Solana: What rising DEX volumes mean for the ecosystem

- Solana’s DEX volumes jumped 177% over the week, higher than any other chain.

- Solana’s TVL increased by 52% in the last month.

In recent months, decentralized finance (DeFi) users have shown increased interest in Solana [SOL]-based protocols, particularly its decentralized exchanges (DEXes).

Solana DEXes witness burgeoning demand

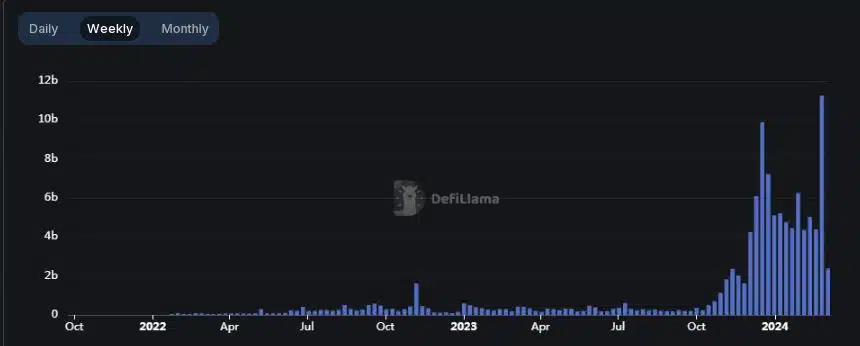

According to AMBCrypto’s analysis of DeFiLlama’s data, Solana-based DEXes logged a cumulative volume of $11.24 billion from the period between 25th February and 2nd March, marking the most prolific week ever.

Additionally, Solana registered a weekly growth rate of a whopping 177%, head and shoulders above any blockchain, including Ethereum [ETH].

After staying suppressed for much of the bear market, Solana’s DEX activity started ascending upwards in Q4 2023. In fact, December witnessed the highest ever monthly DEX volumes, totaling over $28 billion.

While monthly figures dropped in 2024 from this peak, more than $20 billion in trades were still facilitated on Solana DEXes in each of the first two months.

The surge was spearheaded by Jupiter [JUP], the largest DEX on Solana. According to CoinGecko, Jupiter executed trading volumes worth $1.49 billion in the last 24 hours, briefly flipping market leader Uniswap [UNI] V3.

TVL on Solana ascends

Aside from the booming activity on its DEXes, Solana saw a significant increase in the USD value of cryptos locked on its DeFi projects.

Solana’s total value locked (TVL) increased by 52% in the last month, reaching $5.13 billion as of writing. This was the highest rate of TVL growth among top smart contracts blockchains.

The growth was mainly driven by the native token’s massive gains on the price charts. That being said, SOL-denominated TVL also witnessed an impressive rise of 22% year-to-date (YTD).

How much are 1,10,100 SOLs worth today?

The state of SOL

At press time, SOL was exchanging hands at $130.70, after pulling back by 2.81% in the last 24 hours, as per CoinMarketCap. On a broader timeframe, things looked bullish as the fifth-largest crypto was up 28% since the start of 2024.

The market was teeming with “Extreme Greed” sentiment, as per AMBCrypto’s scrutiny of Hyblock Capital data. This signaled an overbought scenario, raising concerns of sharper pullbacks in the days ahead.