Fetch.ai: What crossing this key price level means for FET predictions

- FET’s trading volume increased, as did buying pressure.

- Market indicators turned bearish on the token, suggesting a price correction.

Fetch.ai [FET] displayed a commendable performance last week as its price rallied in double digits. Thanks to the recent uptrend, the token managed to go above a key resistance level. Does this mean that FET is about to reach an all-time high anytime soon?

Fetch.ai crosses a key level

According to CoinMarketCap, FET’s price has rallied substantially in the recent past as its value surged by more than 15% in the last 24 hours alone.

While the token’s price gained bullish momentum, a crypto investor pointed out a key resistance zone near the $0.58 mark. Because of the current uptrend, FET managed to go beyond that level for quite some time.

Range between 0.46c & 0.58c –> Break out from 0.58c –> Pump to ATHs

Sounds like a plan legends pic.twitter.com/94XAN9ecIj

— Crypto Tony (@CryptoTony__) December 12, 2023

Therefore, the possibility of FET reaching new highs seemed likely to happen. At the time of writing, Fetch.ai was trading at $0.5797 with a market capitalization of over $477 million.

The token’s trading volume also surged by more than 190%, which acted as a foundation for the bull rally.

Are investors still buying FET?

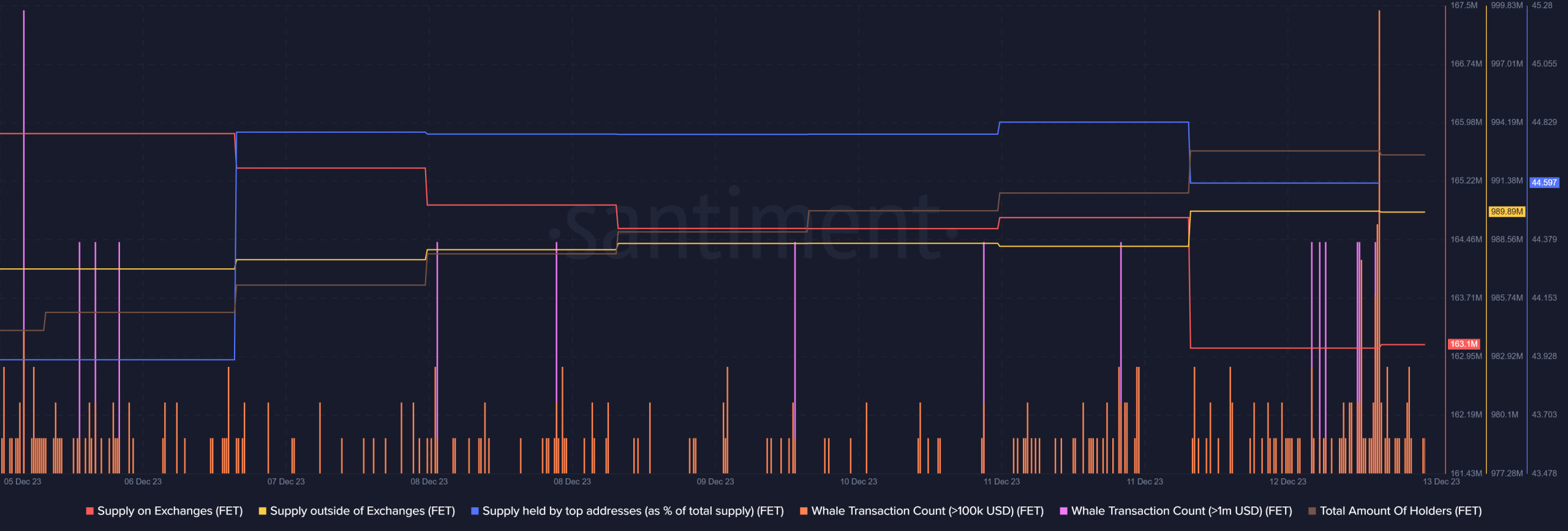

AMBCrypto then took a look at the token’s supply distribution to better understand market sentiment around the token.

Santiment’s data revealed that FET’s supply on exchanges dropped in the last few days. This happened while its supply outside of exchanges increased.

Additionally, its total number of holders increased, reflecting investors’ willingness to buy the token.

Whale activity around the token was also high. This was evident from the rise in FET’s whale transactions.

Not only that, but the whales also bought FET as its supply held by top addresses registered an increase on 7th December 2023, which clearly suggested that big players were actually expecting the token’s price to surge.

