Up or down? Here are UNI’s prospects in the days to come

- Some technical indicators supported UNI’s bullish narrative.

- Whales were still bearish on the token, as exemplified by their lower long exposure.

Decentralized exchange (DEX) coin Uniswap [UNI] has been rather quiet in recent days, recording an insignificant 0.86% growth over the last week, according to CoinMarketCap.

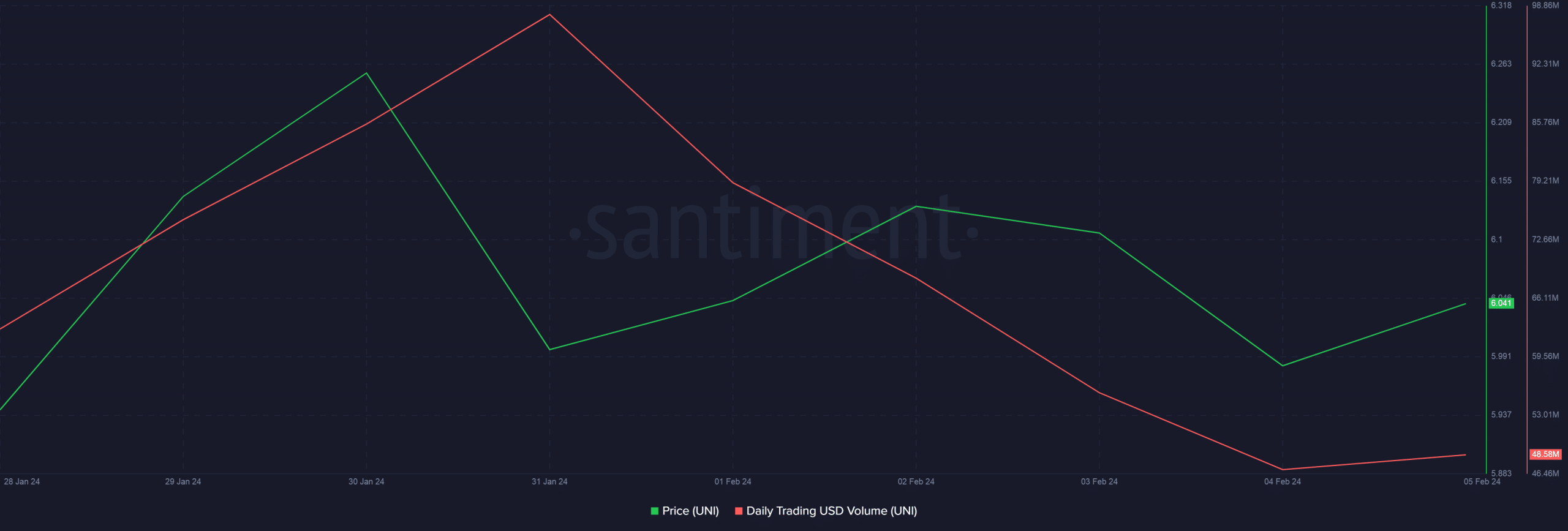

The token’s unimpressive gains kept traders away as the daily trading volume fell sharply since the beginning of the month, AMBCrypto noted using Santiment’s data.

Time to accumulate UNI?

However, the situation might change for the better, if a recent analysis by a prominent technical analyst is to be believed.

Ali Martinez spotted a buy signal while analyzing UNI’s TD Sequential indicator on the 4-hour chart, indicating an “imminent price bounce” in the coming days.

AMBCrypto investigated UNI’s other technical indicators to ascertain the merit of the aforementioned claim.

The Relative Strength Index (RSI) was inching towards the neutral level, a sign that bears were getting exhausted.

Furthermore, the Moving Average Convergence Divergence (MACD) crossed over the signal line, typically seen as a bullish signal by most technical analysts.

Whales refuse to go long on UNI

While technical indicators flashed bullish signs, UNI whales were yet to spring into action.

According to AMBCrypto’s analysis of Santiment data, large transactions involving UNI progressively declined since the start of the month.

However, contrasting trends emerged from different user cohorts.

While addresses with a balance of 1,000–10,000 saw a drop in their holdings, the group with 10,000–100,000 tokens sharply accumulated in the last 24 hours.

As it turns out, whale investors have been bearish on UNI for quite some time now.

The negative readings of Hyblock Capital’s whale vs. retail delta indicator showed whales having less long exposure than retail investors on Binance.

Volumes dip sharply

Meanwhile, Uniswap continued to be the market leader in the DEX industry. It executed trades worth $5.58 billion in the last week, according to DeFiLlama.

Is your portfolio green? Check out the UNI Profit Calculator

This was more than the combined weekly volumes of the second and third-ranked DEXes on the list.

That being said, the weekly volume dropped nearly 30% from the previous 7D period, which might get the proponents concerned.