How is Solana’s value affected by social media-induced FUD, commentary

- SOL plunged by nearly 10% when social mentions of the asset skyrocketed on FTX’s liquidation plan

- SOL regained some sense of steadiness at press time

Despite their evolving technology and growing utility, crypto-assets are still heavily influenced by speculation and social media-induced FUD. The quintessential illustration of this theory could be Solana [SOL], the tenth-largest digital asset by market cap.

Is your portfolio green? Check out the SOL Profit Calculator

Solana highly sensitive to FUD

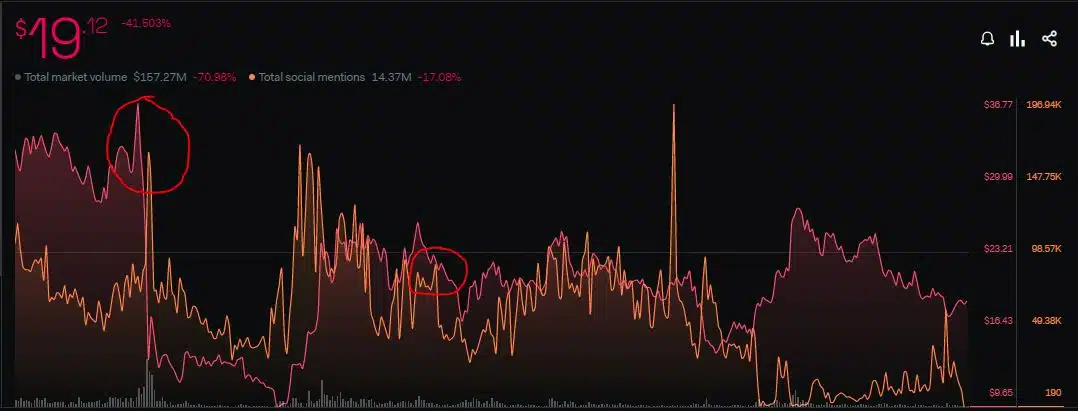

An on-chain analyst who goes by the pseudonym Emperor Osmo took to social platform X to draw attention to the strong correlation between negative social commentary on SOL and the subsequent impact on its price.

It is intriguing to observe the correlation between social media-induced FUD regarding $SOL and its impact on price performance. pic.twitter.com/AR4ZYgJqLD

— Emperor Osmo? (@Flowslikeosmo) September 17, 2023

The most recent example that comes to mind is the FUD surrounding FTX’s upcoming liquidation plan. The bankrupt exchange got court approval to sell its assets, a vast majority of which is held in SOL.

Holders are concerned that the market might be flooded with SOL coins in the near future, resulting in a strong downward pressure on its value.

The attached graph highlights how SOL plunged by nearly 10% as social mentions of the asset skyrocketed. This, despite the plan having adequate safeguards in place, such as placing a cap on the weekly liquidation value.

Blast from the past

The association with FTX brought misery to SOL in the past as well. The stunning collapse of the exchange in the fall of 2022 brought down the market with it.

SOL, on the other hand, sustained significantly more damage as a result of FTX Founder Sam Bankman-Fried’s backing and investments in several of Solana’s projects.

In this case too, SOL’s social mentions surged to new heights with prices following in the opposite direction, as indicated by LunarCrush’s data.

Solana’s history is also marred by periodic network disruptions. These have eroded its relative advantages in speed and efficiency. Earlier in February, Solana suffered a major outage which lasted nearly 20 hours.

The glitch birthed another series of negative commentary around SOL. Words like ‘concern’ and ‘outage’ were frequently used in tandem with SOL in that phase.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Will SOL ride out the storm?

It was therefore expected and evident that a surge in social activity was invariably followed by a drop in SOL’s value. However, as far as the most recent case is concerned, the FUD appeared to be subsiding at press time.

In fact, SOL was up by 4.26% on the 7-day chart, with the 24-hour price action noting some appreciation too.