Ethereum: What $781 million outflows in 7 days means for ETH’s prices

- Ethereum’s Supply on Exchanges increased in the last few days.

- ETH was down by over 2%, and indicators looked bearish.

Ethereum [ETH] has witnessed a considerable amount of outflow from exchanges over the last week. This happened while its price action was bullish.

However, the market turned bearish in the last 24 hours. Did this have a negative impact on ETH’s outflow?

Ethereum’s outflow surged!

Ethereum’s price rested comfortably above the $3k mark as its price rallied by more than 6% in the last seven days.

While that happened, investors stockpiled ETH, hinting that they expected the token’s price to rise further in the coming days.

Titan of Crypto, a popular crypto analyst, recently posted a tweet highlighting this fact.

As per the tweet, crypto exchanges witnessed an outflow of over 260,000 ETH, equivalent to more than $781 million, within the past seven days.

Additionally, Justin Sun also accumulated ETH. As per a recent tweet from Lookonchain, a wallet that possibly belongs to Sun withdrew 15,389 ETH, worth $49.78 million, from Binance again.

The wallet earlier had bought 147,442 ETH, worth $469.9 million at $3,179 since the 8th of April.

However, the last 24 hours witnessed a change in market sentiment as most cryptos’ prices dropped. According to CoinMarketCap, ETH was down by over 2%.

At press time, the king of altcoins was trading at $3,165.53 with a market capitalization of over $386 billion.

Is ETH’s price drop affecting buying pressure?

Since the token’s price dropped, AMBCrypto checked its metrics to find whether this had any impact on buying pressure.

Our analysis of CryptoQuant’s data revealed that ETH’s net deposit on exchanges was high compared to the last seven days’ average. This signaled that investors have started to sell ETH.

