Solana: All about the impact of the Jupiter airdrop on the network

- Solana network saw growth after the Jupiter Airdrop.

- Price of SOL moved upwards, however, social sentiment remained negative.

On the 31st of January, Jupiter, the primary Decentralized Exchange (DEX) on Solana[SOL], executed an airdrop event within the network, garnering considerable interest among users.

Solana managed to handle the massive surge in activity even though it was a large stress test for the network.

Holding on to JUP

Over 440,000 addresses successfully claimed 622 million JUP tokens (equivalent to $3.6 billion) from Jupiter Exchange. However, 54% of eligible wallets have yet to claim JUP, leaving approximately 378 million JUP unclaimed.

The majority of claimants received less than 1000 JUP, with 59% (261,000 wallets) obtaining 200 JUP, while around 1500 wallets received 100,000-200,000 JUP.

Notably, claimants with higher airdrop amounts tend to retain their JUP holdings.

Interestingly, 72% of claimants who received less than 1000 JUP have already divested their holdings. The most steadfast group comprises wallets that received between 50,000 and 100,000 JUP.

1/ One of the largest Airdrop on @solana is live

Over 440k Addresses claimed 622M ($3.6B) JUP token from @JupiterExchange. 54% of the eligible wallets haven't claimed JUP yet, and there are ~378M unclaimed JUP pic.twitter.com/7my3PLTo5I