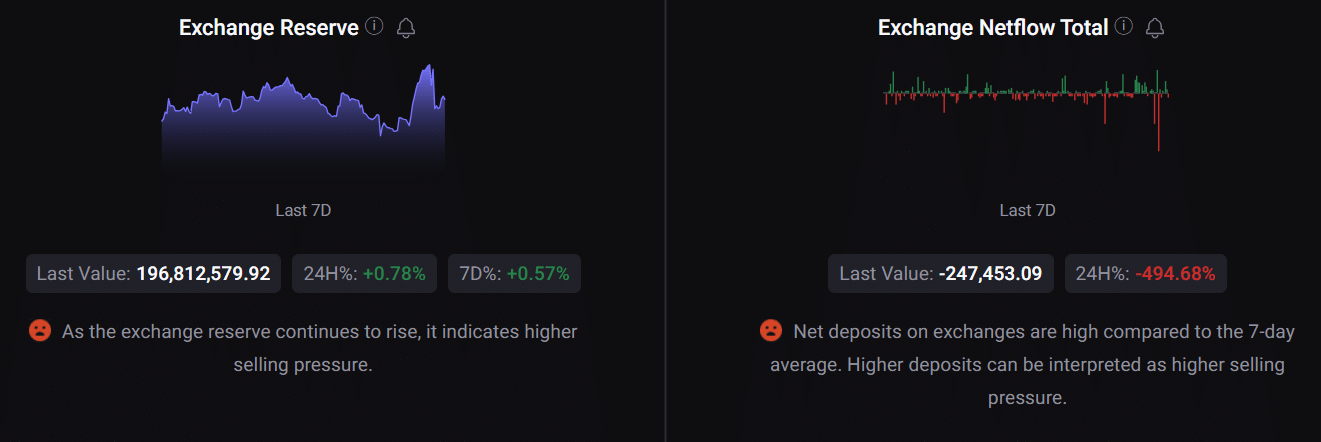

However, CryptoQuant’s data painted a different picture. As per the data, both FET’s exchange reserve and net deposit on exchanges were rising. This hinted at a hike in selling pressure, which is a typical bear signal.

Is a price correction around the corner?

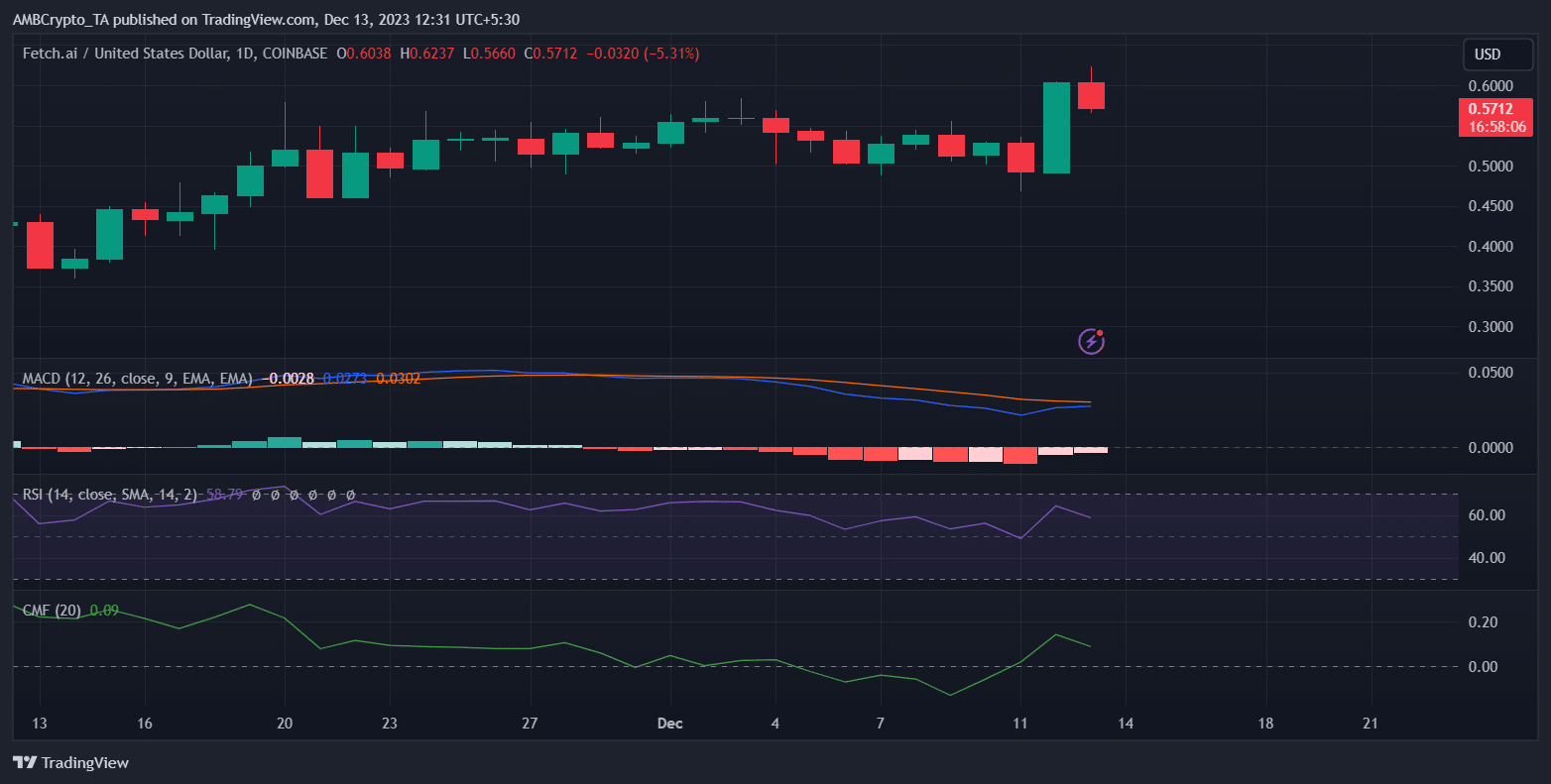

To better understand whether FET’s price would continue to pump or witness a correction, AMBCrypto checked FET’s daily chart.

Fetch.ai’s MACD displayed the possibility of a bearish crossover. Its Relative Strength Index (RSI) also registered a decline.

Realistic or not, here’s FET’s market cap in BTC terms

Additionally, FET’s Chaikin Money Flow (CMF) followed a similar declining trend.

Considering these indicators, it was likely that FET would witness a slight price correction in the near term before it continued its bull rally to reach new highs.