Binance NFTs remain resilient in uncertain market

- Despite BNB’s recent price struggles, NFT activity on BNBchain remained robust.

- Binance faced challenges such as declining dApps and legal issues, which could impact both the protocol and token.

Despite recent price challenges faced by Binance [BNB] and the BNB Smart Chain [BSC], the platform has seen significant activity with its NFTs, indicating a semblance of resilience in its ecosystem.

Is your portfolio green? Check out the BNB Profit Calculator

Ecosystem remains adaptable

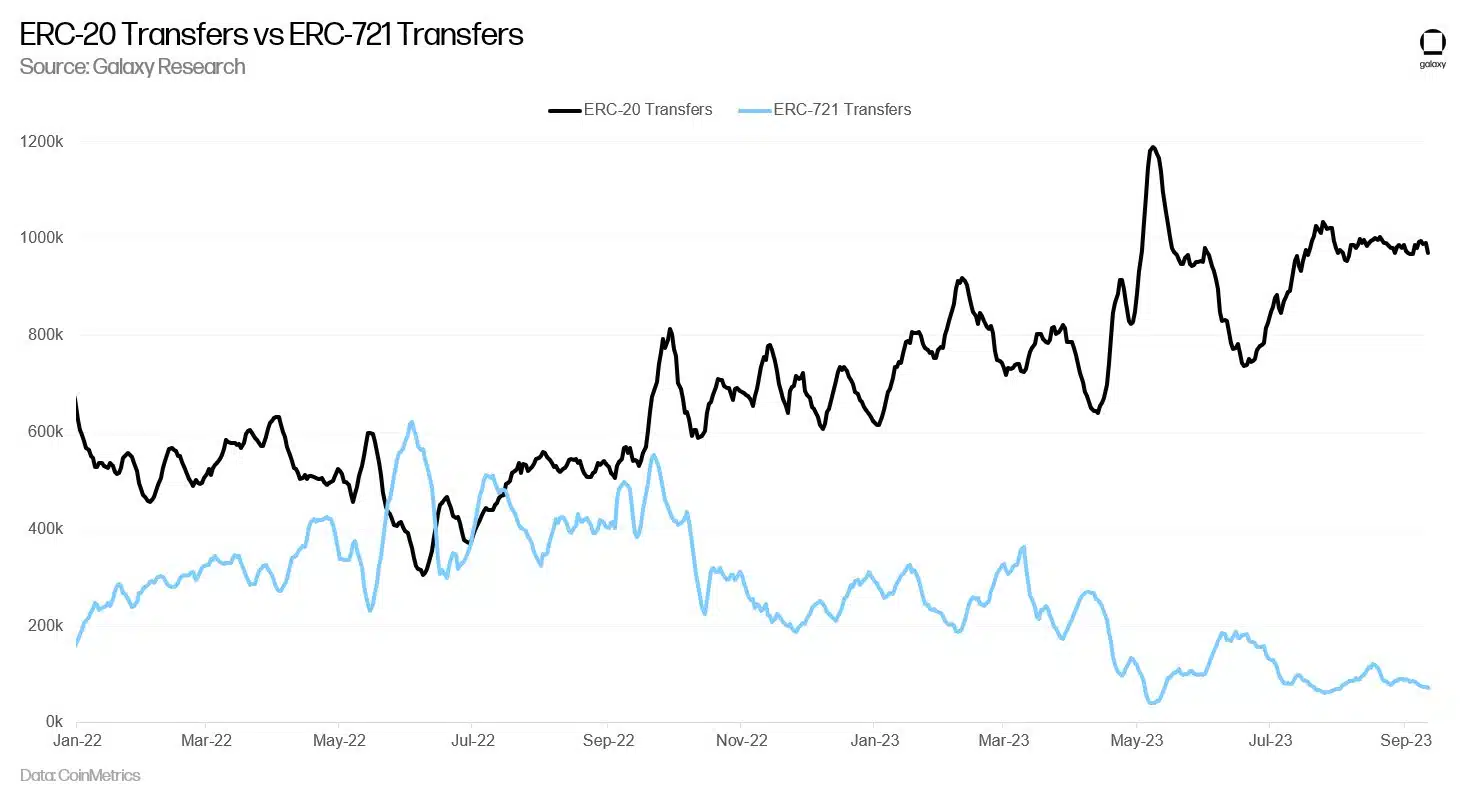

Galaxy’s data highlighted that Ethereum [ETH] and BSC boasted the highest numbers of active addresses interacting with NFTs. Ethereum took the lead at press time with 28k daily active NFT addresses, closely followed by BSC with 27k.

