Bitcoin: What do the next 2 years hold for BTC?

- Analyst Lyn Alden expressed a bullish 2-year view on Bitcoin, citing long-term potential and resilience.

- Bitcoin’s market indicators, including price, Open Interest, and sentiment, offered positive signs for future growth.

With Bitcoin’s [BTC] price surge inciting optimism in the crypto world, analyst Lyn Alden shared a favorable long-term view on both the king coin and gold, citing potential fiscal challenges ahead. Notably, she expressed a 2-year bullish perspective on Bitcoin.

Is your portfolio green? Check out the BTC Profit Calculator

Analyst’s positive outlook

Alden emphasized Bitcoin’s resilience, even in the face of a global coordinated crackdown.

She suggested that Bitcoin only requires a few small, decentralized footholds in various jurisdictions to endure such challenges, offering profit potential to those who support these decentralized bases.

This outlook is promising for Bitcoin holders, as it suggests that the cryptocurrency could withstand regulatory pressures and emerge stronger, ultimately benefiting its long-term investors. In terms of Bitcoin’s press time status, it was trading at $29,524 at the time of writing.

The Long/Short Difference for Bitcoin had increased, indicating that long-term holders were accumulating BTC. This behavior suggested confidence in the digital asset’s future potential.

Traders get active

Open Interest in Bitcoin had also grown in line with its price surge. This reflected the increasing number of contracts that haven’t been settled in the market.

Generally, rising Open Interest can indicate growing trader participation and interest in Bitcoin futures. The implications of this include a more active and liquid market.

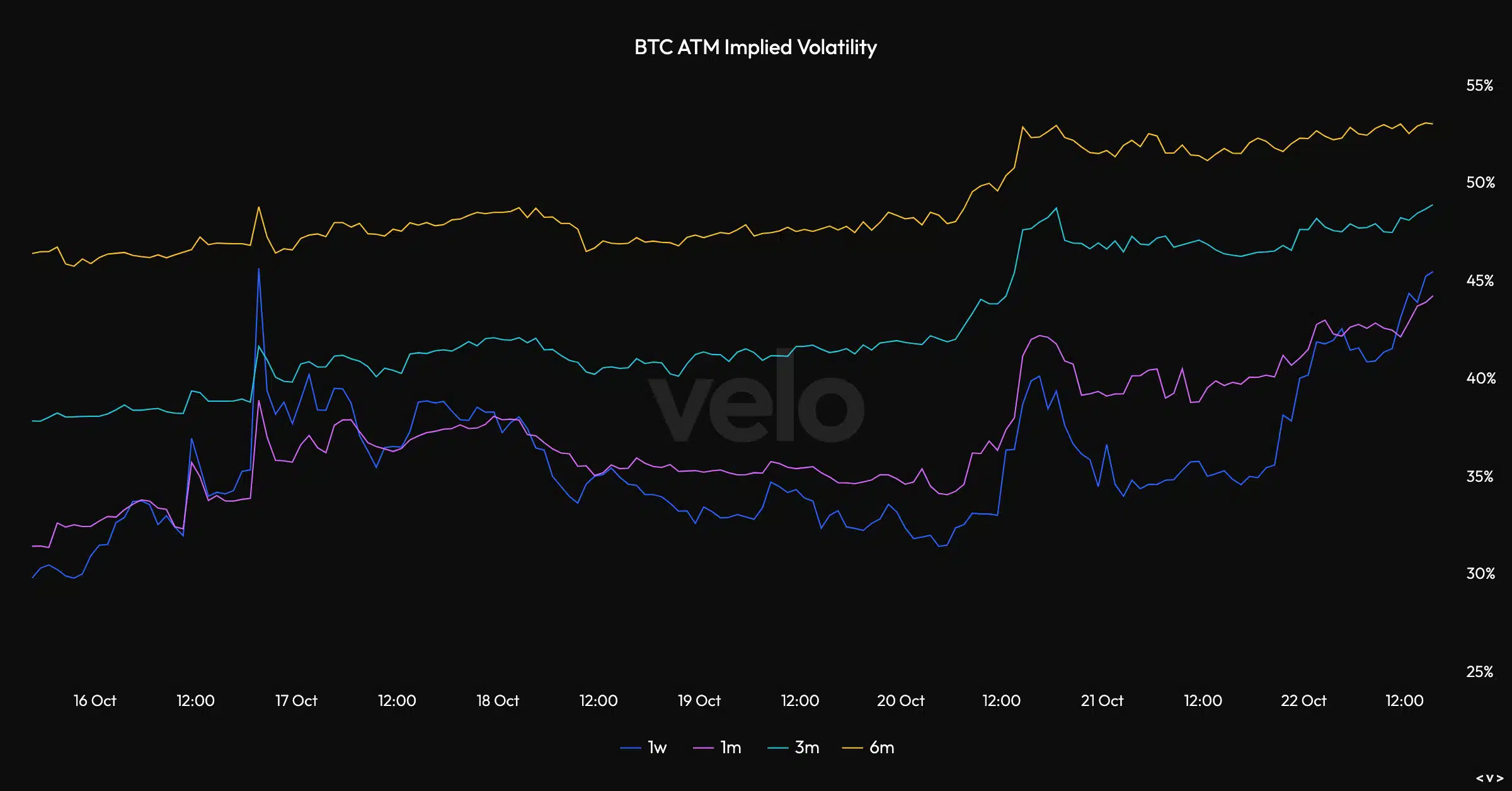

The Implied Volatility for Bitcoin had also surged. Implied Volatility is a measure of the market’s expectations regarding future price fluctuations.

An uptick in Implied Volatility may signify that traders anticipate more significant price movements in the near future. This could lead to higher trading activity and potentially larger price swings.

Conversely, the BTC 25 Delta Skew, which measures the perceived risk of large market moves, had significantly declined. A reduced Skew indicates a more balanced sentiment in the market.

Traders may perceive lower risks associated with large price swings, which can influence trading strategies and market behavior.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Finally, the BTC Put-to-Call Ratio fell from 0.52 to 0.47. This ratio compares the trading volume of put options (bets on price declines) to call options (bets on price increases).

A decreasing Put-to-Call Ratio suggests a more bullish sentiment among investors. At press time, traders were less inclined to bet on price drops, indicating overall optimism regarding Bitcoin’s future performance.