UNI gains more than 10% in a week as bulls seek to undo recent losses

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- UNI retains a bearish structure on the one-day timeframe

- A rejection from a local high could be on the cards

Uniswap [UNI] was in the news recently after a research firm concluded that the liquidity on Uniswap V3 could reach $1 trillion. Another report highlighted the growth of Uniswap as a high-volume DEX, which strengthens the position of long-term UNI investors.

How much are 1, 10, or 100 UNI worth today?

UNI prices have been in a downtrend over the past month. A retest of a higher timeframe support zone saw a notable bounce for UNI, but this does not break the trend. The lower timeframe sentiment begun to shift.

Uniswap labors within a downtrend but a structural break could be close

Despite the strong bounce over the past week, the Relative Strength Index (RSI) on the one-day chart continued to remain beneath the neutral 50 mark. That could change, though, as the indicator stood at 46 at press time. Alongside the trend, the market structure of Uniswap was also bearish. The recent lower high at $4.53 must be beaten before this bias can flip bullishly.

Yet, the trading volume has been in decline since August. The On-Balance Volume (OBV) was also indifferent to the recent rally and could not breach the local peaks formed in the past three weeks. Unless this changes, the idea of a strong UNI rally would be dubious.

A move to the $4.5-$4.6 region would present a low-risk shorting opportunity. However, if UNI can break above and retest the same as support, swing traders can look to buy the token. To the north, the $4.87 and $5.2 resistance levels can be the take-profit targets.

The short-term market sentiment is already bullish

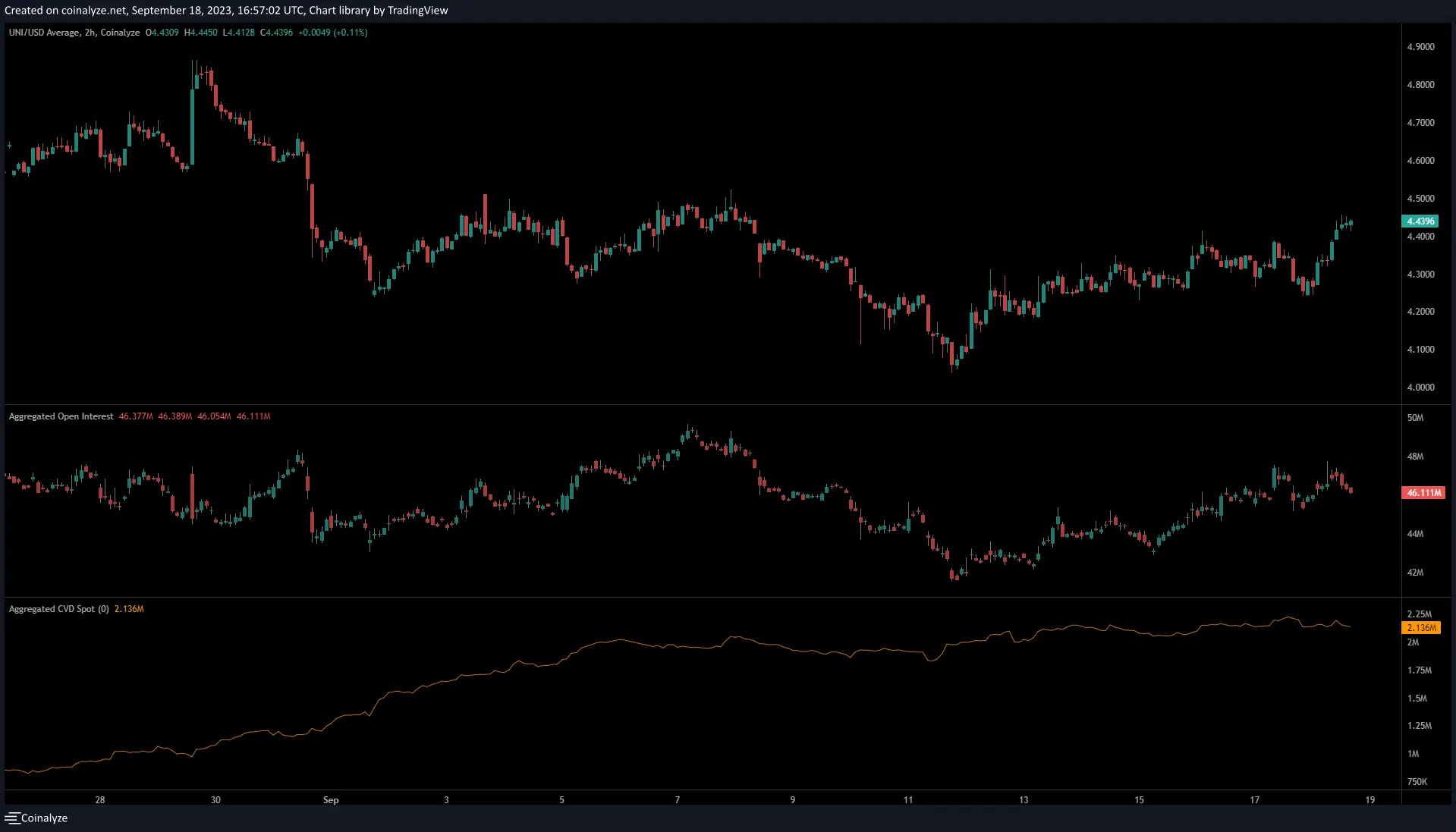

Source: Coinalyze

After 11 September, UNI’s ascent on the price front was accompanied by a rise in the Open Interest. This signaled bullish conviction and bidders in the futures market expecting further gains. It was complemented by a minor move higher on-the-spot CVD.

Source: MobChart

The orderbooks noted a significant pocket of liquidity at $4.5 and $4.8, both of which were also recent lower highs. It was possible that UNI prices would tap these liquidity pockets before a bearish reversal.

Realistic or not, here’s UNI’s market cap in BTC’s terms

Overall, even though Uniswap noted impressive gains over the past week, it remained likely that the downtrend on the daily timeframe would continue. A Bitcoin [BTC] rally past $28k could fuel bullish hopes for UNI.