Bitcoin is at its most profitable in two years

- Bitcoin’s SOPR suggested that its short and long-term holders were holding at a profit.

- Its MVRV ratio sat at its highest level since March 2022.

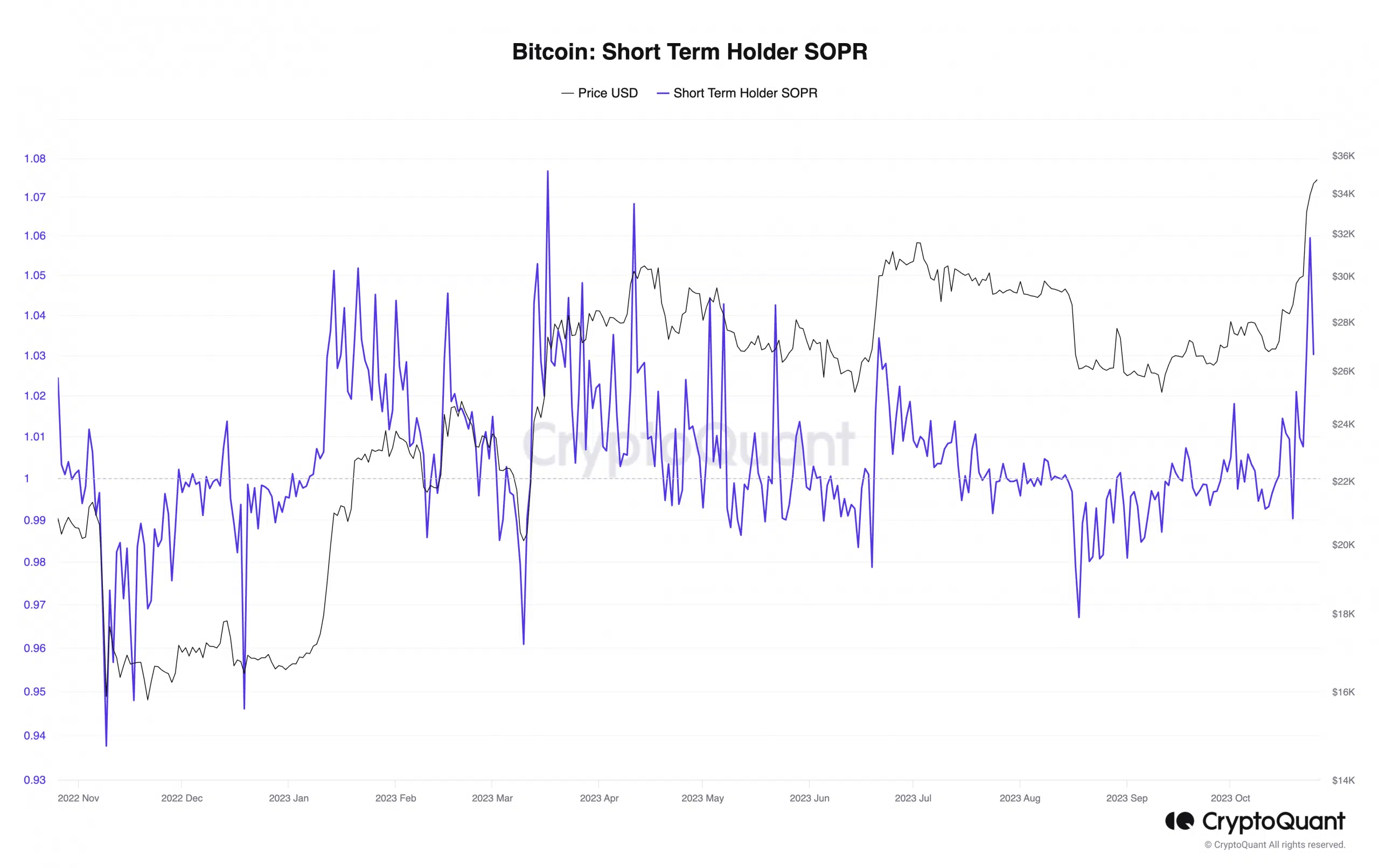

With Bitcoin [BTC] trading at multi-month highs, the Spent Output Profit Ratio (SOPR) for its short-term holders (STH) climbed to its highest level since May, data from CryptoQuant showed.

How much are 1,10,100 BTCs worth today?

BTC’s SOPR measures the degree of profit and losses incurred by the coin’s holders over a given period of time.

When SOPR is higher than one within a particular period, this means that those that sold at the current price sold at a profit. Conversely, when the metric is less than one within a specified window period, those that sold within that time frame incurred losses.

At press time, the STH-SOPR was 1.03. Data tracked by CryptoQuant showed that this has climbed steadily since 19 October, suggesting all transactions made by investors that have held BTC for less than 155 days have returned a profit.

During that period, BTC’s value has jumped by 22%, data from CoinMarketCap revealed.

Commenting on the profit-taking activity of BTC’s STH in a new report, pseudonymous CryptouQant analyst Elcryptotavo noted that this cohort of investors is “selling the pump.”

On the other hand, “long-term-holders (LTH)are not going anywhere,” the analyst added. While the LTH-SOPR sat above 1 at press time, suggesting that this group of investors were also in profit.

Moreover, the slow decline in the Coins-Destroyed-Days metric showed that they have reduced their distribution.

BTC market in its best shape in the last year

At press time, BTC’s market value to realized value ratio (MVRV) was 71.30%. According to data from Santiment, the last time the leading coin’s MVRV was this high was in March 2022.

An asset’s MVRV ratio tracks the ratio between the asset’s current market price and the average price of every coin or token of that asset acquired. A positive MVRV ratio above one signals that an asset is overvalued.

According to Santiment, the more this ratio increases, the more likely traders have historically demonstrated their willingness to sell.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Conversely, a negative MVRV value shows that the asset in question is undervalued, and if holders sold at the asset’s current price, they would realize losses.

Sitting above 70%, BTC’s MVRV ratio suggested that if all holders sold at the coin’s current market value, they would, on average, realize around 70% profit.