Ethereum: How Celsius’ latest move might impact your ETH holdings

- Celsius has decided to unstake its ETH holdings to repay its creditors.

- The last week has seen a decline in demand for ETH.

In a series of posts on X, bankrupt cryptocurrency lender Celsius Network [CEL] announced plans to unstake its Ether [ETH] holdings as a part of its ongoing restructuring process.

In preparation of any asset distributions, Celsius has started the process of recalling and rebalancing assets to ensure ample liquidity

— Celsius (@CelsiusNetwork) January 4, 2024

The beleaguered crypto lender, which has been in bankruptcy court since it made its Chapter 11 filing in July 2022, noted that it has initiated a process of recalling and rebalancing assets to guarantee that it has sufficient liquidity to offset its liabilities under the bankruptcy proceedings.

Celsius added that the unlocking event is expected to take place within the next few days. It further said that eligible creditors will receive in-kind distributions of Bitcoin [BTC] and ETH as per the approved restructuring plan.

Ethereum at risk?

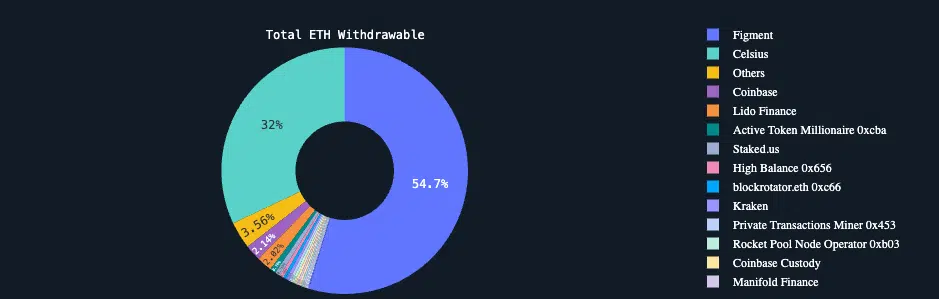

According to data from Nansen, 32% of ETH coins awaiting withdrawal are currently linked to Celsius. This accounts for a substantial 206,300 ETH, valued at about $468.5 million based on the leading altcoin’s current price.

With such a large volume of coins ready to be released onto the market, some believe that it would put downward pressure on ETH’s price. Others, however, opined that it might benefit the ETH market once Celsius concludes its restructuring efforts.

As of this writing, ETH exchanged hands at $2,250. The alt has witnessed a 5% drop in value in the last week, according to data from CoinMarketCap.

The coin’s momentum indicators observed on a 24-hour chart have trended downward since the year began, suggesting a decline in buying momentum since then. At press time, ETH’s Relative Strength Index (RSI) was 48.82, while its Money Flow Index (MFI) was 54.74.

Its Chaikin Money Flow (CMF) spotted below the zero line confirmed that traders have increasingly removed liquidity from ETH markets. Fears of a blanket SEC rejection of Bitcoin ETFs could be driving this capital removal.

A significantly positive correlation exists between BTC and ETH. Hence, should the rejection result in a decline in BTC’s price, ETH’s price is sure to witness a retraction as well.

Is your portfolio green? Check out the ETH Profit Calculator

The coin’s negative directional index (red) rested above the positive directional index (green) at the time of writing. This suggested that selling pressure exceeded coin accumulation.

These lines have been so positioned since 3rd January, corresponding with the decline in demand.