Why Optimism’s latest decision holds promising position for OP

- The project would sell and lock 116 million tokens in two years.

- OP has more holders with profits than ARB.

In an update on 20 September, Optimism [OP] revealed it would sell 116 million tokens to seven buyers. According to Optimism, the decision was not made out of the blue. Instead, the project had a governance decision with its community before the resolution concluded.

Read Optimism’s [OP] Price Prediction 2023-2024

The sale does not affect belief in OP

Details from the token sale announcement showed that there was almost no need for OP holders to panic. This was because the sale was for treasury management purposes, and the planned transactions were subject to a two-year lock from unaffiliated third parties.

Usually, token locks assist projects in avoiding liquidity issues. Since the locked tokens cannot be traded in the open market or moved, it could help stabilize the crypto price and assure developers of the project’s commitment to its long-term objectives.

Interestingly, the disclosure came off the back of an IntoTheBlock analysis of Optimism’s on-chain state. The analysis, which was published hours before the Optimism sale update, explained that 27.19% of the total OP holders are in profit.

Compared to its closest competitor Arbitrum [ARB], IntoTheBlock noted that Optimism was doing relatively well. Regarding this, the blockchain analytics platform noted that,

“While this figure might initially appear low, it is critical to contextualize it within the broader market. For instance, we see much lower percentages with ARB, where 96.19% of holders are at a loss.”

Early signs of success?

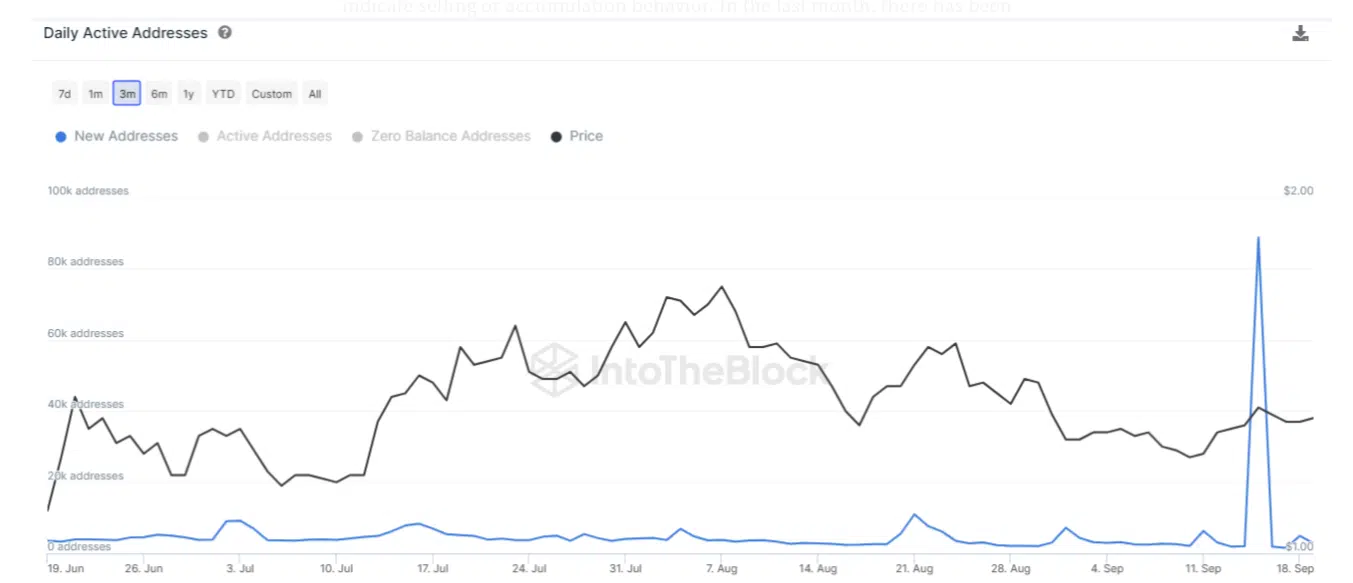

But that was not the only indicator that reflected Optimism as a “full of promise” project. Another metric that indicates the positive perception the broader market has toward OP is the active addresses.

Active addresses show the number of distinct addresses involved in the transfer of an asset within a specific timeframe.

