Is Lido’s TVL on the road to recovery after Solana sunset?

- After a brief decline following its exit from Solana, Lido’s TVL resumed its growth.

- LDO’s price has climbed to a two-month high.

The leading liquid staking protocol for Ethereum [ETH], Lido Finance [LDO] saw its total value locked (TVL) surge by over 7% in the past week.

Is your portfolio green? Check out the LDO Profit Calculator

This was due to an uptick in the prices of ETH, Polygon [MATIC], and Solana [SOL] and the new deposits made through Lido during that period, the protocol noted in its latest weekly update on X (formerly Twitter).

? Lido Analytics: October 16 – 23, 2023

TLDR:

– TVL surged 7.08%, rising to $14.84b.

– 16,576 ETH in new deposits over the past 7 days.

– stETH APR grew with the 7d MA at 3.72%.

– Total (w)stETH in DeFi grew +0.46% to 3,177,384 stETH (35.99% of total stETH supply). pic.twitter.com/Oj46ky5SpZ— Lido (@LidoFinance) October 24, 2023

Between 16 and 23 October, the values of ETH, MATIC, and SOL increased by 6%,18%, and 32%, respectively. The TVL growth came a week after it experienced a 5% dip following Lido’s decision to cease operations on Solana.

At press time, Lido’s TVL stood at around $15.84 billion, with a double-digit rally in the last month, data from DefiLlama showed.

A primer on Lido’s performance in the last week

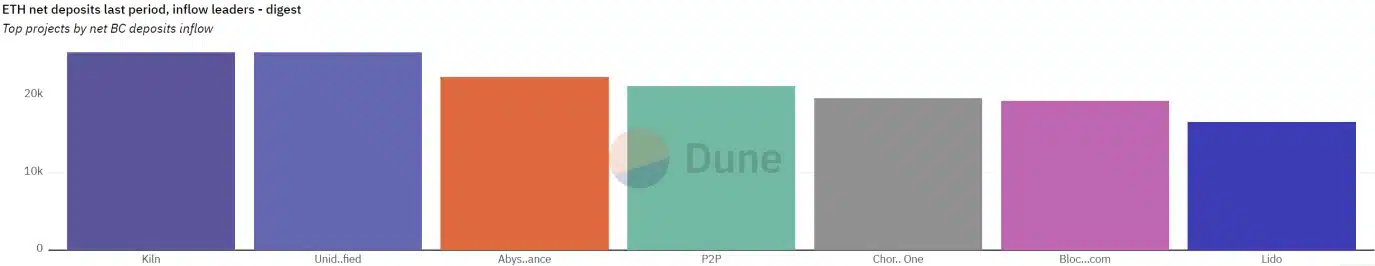

In terms of net new deposits to the Ethereum Beacon Chain, Lido previously led other protocols. However, the past two weeks have been marked by a decline in new Ether deposits made through the decentralized finance protocol.

During the period under review, new deposits to the Ethereum Beacon Chain made through Lido totaled 16,576 ETH in the form of staked coins, putting it six places behind Kiln, which logged the most deposits, data from Dune Analytics showed.

This represented a 66% decline from the 48,480 ETH in net new stakes made to Ethereum through Lido between 9 and 16 October.

Despite the fall in new stakes through the protocol, Lido’s Annual Percentage Rate (APR) earned on its staked Ether [stETH] grew by 12%. As of this writing, this stood at 3.79%, having grown by 6% month-to-date.

Regarding Layer 2 (L2) platforms, data from Dune Analytics showed a 0.74% increase in the amount of stETH bridged to Arbitrum [ARB].

Realistic or not, here’s LDO’s market cap in BTC’s terms

On the other hand, Polygon and Optimism [OP] recorded respective declines of 4% and 0,50% in the amount of bridged stETH between 16 and 23 October.

LDO follows general market trend

Benefitting from the general market growth in the past few days, LDO’s value rallied by over 20% in the last week. At press time, the altcoin exchanged hands at $1.86, its highest price level since 23 August, according to data from CoinMarketCap.