Will Uniswap’s V3 liquidity reach $1 trillion?

- JIT LPs preferred to earn ETH over USDC.

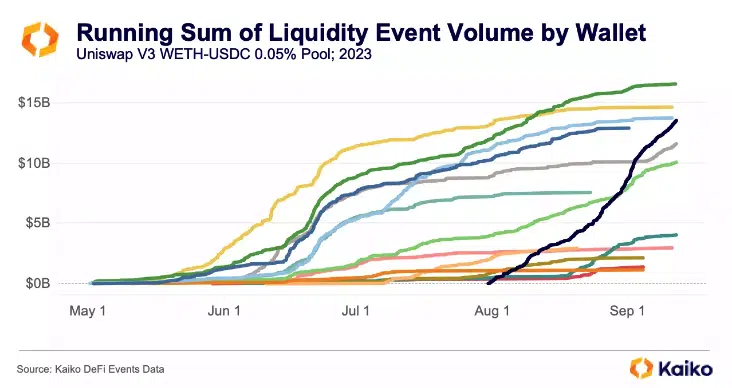

- While volume decreased at some point, it recovered in June.

This year, the liquidity on Uniswap [UNI] V3 has hit $75 billion. But the same metric could be on its way to $1 trillion, according to a recent analysis provided by research firm Kaiko.

How much are 1,10,100 UNIs worth today?

To explain this possibility, Kaiko considered the Just-In-Time (JIT) liquidity. It also looked at the transactions, and event volume existing on the Automated Market Maker (AMM).

ETH before USDC

First, it’s important to define what the JIT is, especially for the unaccustomed. The JIT liquidity is a liquidity provision strategy found in AMMs like the Uniswap Protocol, where a liquidity Provider (LP) mints and burns a concentrated position immediately before and after a swap.

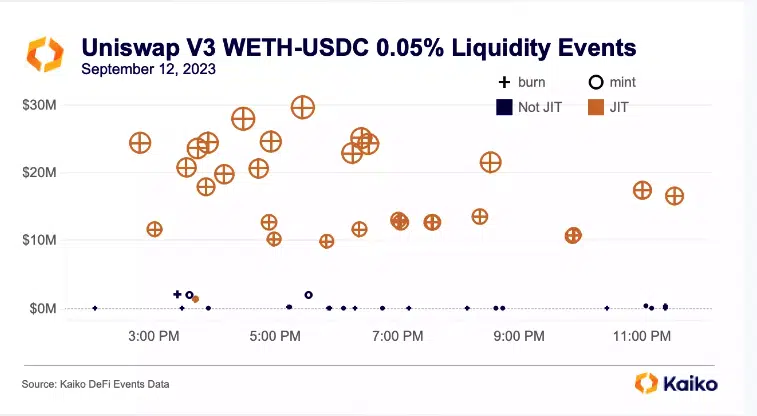

Kaiko, in its report, considered the WETH-USDC pool, explaining how JIT transactions were notably larger than regular transactions, with a minimum size of $10 million.

To understand the image above, the leading crypto market provider explained that:

“JIT transactions are colored in orange, while regular transactions are in blue. The crosshairs represent a mint and burn of the same USD value in the same block.”

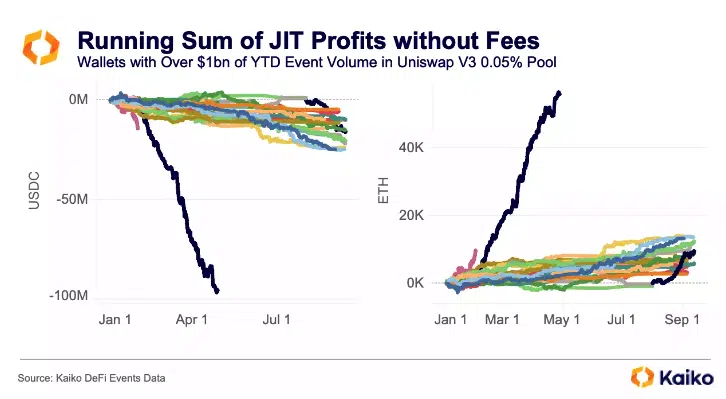

Another way to evaluate the $1 trillion projection is by looking at the way wallets are conducting transactions. From the report, Kaiko mentioned that the top wallets were ending transactions with more Ethereum [ETH] than USD Coin [USDC].

As a result of this resolve, the top wallets on Uniswap V3, which included JIT LPs, preferred to operate in blocks where ETH’s price decreased. This action ensured that LPs received more ETH than USDC. In turn, this leads to more profits for the liquidity providers.

Prepare for the consistent influx

Furthermore, the report mentioned how most JIT transactions were in the $20 million to $40 million region. Due to this, JIT LPs made more in income fees, reducing their exposure to USDC, and increasing it to ETH. The report noted,

“It’s quite rare for a JIT transaction to profit more than $5k. However, as another paper found, for JIT LPs these “portfolio change” profits contribute more to JIT LP income than fees do.”

However, there was one drawdown that Kaiko did not fail to mention. This was because USDC fell below the 1:1 dollar peg, and even below $0.90. Therefore, JIT LPs had to struggle with managing their portfolios.

Consequently, JIT volume fell. But two months later, the volume broke the $2 billion threshold again. Up until press time, the running sum of liquidity events on the WETH-USDC began surging in volume and has remained in the upward direction.

Realistic or not, here’s UNI’s market cap in ETH’s terms

More recently, JIT’s new wallets on Uniswap have done $15 billion in volume. Even though the market participants are fewer, it could well be on its way to $1 trillion. Kaiko concluded,

“The JIT market is constantly in flux, totally unseen to the average DeFi user. But JIT LPs favor this pool for three main reasons: it is consistently one of the highest volume pools in DeFi, it is very liquid, and there is only one volatile asset.”