Lido’s wstETH lands on multiple chains – Here’s what it means

- Lido’s wstETH has now been integrated with the BNB Chain, Avalanche, and Scroll.

- The project’s TVL increased, and stETH bridged via Ethereum L2s also jumped.

Through LayerZero, Lido Finance’s wrapped staked Ethereum [wstETH] has been integrated into the BNB Chain, an Ethereum [ETH] L2 Scroll and Avalanche [AVAX]. According to LayerZero, which is an omnichain interoperability protocol, the wstETH would function as an Ominichain Fungible Token (OFT) via the integration.

Realistic or not, here’s LDO’s market cap in AVAX terms

OFTs are the pathway

For context, OFTs are extensible token contracts that eliminate the need for additional wrapped assets while enabling interaction between blockchains.

Also, LayerZero noted that Lido’s wstETH seemed like the perfect fit because of its widespread adoption and DeFi-compatibility of the stETH token.

@LidoFinance's leading product is stETH. wstETH acts as a DeFi-compatible version of the stETH token and has taken Ethereum by storm.

wstETH is now integrated with LayerZero's OFT standard, enabling fast and secure horizontal composability between enabled chains. ?

— LayerZero Labs (@LayerZero_Labs) October 25, 2023

In addition to the aforementioned reasons, the development also seemed to align with Lido’s inclination toward different chain expansion. As a Liquid Staking Derivative (LSD) project, Lido has stamped its authority as a leader in the sector.

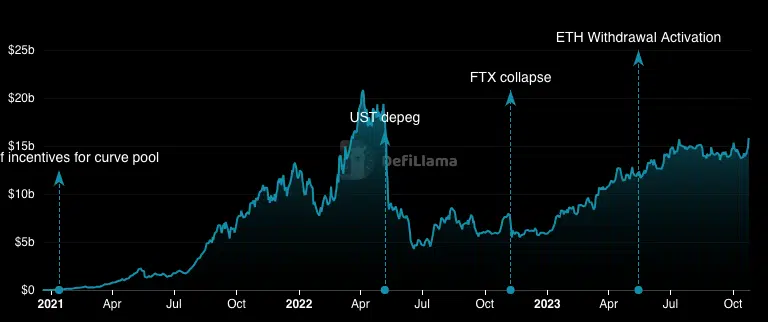

For instance, a look at the LSD Total Value Locked (TVL) standings showed that Lido was top. At press time, DeFiLlama showed that the TVL was $15.97 billion. This represents a 17.58% increase in the last 30 days.

The TVL measures the value of assets staked or locked in a protocol. When the TVL increases, it means more liquidity has entered into the system, indicating an improvement in trust by market players.

On the other hand, a decrease in the metric suggests wariness in deploying capital into the protocol.

A group of satisfied parties

For Lido, the current TVL condition aligned with the former. AMBCrypto also had the chance to discuss with the BNB Chain team about the development. During the quick conversation, the team agreed that the integration was a welcome development saying that,

“We’re thrilled to welcome Lido, one of the industry’s most popular protocols, to the BNB Chain ecosystem via LayerZero’s bridging infrastructure. By introducing native wstETH into BNB, we bring greater accessibility, decentralization, and a streamlined DeFi experience to our users.”

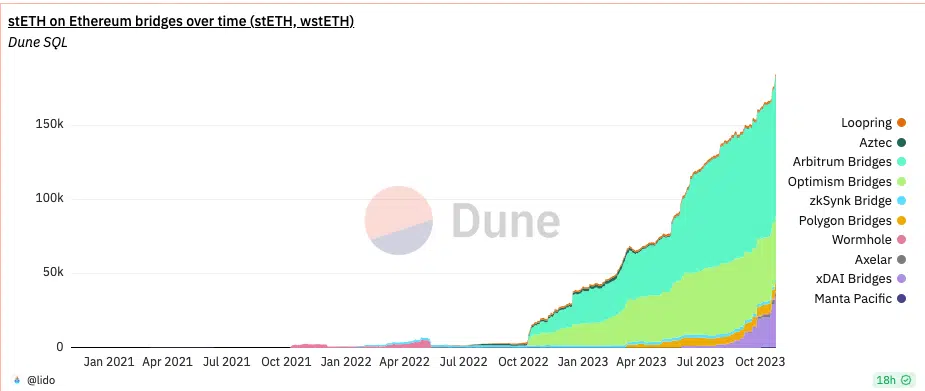

A look at Dune Analytics data showed the wstETH liquidity pools on several Ethereum bridges have gotten a lot of attention lately. For example, wstETH and stETH bridged via Loopring, Arbitrum [ARB], and Optimism [OP] have experienced a significant increase in growth since October 2022.

How much are 1,10,100 Lido stETH worth today?

This increase means that there has been a surge in the number of users who minted their ETH with the aim of receiving daily rewards via staking.

At press time, Arbitrum has the highest number of Lido wstETH bridged out of all the Ethereum L2s. The project was followed by Optimism and Loopring in second and third respectively.