Arbitrum: Why the selling pressure on ARB’s price?

- ARB ranked one on the list of L2s by fees in the last six months.

- ARB was down by nearly 5% in the last 24 hours.

Though the market was bullish, things for Arbitrum [ARB] did not look good on the price front as its daily chart was red. The possible reason behind this price drop could be a major sell-off that recently happened.

However, not everything was bad, as Arbitrum did well in terms of captured value.

Arbitrum outshines other L2s

Martin Leinweber, a digital asset strategist, posted a tweet on 11th March, highlighting one of the latest achievements of Arbitrum.

As per the tweet, ARB had generated the highest fees among L2s in the last six months, as the value was near $45 million. Apart from Arbitrum, zkSyc Era, Optimism [OP], Starknet, and Base also made it to the top five on the same list.

Since fees remained high, AMBCryto checked Artemis’ data to delve deeper into the L2’s state. We found that L2’s revenue also spiked on the 5th of March, as it exceeded $250,000.

Things on the DeFi front also looked optimistic, which was evident from the consistent rise in its TVL.

ARB is suffering, though

In the meantime, while investors were enjoying profits because of the bull market, ARB investors had to encounter losses.

According to CoinMarketCap, ARB was down by nearly 5% in the last 24 hours alone. At press time ARB was trading at $1.99. A possible reason for this sudden drop could be a major sell-off.

Spot On Chain recently posted a tweet highlighting that DeForce and Synapse, two large institutions, sold a considerable amount of Arbitrum days before the upcoming Ethereum Dencun upgrade.

To be precise, DeForce deposited 2.45 million ARB, which was worth over $5 million to Binance. On the other hand, Synapse swapped 1.3 million ARB for over 2 million USDC recently.

Does this mean that the institutions have lost confidence in ARB, hinting at a further downtrend?

Way ahead for ARB

Our analysis of Hyblock Capital’s data revealed that ARB’s liquidation increased when its price reached $2.27. After that, the token witnessed a correction.

Going southward, a certain amount of ARB will get liquidated if its price touches $1.9. Therefore, if ARB remains above that level, the chances of a recovery still persist.

Read Arbitrum’s [ARB] Price Prediction 2024-25

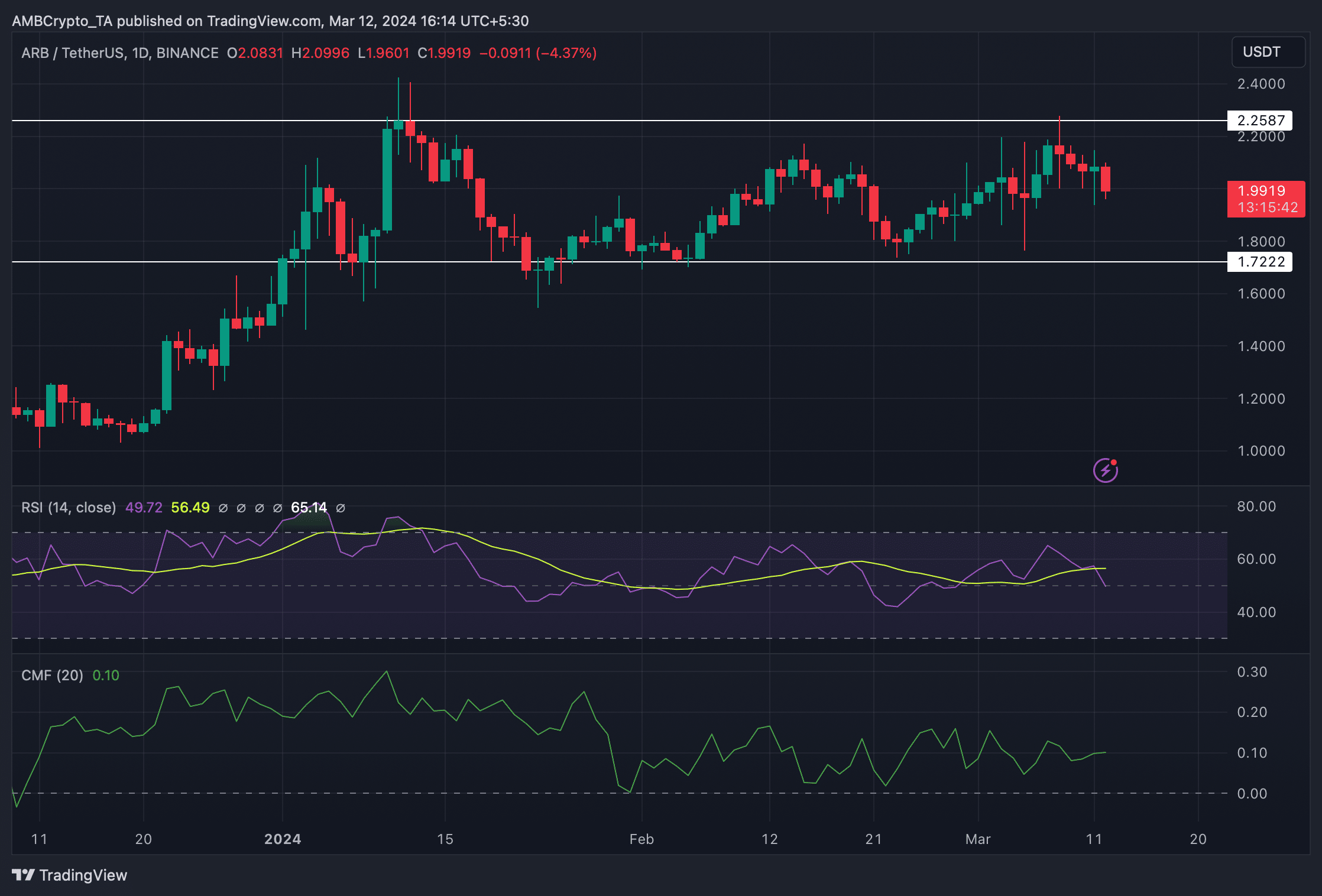

To see which way Arbitrum might head, we then took a look at its daily chart. We found that ARB’s price was somewhat in a consolidation phase. Therefore, investors might have to wait a little longer before witnessing a price uptick.

In fact, its Relative Strength Index (RSI) registered a sharp downtick. Nonetheless, the Chaikin Money Flow (CMF) slightly supported the bulls as it moved up marginally.