Can BNB retest its all-time high in 2024?

- BNB’s volume surpassed $2 billion, indicating a possible climb toward $500.

- A rise to its previous ATH largely depends on demand and market sentiment

On the 27th of February, the price of Binance Coin [BNB] hit $400 for the first time since May 2022. This landmark explains how the coin has enjoyed the broader bullish sentiment spread across the market.

However, AMBCrypto considered the price increase the least of where BNB could reach in 2024

But why this sentiment? One reason was the Fear, Uncertainty, and Doubt (FUD) BNB had endured between last year and the time of writing. On several occasions, we reported how Binance, the exchange behind the development of BNB, faced legal issues in the U.S.

In crypto, FUD refers to negative opinions or news related to a cryptocurrency. Most times, when an asset experiences FUD, the price feels the heat.

But BNB’s case seems different as the coin has gained an astonishing 73.87% in the last 90 days. A performance like this was a testament to BNB’s strength.

BNB ignores its predicament

A few weeks ago, AMBCrypto had explained how the coin price could rise to $400. With that achieved, and Binance’s $4.3 billion fine paid, BNB might now gain balance without unnecessary interference. If so, the price action could get closer to its previous All-Time High (ATH).

Furthermore, it is important to note that this potential prediction would not happen without retracements or consolidation at different times. BNB’s ATH was $686.31 three years ago. At press time, the coin was 68.36% down from its ATH.

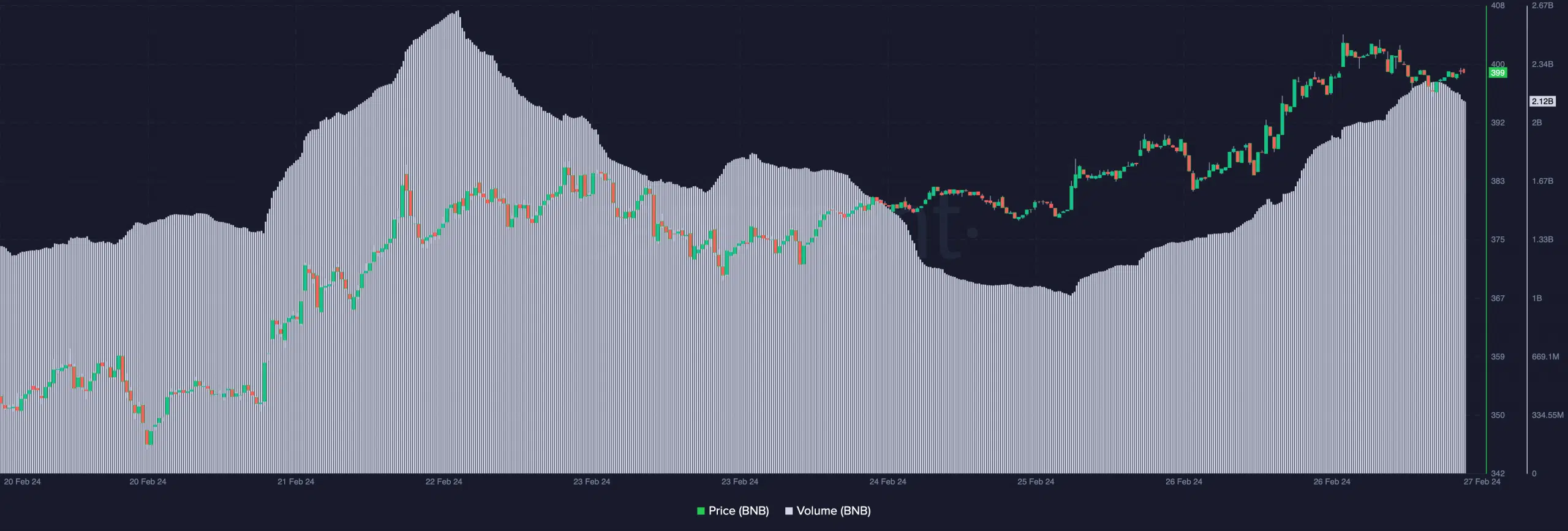

However, BNB’s price might not hit ATH without significant demand. According to on-chain data from Santiment, the volume had increased.

On the 25th of February, Binance Coin’s on-chain volume was around $1 billion. But as of this writing, the metric had increased to $2.12 billion.

The increase in volume suggests that traders were actively buying and selling the coin. If the volume continues to increase as the price climbs, then BNB could head toward $500 within a few weeks.

‘Higher higher’, indicators reveal

In terms of the price action, the daily chart showed that bulls were able to breach the resistance at $329.60, thanks to the support at $300. Also, the 50 EMA (blue) had crossed over the 200 EMA (yellow), indicating a long-term bullish trend.

If the EMAs maintain these positions over the next few months, BNB’s price might continue to ascend. Further, the Aroon indicator reinforced the bullish forecast shown by the EMA.

At press time, the Aroon Up (orange) was 92.68% while the Aroon Down (blue) dropped. In addition, AMBCrypto evaluated the Chaikin Money Flow (CMF) whose reading was 0.28. When combined with the price movement, the indicator suggests an uptrend.

Is your portfolio green? Check the BNB Profit Calculator

For the time being, BNB’s price might climb much higher over the next few weeks. Depending on the market sentiment across the next quarter, the coin has the potential to close in on $700.

But if the bullish momentum currently experienced slows down, BNB might find it hard to surpass its ATH, and the next opportunity could be moved to 2025.