For OP, it has not only witnessed a surge in active addresses, but new addresses have also been flowing into the network at a very rapid rate. For instance, toward the end of August, Optimism recorded an 11,000 increase in new addresses.

Also, September started with a bang for the Ethereum [ETH] L2. In the first week of the month, 7,200 new addresses joined, and on 15 September, there was a tremendous increase of 88,000 for the metric.

The hike in new addresses signifies superb network growth for Optimism. It also illustrates increasing user adoption and a jump in the project’s traction.

As per exchange activity, IntoTheBlock revealed that about $343 million worth of OP left the shores of exchanges in August. Combined with the increase in the creation of new addresses, the exchange withdrawals suggest that many holders may be ready to keep OP for the long term.

Realistic or not, here’s OP’s market cap in ARB terms

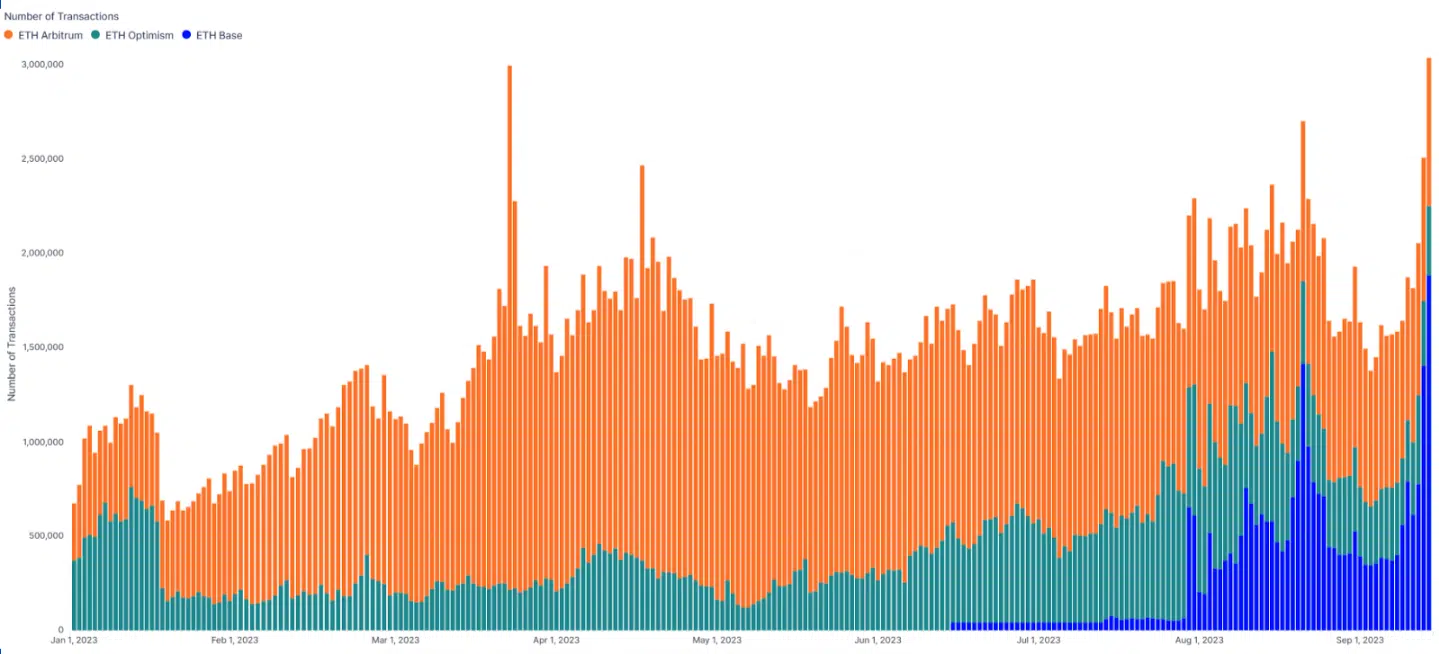

Finally, how does Optimism compare to other L2s? Well, IntoTheBlock mentioned that Optimism’s development around the SuperChain and OP Stack has pegged back Arbitrum’s initial dominance.

However, Coinbase’s L2 Base has led both Arbitrum and Optimism in terms of transactions lately. Regardless, Optimism still seemed like a fierce competitor to Base than Arbitrum considering the circumstances at press time.