— Tom Wan (@tomwanhh) February 1, 2024

Solana stands tall

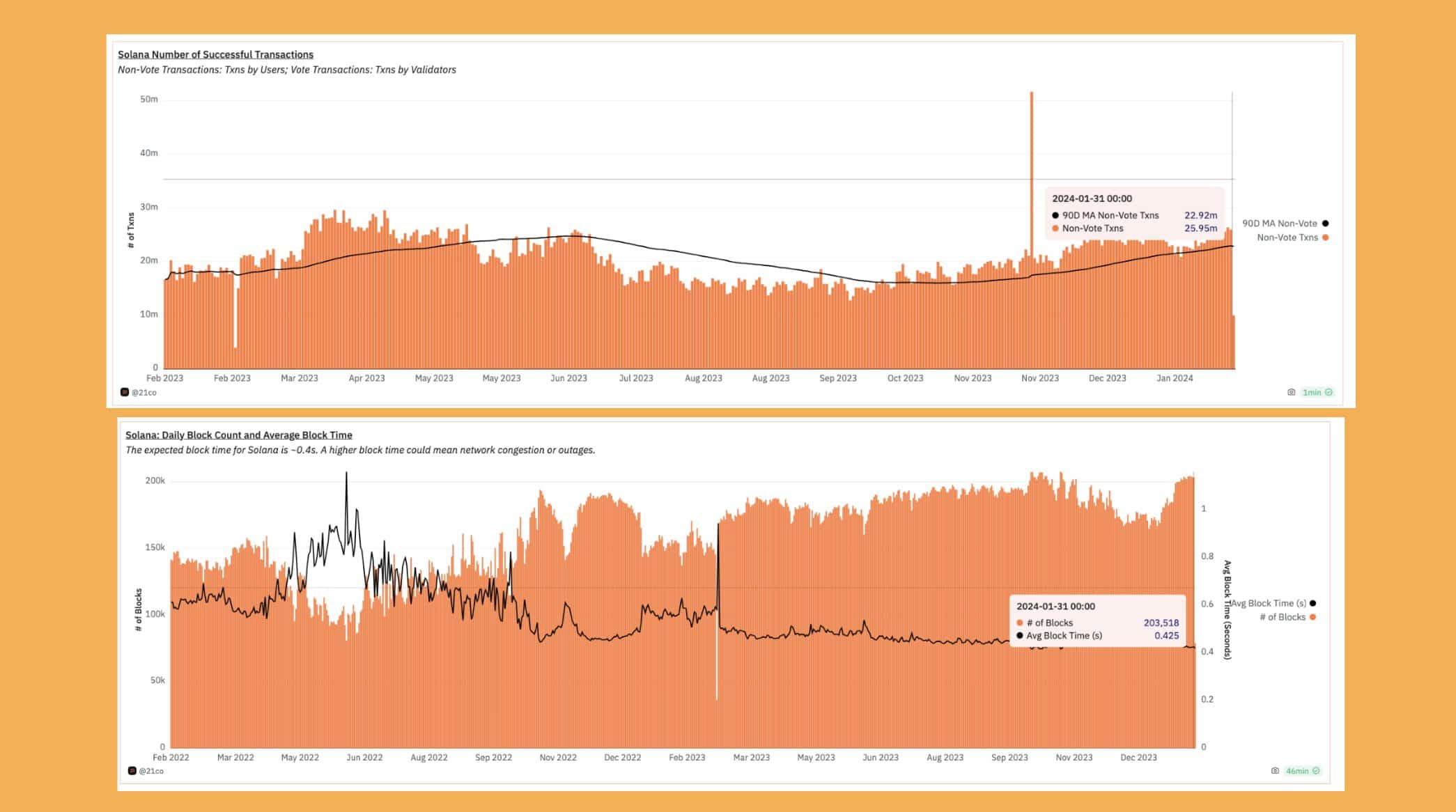

Solana processed 13% more transactions than in the preceding 90 days, maintaining a block time of around 400 milliseconds.

While the network appeared to operate as usual, there was a surge in wallet activity, with increased competition for faster transaction inclusion.

Notably, Solana experienced a one-year high in active addresses on the day of the JUP Airdrop.

