Bitcoin’s $259M short squeeze: What next as prices fall below $70K?

- BTC saw the largest volume of short liquidation in almost two years.

- BTC has slipped below the $70,000 price zone.

Bitcoin [BTC] is poised for a pivotal year in 2024, potentially making history or repeating past trends. Recently, its price surge triggered the largest short squeeze since 2022, leading to a significant rise in Open Interest volume.

Although the price has since declined, this could be a sign of another major move ahead.

Bitcoin knocks out short traders

Like a boxing match, Bitcoin and the market have been going head-to-head in the ring. Many spectators bet against Bitcoin emerging victorious, but the reverse saw them counting their losses.

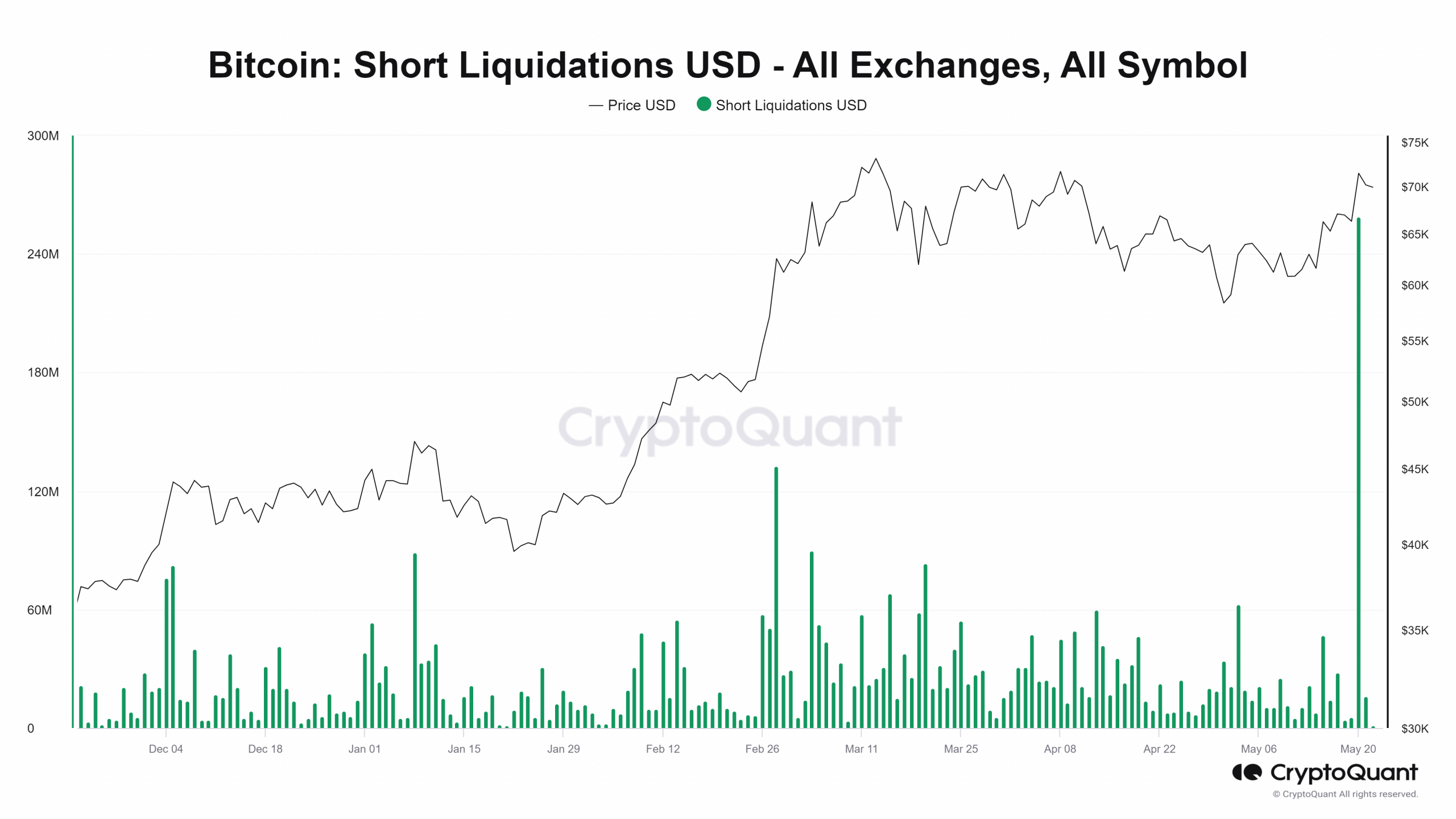

This scenario played out recently when a rise in BTC’s price led to a massive liquidation of short positions. According to CryptoQuant, by the end of trading on 20th May, over $259 million in short positions were wiped out.

This event, known as a short squeeze, occurs when the price of an asset rises sharply, forcing traders who had bet on a price drop to close their positions. According to data, this was the largest short contract liquidation since 2022.

