Can Cardano hit $10 this bull cycle?

- A repeat of the last bull season performance could send ADA to double-digits.

- On-chain metrics and technical indicators supported a price hike.

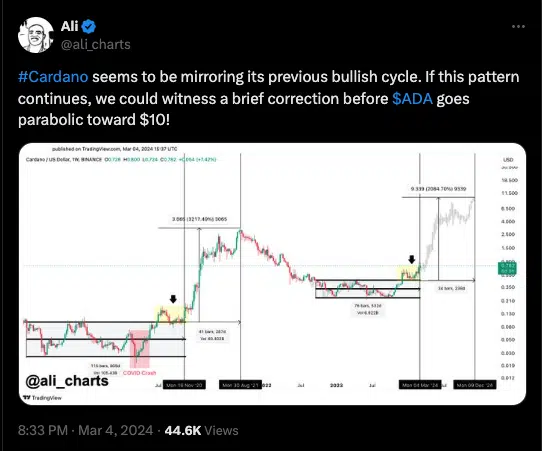

Cardano [ADA] could be set to hit $10 this cycle. According to analyst Ali Martinez, Cardano displayed signals similar to its performance in the 2021 bull market.

However, the analyst mentioned that the potential rally would not be straightforward. Instead, ADA might undergo a correction before moving to $10.

The token has changed its ways

Around December 2021, ADA’s price was $0.15. But 10 months later, the price had increased, and by September 2021, it changed hands at $3. This year, the token seems committed to improving from 2023’s lackluster performance when it struggled to follow Bitcoin’s [BTC] uptrend.

In the last 30 days, ADA’s price climbed by 53.28% while trading at $0.77. But before this significant jump, the token had shown signals that it could perform better. One area where Cardano excelled was in terms of development activity, which served as the consistent bullish metric.

According to AMBCrypto’s on-chain analysis, ADA’s Social Dominance dropped to 0.30%. Social Dominance measures the rate of discussion a project has compared to others in the top 100. Therefore, the decrease implies that traders were taking their eyes off ADA.

But for the price action, the decrease in Social Dominance is a plus. This is because an extremely high Social Dominance would have signed a local top. As such, ADA’s price has the potential to rally. However, it is not guaranteed that the value would hit $10.

On the daily ADA/USD chart, the token looked like it had a clear path to $1. AMBCrypto also examined the Exponential Moving Average (EMA).

At press time, the 50 EMA (blue) had crossed over the 200 EMA (yellow), indicating a bullish long-term trend.

A correction may not stop ADA

Furthermore, signals from the Fibonacci extension showed that ADA’s price could rise as high as $1.40 in the near term. Concerning the Money Flow Index (MFI), the chart showed that the reading increased.

A high MFI reading suggests that a lot of capital flowed into ADA.

The reading at 80.25 implied that ADA was overbought. Thus, the correction talked about earlier could be close. If ADA corrects, the price could drop to $0.65.

However, the rebound afterward could be massive. In a highly bullish case, it might not be out of place to see the Cardano native token at $2.

Beyond the price action, Cardano’s Total Value Locked (TVL) signaled that trust had returned to the ecosystem. At press time, the TVL had risen to $495.14 million, indicating that market players have locked more assets into the protocol.

Is your portfolio green? Check the Cardano Profit Calculator

As an important indicator of investor trust, a rise in the TVL could spread to its price. If Cardano’s TVL rises past $1 billion, then ADA to $10 could be an option.

But that is not the only condition attached to it as other metrics could also play a role in the price prediction.