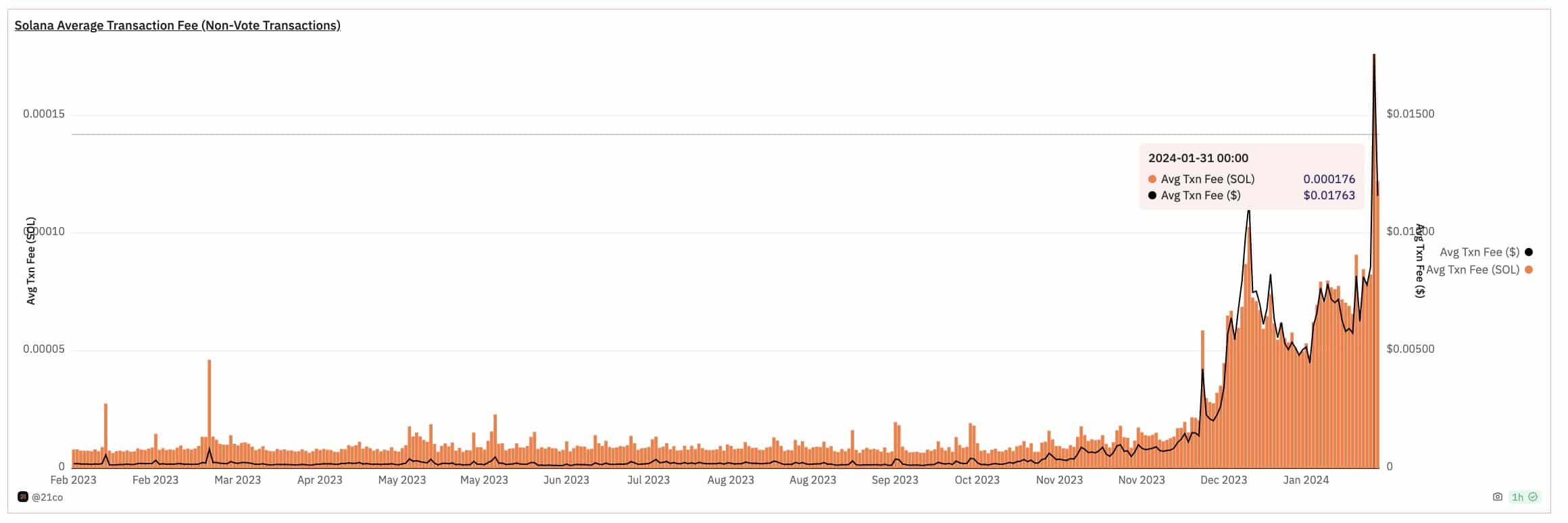

At least 50% of these active wallets are engaging in claiming JUP. The heightened wallet activity could potentially lead to an increase in average transaction fees, which have already doubled compared to the previous day, 30th January.

Nevertheless, the impact on users remained minimal, with each transaction costing approximately $0.017.

Skepticism on the social front

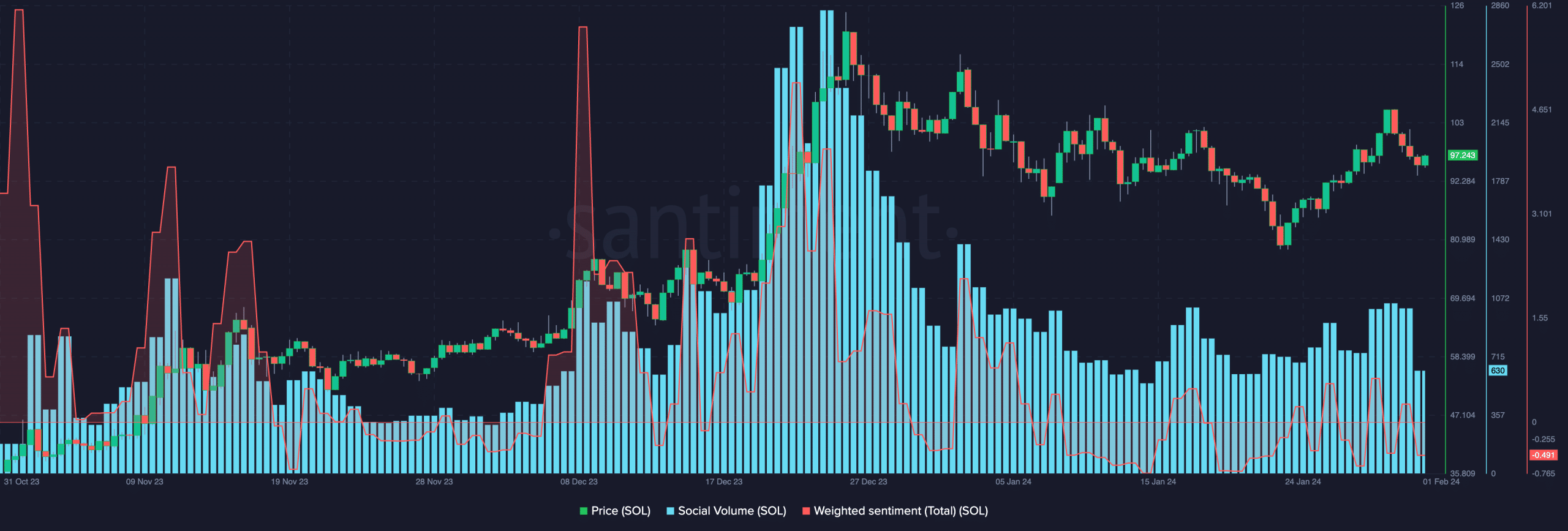

There was a positive impact observed for the SOL token as well. The price of SOL grew by 4.6% in the last 24 hours. Moreover, social volume around SOL also saw an uptick indicating that the token was gaining popularity.

However, the negative sentiment around SOL grew significantly, suggesting that negative comments around SOL were outnumbering the positive ones.

Is your portfolio green? Check out the SOL Profit Calculator

Even though SOL’s price could further grow from this point forward due to the interest generated by Jupiter, the negative weighted sentiment may provide a hindrance to its rally.