Ethereum falls 6% in 24 hours: How did holders react?

- ETH witnessed its highest drop in over two months.

- The Ethereum in profit has gone below 80%.

Ethereum [ETH] experienced a significant decline in its price, leading to a corresponding decrease in profit supply.

Ethereum sees highest drop in months

On the 2nd of January, Ethereum faced a notable decrease of over 6%, settling at about $2,210 based on a daily timeframe chart. The chart analysis showed a positive start to the year, with some intermittent declines up to the 2nd of January.

However, the most recent dip marked the steepest drop observed in the past few weeks.

Additionally, this price drop caused the Relative Strength Index (RSI) to fall below the neutral line. As of this writing, the RSI remained below the line despite a slight uptick in the price.

The price was around $2,230, with less than a 1% increase as of this writing. Also, the short-moving average (yellow line) continued to act as support for now. Nevertheless, this support could shift if the price falls below the existing range.

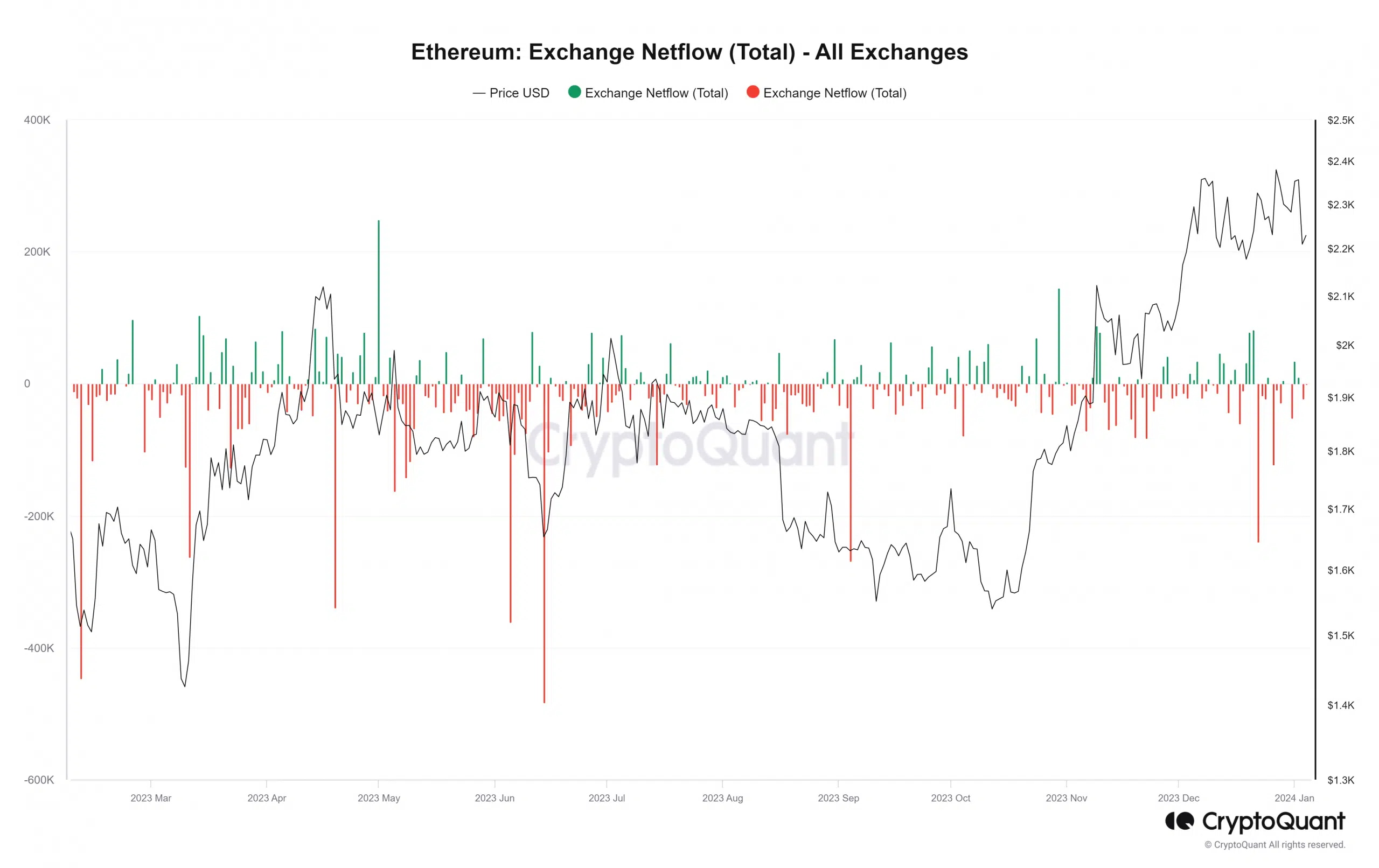

Ethereum sees more outflows

Surprisingly, Ethereum witnessed increased outflows on the 3rd of January, even in the face of a declining price. Leading up to this date, there was a prevailing trend of inflows, signifying a greater influx of ETH into exchanges for potential sale.

However, this pattern shifted on the 3rd of January, with over 22,000 ETH leaving exchanges. The netflow on exchanges remains positive, albeit marginally, indicating a higher sales volume.

It is notable that, at press time, there was no evident indication of an imminent sell-off.

ETH supply in profit takes a slight beating

The impact of the price decline extended to the Ethereum supply in profit. AMBCrypto’s analysis of the supply in profit on Santiment showed a significant reduction in the volume of ETH that was in a profitable position.

Before the 3rd of January, the supply in profit was over 110 million ETH, constituting over 84% of the total supply.

Is your portfolio green? Check out the ETH Profit Calculator

However, by the conclusion of the day on the 3rd of January, this figure had decreased to around 107 million, accounting for about 82% of the supply.

As of this writing, the supply in profit had further reduced to around 104 million, representing about 79% of the total supply.