Maker logs a spike in network activity – Can it boost MKR prices?

- There has been an uptick in MKR’s network activity.

- The token assessed on a weekly chart showed that it remains primed for further price rallies.

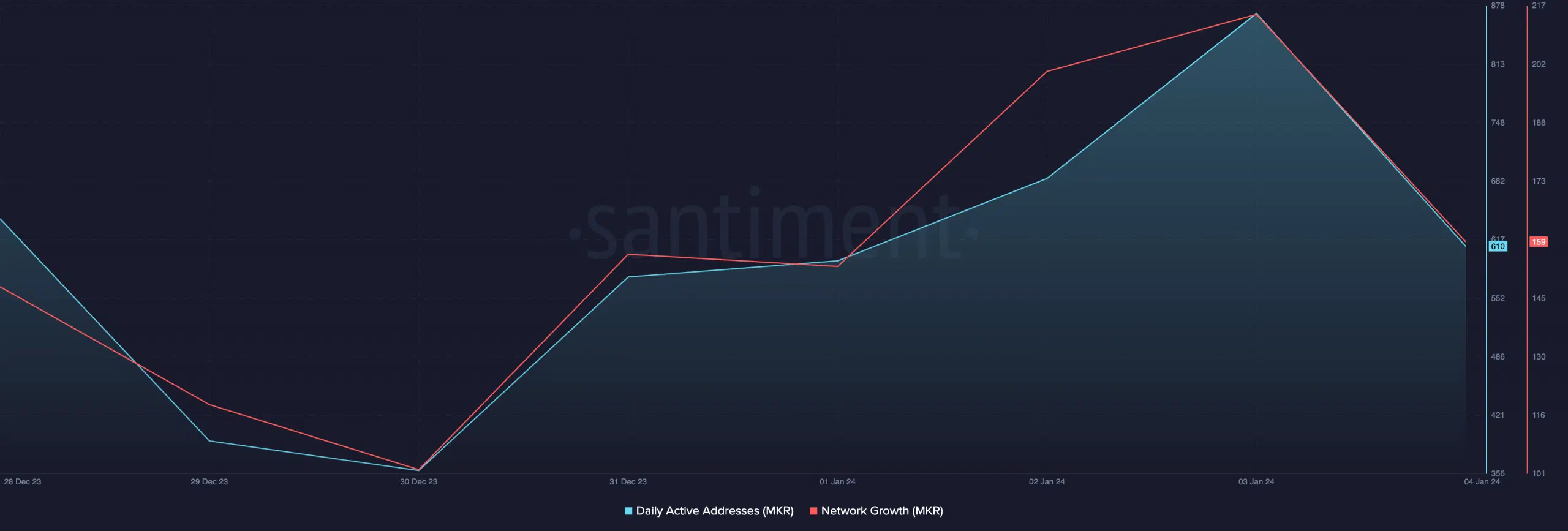

The year so far has seen a notable rise in the daily count of addresses executing trades involving the Maker [MKR] token, on-chain data from Santiment has shown.

As of 4th January, 610 addresses completed trades involving the altcoin, marking a 3% uptick from the 594 addresses recorded on 1st January.

While its daily active address count climbed, MKR also recorded a corresponding rally in its daily new demand. According to the data provider, the daily count of new addresses created to trade the alt has risen by almost 5% since the year began.

In a post on X (formerly Twitter), Santiment noted that the growth in an asset’s network activity is often “accompanied by market cap growth.”

This has been the case for MKR, whose market capitalization and price have risen by 9% and 7%, respectively, in the past four days.

MKR on a weekly chart

At press time, the alt exchanged hands at $1,808, according to data from CoinMarketCap. Its price movements assessed on a 7-day chart revealed a steady demand for MKR and the continued presence of bullish sentiment in the market.

According to readings from its Directional Movement Index (DMI), its positive directional index (green) rested above the negative directional index (red) at press time.

When these lines are positioned in this manner, it suggests that buying pressure is greater than selling pressure, indicating a potential upward trend.

The Average Directional Index (yellow), which confirms the strength of a market trend was spotted at 35.86 as of this writing. An ADX above 25 generally suggests a relatively strong trend, Hence, the MKR market is trending in a clear direction.

Further, key momentum indicators positioned near overbought regions at the time of writing signaled that buying activity outpaced token sell-offs. For example, MKR’s Relative Strength Index (RSI) was 71.46, while its Money Flow Index (MFI) was 68.50.

How much are 1,10,100 MKRs worth today?

Likewise, the token’s Chaikin Money Flow (CMF) maintained an uptrend at press time and rested above the zero line.

The CMF value of 0.08 confirmed the steady inflow of liquidity into the MKR market, a trend known to drive up an asset’s price further.