Should Cardano HODLers expect ADA to hike or not?

- The resistance at $0.53 might prevent ADA from rallying.

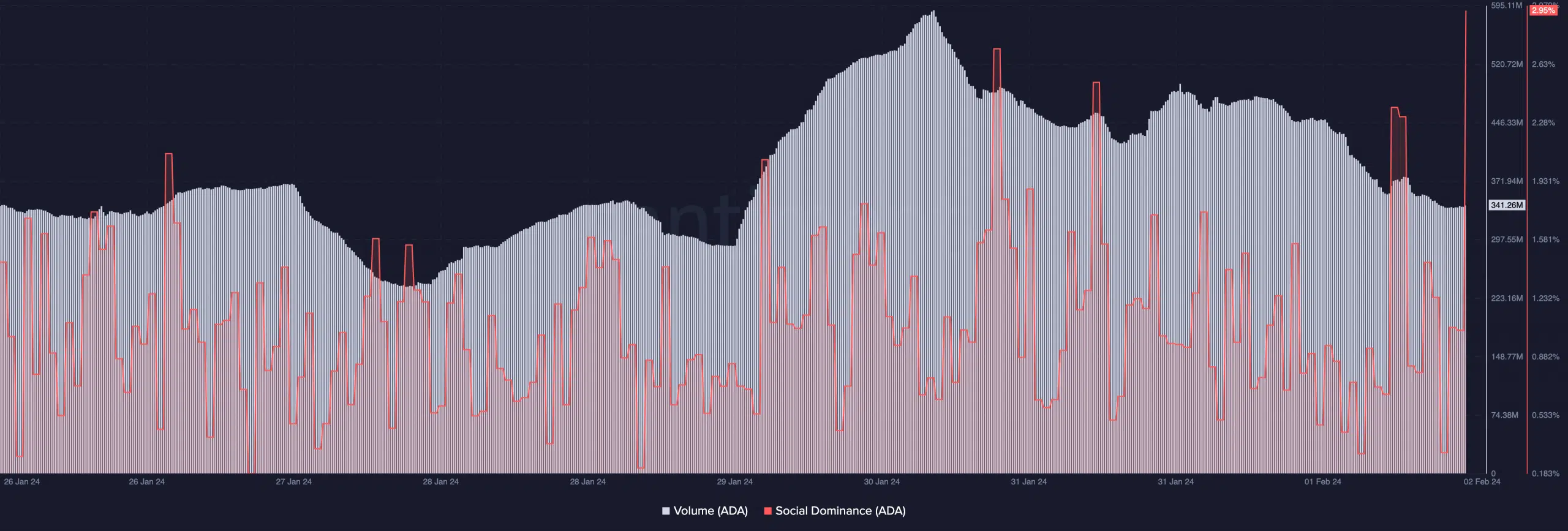

- Cardano’s volume dropped while social dominance increased.

The value of Cardano [ADA] has fallen by 18.45% since the year began, CoinMarketCap data showed.

However, AMBCrypto’s assessment of the price tracking platform showed that the price jumped by 3.60% in the last 24 hours. This increase ensures that ADA was back above $0.50.

Despite the rise, on-chain data revealed some interesting things that happened on the Cardano network. The first one was with the 24-hour active addresses.

Activity takes a backseat

According to Santiment, the active addresses increased to 45,000 on 1st of February. However, press time showed that the metric had plummeted, and was at 40,400.

Active addresses show the number of wallets involved in incoming and outgoing transactions. Though not always, a jump in active addresses is mostly bullish for a cryptocurrency. Therefore, one can assume that the recent decline puts Cardano at risk of a short-term decline.

However, the metric alone cannot determine if ADA’s price would accelerate or otherwise. This was why AMBCrypto decided to examine the price potential from a technical angle.

According to the ADA/USD 4-Hour chart, the token was around the same support level it was on the 8th of December. Recall that afterward, ADA’s price jumped to $0.64.

But this time, it seemed different largely because of the resistance at $0.53. For ADA to beat the resistance, buying pressure has to increase.

ADA might struggle to ascend

Indications from the Moving Average Convergence Divergence (MACD) showed that ADA’s reading was negative. This implies that the momentum was bearish.

Also, the 12-day EMA (blue) was below the 26-day EMA 9 (orange). If these indicators stay that way, then ADA might not repeat the uptrend it had in December.

Furthermore, the On Balance Volume (OBV) was around the same spot, indicating the dearth of buying pressure. In a highly bullish case, ADA might jump to $0.53 or $0.55.

However, signals from the indicators suggest that ADA’s price might either stall at $0.50 or move below it.

In terms of the volume, Santiment showed that the metric has decreased. For instance, Cardano’s volume was 586.31 million on the 30th of January. But as of this writing, it had fallen to 341.26 million.

This decline suggests that interest in ADA has subsided. When related to the price action, the falling volume and rising price, suggest that the token might soon become weak.

Read Cardano’s [ADA] Price Prediction 2023-2024

In addition, Cardano’s social dominance had spiked to 2.95%. This means that a lot of discussion about the token was going on. In terms of the price, the high social dominance could be a sign of the local top.

As it stands, ADA’s bearish prospect was more than its bullish one. Therefore, traders might need to wait a little longer before ADA ascends much higher.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)