Ethereum gets a privacy boost: Vitalik demos revolutionary ‘privacy pools’!

- Ethereum welcomed a new on-chain privacy feature that keeps illicit funds at bay.

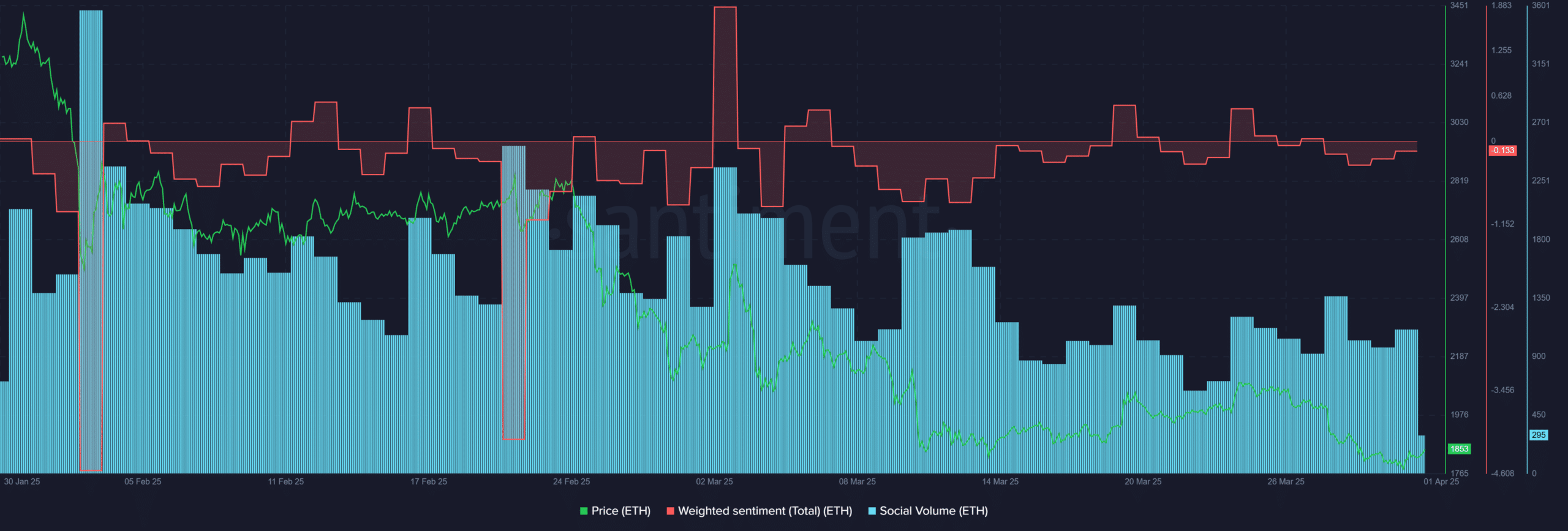

- ETH’s sentiment didn’t improve much despite the positive update.

Ethereum [ETH] has welcomed a new layer of user privacy and safety from illicit funds after Privacy Pools went live.

Picture this: you wish to donate or send payments on-chain without recipients or nosy sleuths unnecessarily doxxing (checking your identity and balance on your wallet address).

At the same time, this level of privacy should be achieved but kept away from illicit funds like the ones from Lazarus Group. That’s precisely what Privacy Pools does.

Oxbow, the firm behind the Privacy Pools protocol, noted,

“ETH users can now achieve on-chain privacy, while still dissociating from illicit funds. It is now up to all of us to Make Privacy Normal Again.”

Impact on Ethereum

The protocol emphasized its non-custodial nature, giving users greater control, while initially setting deposit limits between 0.1–1 ETH ($186–$1800). These limits will be raised after initial monitoring.

This is not Ethereum’s first attempt at enhancing privacy. Crypto mixers like Tornado Cash and Railgun have long concealed on-chain transaction details. However, Tornado Cash faced scrutiny for enabling groups like Lazarus Group to launder billions in stolen funds.

New platforms like Privacy Pools aim to balance privacy with compliance by blocking illicit transactions. Ethereum co-founder Vitalik Buterin, a proponent of such technology and a frequent Railgun user, has already tested the platform.

Despite the positive update, however, ETH’s sentiment didn’t sharply reverse to ‘posiitve’ side. Since February, ETH’s weighted sentiment has been overly negative. This suggested overall caution amongst investors.

Additionally, social volume dipped to new lows in March compared to February. This revealed that there wasn’t much market interest in the altcoin.

This has kept the altcoin below $2K and could be dragged to $1.6K if muted demand persists in the next few days.