When considering the 30-day Simple Moving Average (SMA), there were a collective 67.5k active NFT addresses across various networks at the time of writing. This surge in NFT activity held promise for the BNB’s future.

The DeFi ecosystem

However, it’s not all smooth sailing. Some of Binance’s key dApps, like PancakeSwap [CAKE], faced declining performance.

Moreover, DappRadar revealed a 29.78% drop in unique active wallets, an 18% decrease in the number of transactions, and a substantial 28.7% decline in volume over the last 30 days.

These dwindling dApp metrics could potentially impact the overall protocol, raising concerns about user engagement and activity. It’s vital for Binance to address these issues and work on strategies to reinvigorate its dApp ecosystem.

On the same note, the Total Value Locked (TVL) on BSC also witnessed a material decline in recent weeks. Concurrently, decentralized exchange (DEX) volumes have experienced significant reductions.

These negative trends in TVL and DEX volumes could further affect the protocol’s overall health and usage. Binance may need to explore new incentives or improvements to regain TVL and DEX activity.

Looking at the price

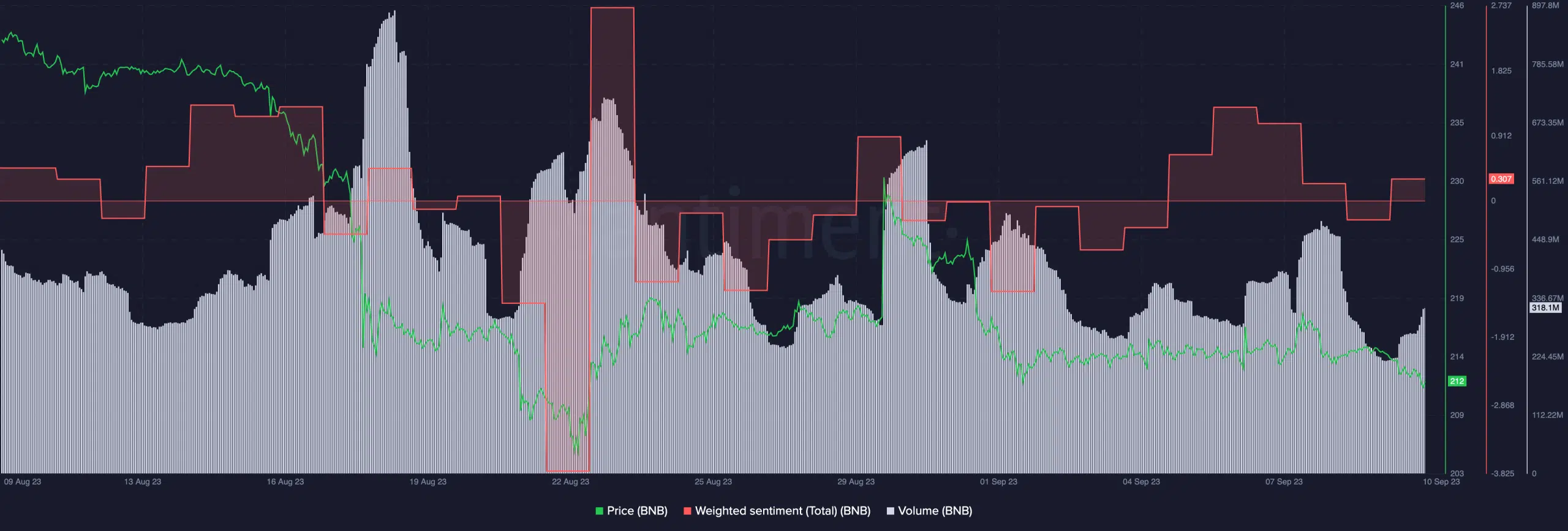

The price of BNB itself has faced a decline in recent weeks, with the token trading at $212 at press time. Additionally, trading volumes for BNB have diminished, indicating reduced trading interest.

Nevertheless, despite these challenges, the weighted sentiment for BNB remained relatively high at press time. This suggested that despite the price fluctuations and declining metrics, the community and market sentiment around BNB remained positive.

This resilience could be attributed to the broader trust in Binance and its ecosystem.

Realistic or not, here’s BNB’s market cap in BTC’s terms

Looking forward, it’s essential to consider external factors that may influence the BNB protocol and its token. Binance’s ongoing legal issues and regulatory concerns in various jurisdictions could impact the platform’s operations and reputation in the coming months.

These external pressures may contribute to the overall uncertainty surrounding the BNBchain, and Binance should continue its efforts to address these concerns transparently.