply, it may eventually drive it closer to its dollar peg.

Aave DAO ratified the proposal unanimously. As seen in the above graph, the attempts started to reap awards as GHO’s circulating supply fell by more than 13% in the last two days.

How much are 1,10,100 AAVEs worth today?

Arbitrage opportunities on the way

A big part of the problem also arises because of a lack of a robust redemption mechanism and arbitrage opportunities. Unlike other stablecoins, arbitrageurs can’t profit from depegging events in GHO.

However, this could change with the upcoming launch of the GHO Stability Module (GSM). The Module would allow users to mint GHO using other stablecoins as collateral. As a result, GHO issued through the GSM can be redeemed 1:1 for the underlying stablecoin collateral.