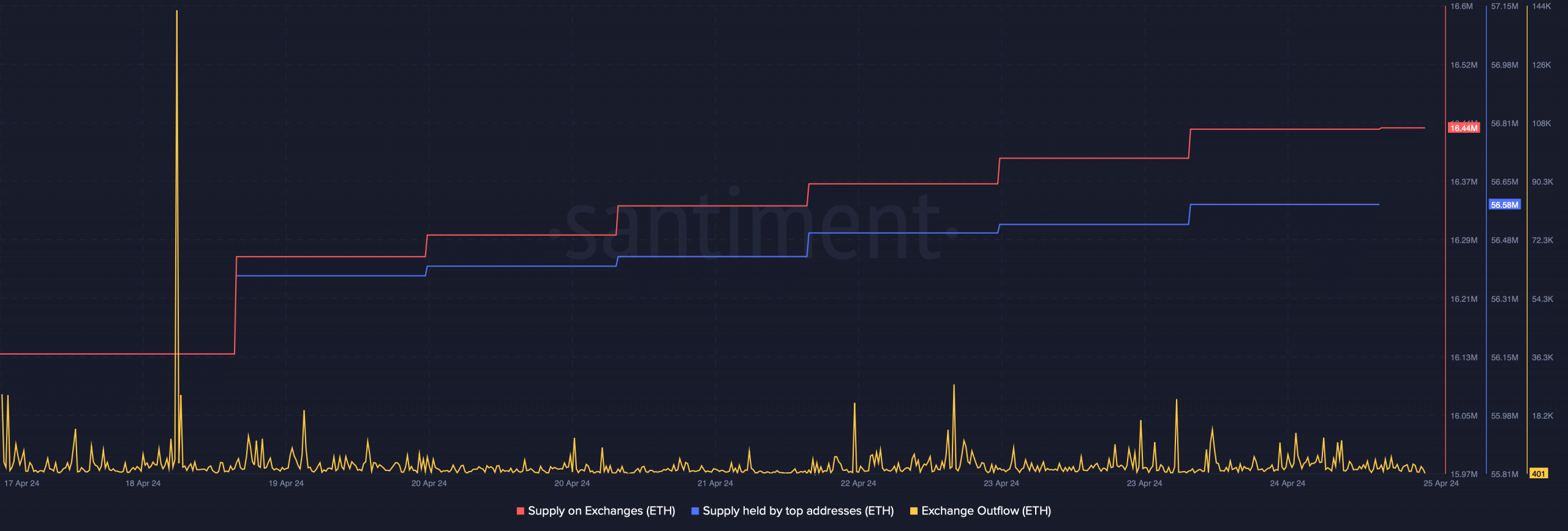

The token’s exchange outflow declined in the last few days. Additionally, the fact that investors were selling Ethereum was further proven by its supply-on-exchange graph as it went up.

Notably, the price decline didn’t affect whale accumulation. This seemed to be the case as ETH’s supply held by top addresses continued to rise last week.

Going forward

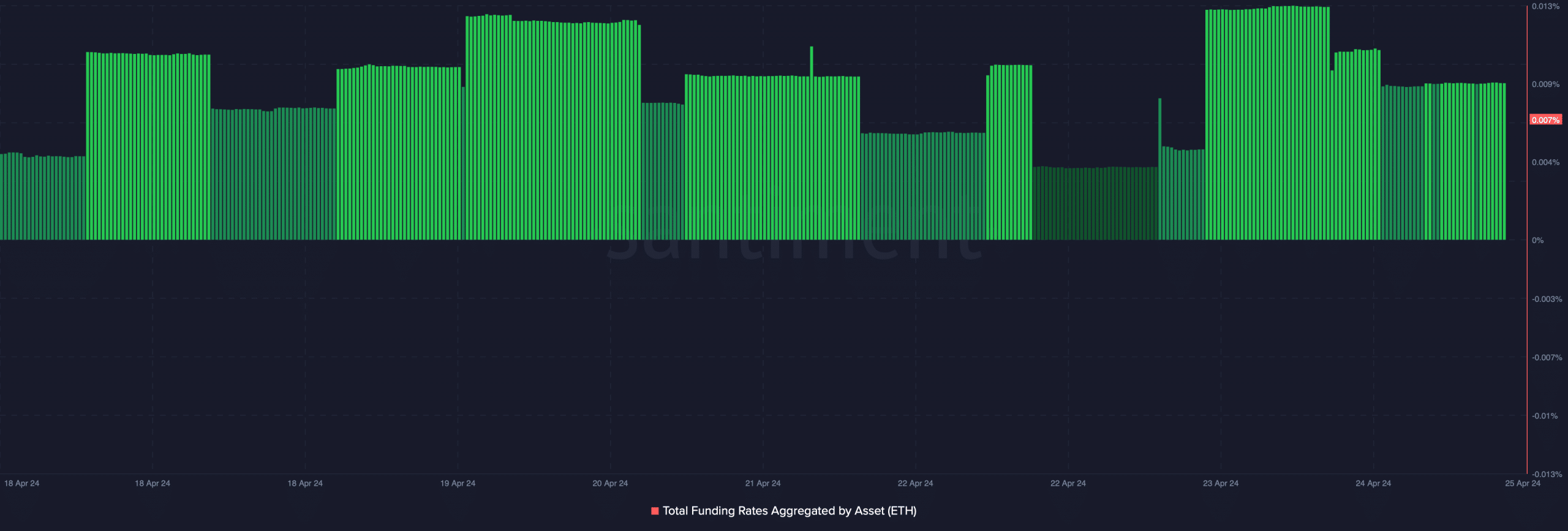

AMBCrypto then analyzed ETH’s derivatives metrics and technical indicators to see if the rise in selling pressure could further impact its price. The token’s Funding Rate increased.

Read Ethereum’s [ETH] Price Prediction 2024-25

Generally, prices tend to move the other way than the Funding Rate. This movement suggested a continued price drop for ETH.

