Aave: Is a rally on the cards?

- AAVE has presented two significantly bullish trends.

- However, the altcoin may not be poised for an uptrend just yet.

In a recent post on X (formerly Twitter), on-chain analytics firm Santiment said that the price of Aave [AAVE] might not reflect the overall downward trend that prevailed across the broader cryptocurrency market.

? #Aave has some #bullish divergences forming as it has stayed around the middle of the pack among other #altcoins. The 50th ranked market cap asset has the most coins held by the top 150 wallets in 5 months, and RSI has entered a bounce zone. https://t.co/NmRrlQRrpx pic.twitter.com/M65PEli3Uu

— Santiment (@santimentfeed) December 12, 2023

The data provider stated that the altcoin had shown two important bullish divergences, indicating underlying support for the asset.

What are the bullish trends?

Santiment found that, at press time, the top 150 wallets in the crypto market held the most AAVE tokens in the last five months. As of this writing, these wallets held 9.61 million AAVE tokens, representing the highest amount since July.

Since the 5th of November, this investor group has been consistently growing their AAVE holdings, resulting in a 3% increase in their share of AAVE.

This accumulation suggested increased whale interest in the asset. It could be interpreted as a bullish sign as well, as whales often have a significant influence on market movements.

Another bullish signal presented by AAVE is that its Relative Strength Index (RSI) has entered a “bounce zone,” Santiment noted.

This indicator measures the momentum of an asset’s price movement. It is said to have entered a “bounce zone” when the downward price movement of an asset slows or reverses. It is typically seen as a signal of an upcoming price increase.

At press time, AAVE’s RSI was 38.34. According to Santiment, an RSI value of less than 40 is a level “which price bounces” historically.

Do not be swayed just yet

While these bullish divergences hint at an upward price correction, further assessment of other on-chain metrics revealed that the reversal might not occur in the short term.

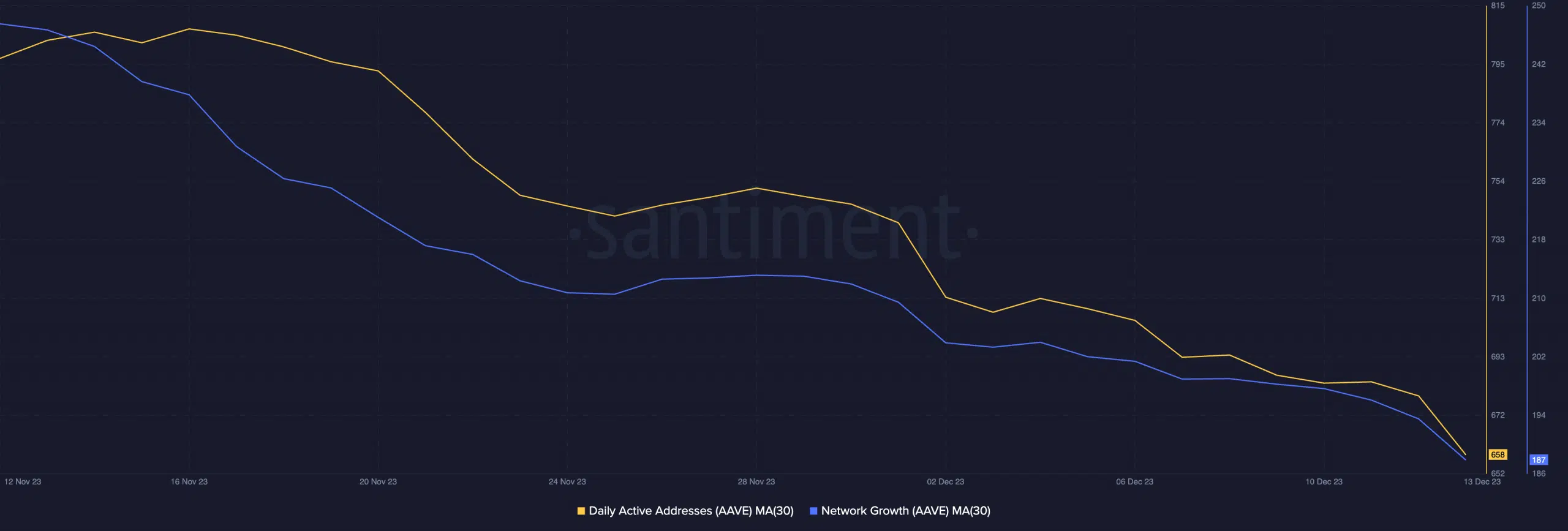

AAVE’s network activity pointed to a steady decline in AAVE’s accumulation in the last month. The token’s daily active address count observed on a 30-day moving average has witnessed a 17% decrease in the last 30 days.

Likewise, new daily demand for AAVE has dropped within the same period. According to Santiment’s data, new demand for AAVE has plummeted by 24% in the last 30 days.

For any upward price correction to occur, there has to be a notable uptick in demand for AAVE.

Apart from the low trading activity involving the altcoin, the general market’s sentiment has also turned negative. At press time, AAVE’s Weighted Sentiment was -0.492.

Realistic or not, here’s AAVE’s market cap in BTC’s terms

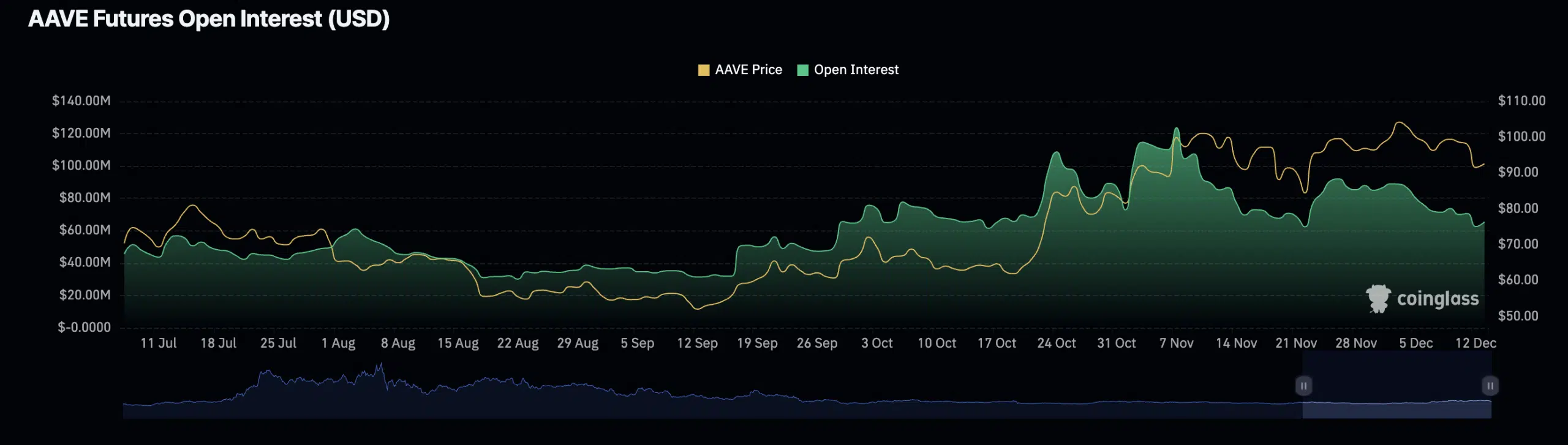

The token’s Futures market has also been plagued by a steady decline in Open Interest since the end of November. According to data from Coinglass, AAVE’s Open Interest has dipped by 31% since the 25th of November.

When an asset’s Open Interest declines in this manner, it means that traders are closing their existing positions without opening new ones.