Bitcoin trails behind the S&P 500 as ETF hype fizzles out

- S&P 500 trends over Bitcoin.

- BTC attempts recovery as it goes over $40,000.

In recent days, the price of Bitcoin [BTC] has experienced a downward trend, dipping below the $40,000 mark at certain intervals. However, how does this decline compare to other assets such as Ethereum, the S&P 500, and gold?

S&P 500 outperforms Bitcoin

Following the announcement of 11 spot ETFs, Bitcoin’s price trend has yet to see the same upward trajectory observed before.

An examination of Santiment’s chart showed a decline in BTC’s price, with assets like Ethereum and the S&P 500 surpassing it.

Around 13th January, just days after the ETF announcement, BTC’s price began to decrease, and both ETH and the S&P 500 started trending higher.

ETH emerged as a notable winner, reaching above the $2,600 price range and trending higher than equities. However, by 17th January, equities gained momentum, while ETH started declining and BTC experienced an even more significant drop.

When BTC fell to the $41,000 price range, the S&P 500 had already started trending above the crypto assets.

As of the latest update, the S&P 500 was trading at around $4,890, marking a new all-time high and outperforming all other analyzed asset classes. This suggests that equities are performing better than cryptocurrencies and gold.

Furthermore, at the time of this report, BTC had staged a recovery and was trending above both ETH and gold, although still below equities in terms of performance.

Bitcoin sees second-highest rise in the year

A detailed analysis of the Bitcoin daily timeframe chart showed a notable recovery on 26 January, following a period of decline.

The analysis reveals that by the close of trading on 26th January, BTC had experienced a substantial gain of 4.6%. This marked the second-highest increase observed in the year thus far.

Additionally, this upward movement successfully propelled BTC above the $41,000 price range after trading below $40,000 for several days. At the current moment, BTC was trading at around $41,600, with a slight decline of less than 1%.

How much are 1,10,100 BTCs worth today

Daily active address declines

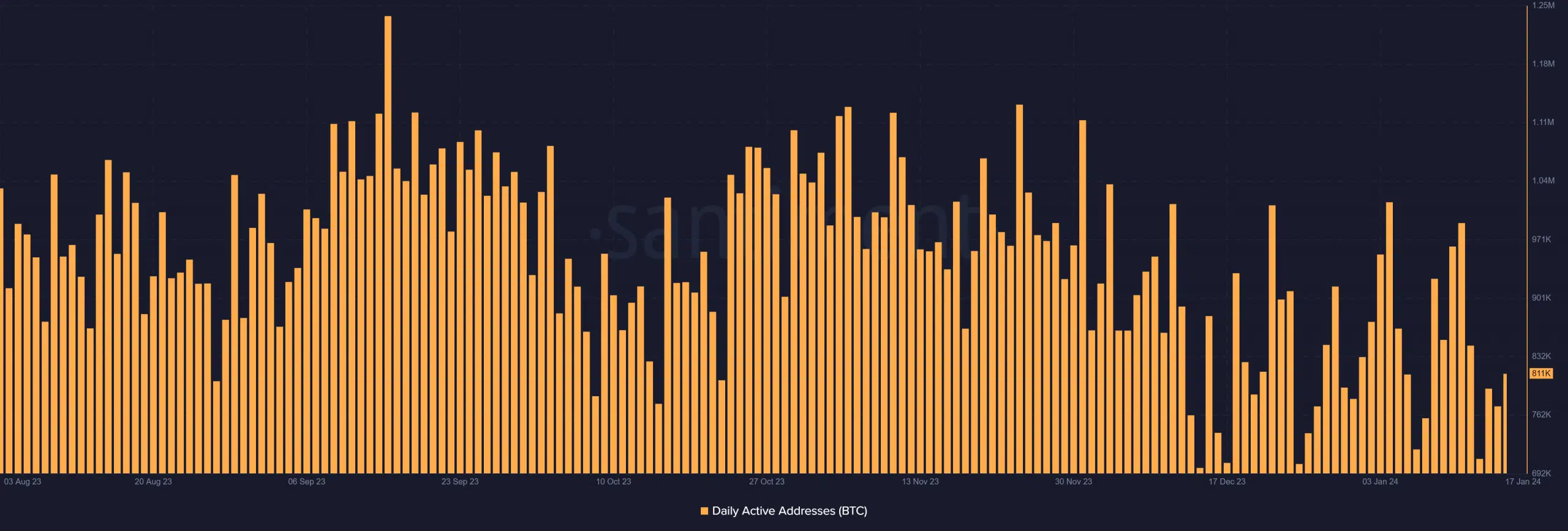

An examination of the Bitcoin daily active addresses showed a recent slowdown in activity over the past few days. The chart reveals that in the current month, Bitcoin has only reached the milestone of 1 million active addresses once.

Contrasting this trend with the previous month, it becomes evident that, during that period, the number of active addresses went over 1 million on multiple occasions. As of the current analysis, the count of active addresses was around 811,000.