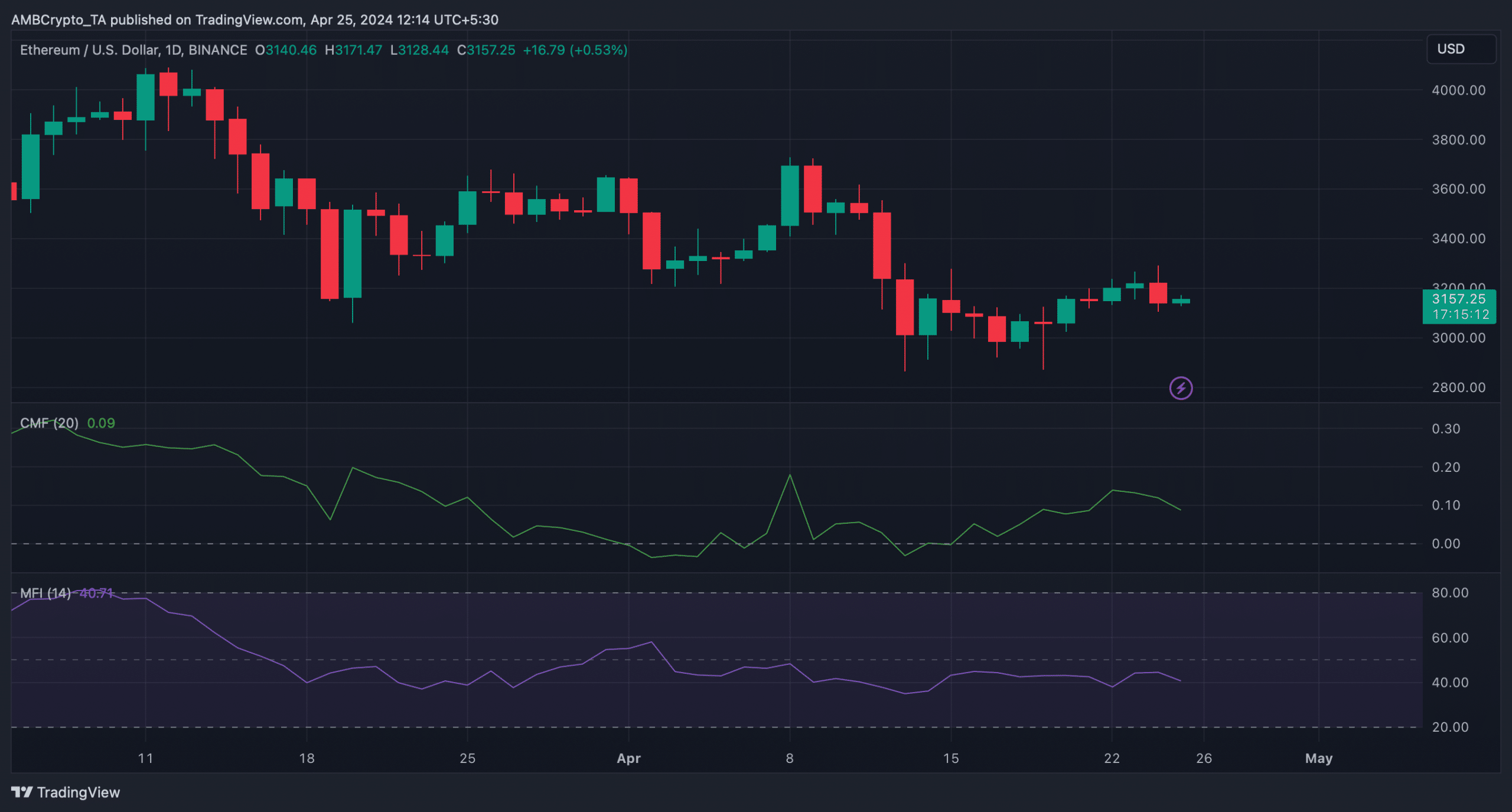

Technical indicators also looked bearish. For instance, both ETH’s Chaikin Money Flow (CMF) and Money Flow Index (MFI) started to decline, showing a continued price drop in the coming days.