In a short sale, traders borrow shares of an asset, expecting its price to drop so they can buy it back at a lower price, return the shares, and pocket the difference.

If the price rises instead, they must buy back the shares at a higher price, incurring a loss. This is what happened with Bitcoin, driving up the volume of its Open Interest.

Bitcoin Open Interest climbs

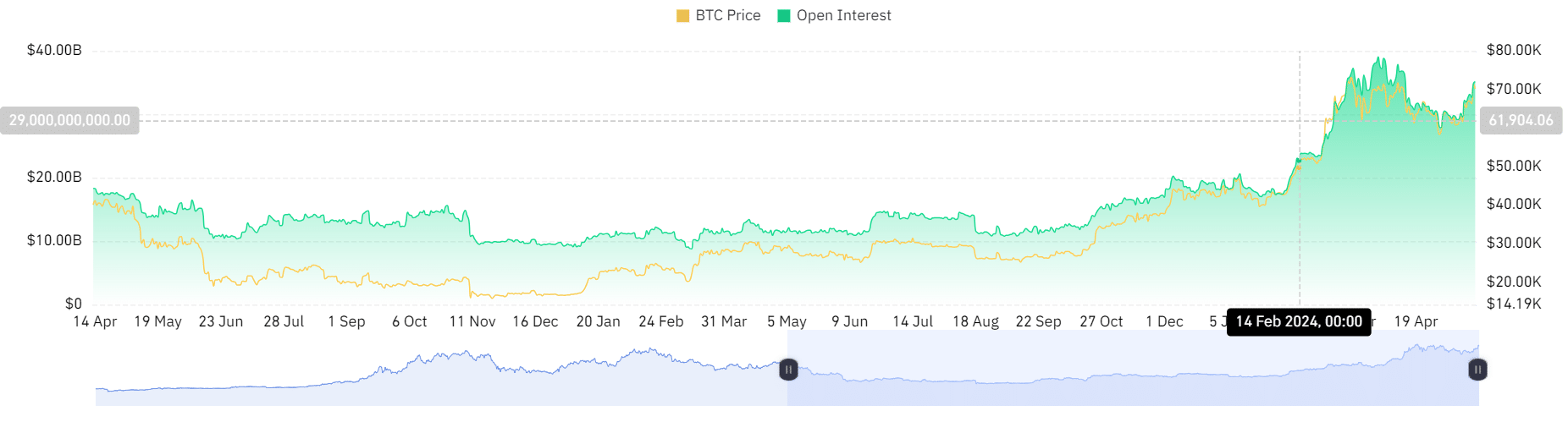

An analysis of Bitcoin Open Interest on Coinglass indicated a substantial recent cash inflow.

One effect of short liquidations is that closing positions prompts more buyers to create new positions, causing additional cash to flow into the asset, in this case, Bitcoin, and increasing the Open Interest.

As of now, BTC’s Open Interest was $35 billion. Despite the price of BTC falling below the $70,000 range in the last 24 hours, Open Interest has continued to rise.

This suggests that more traders are still betting on another price increase in addition to short positions being settled.

How BTC has trended

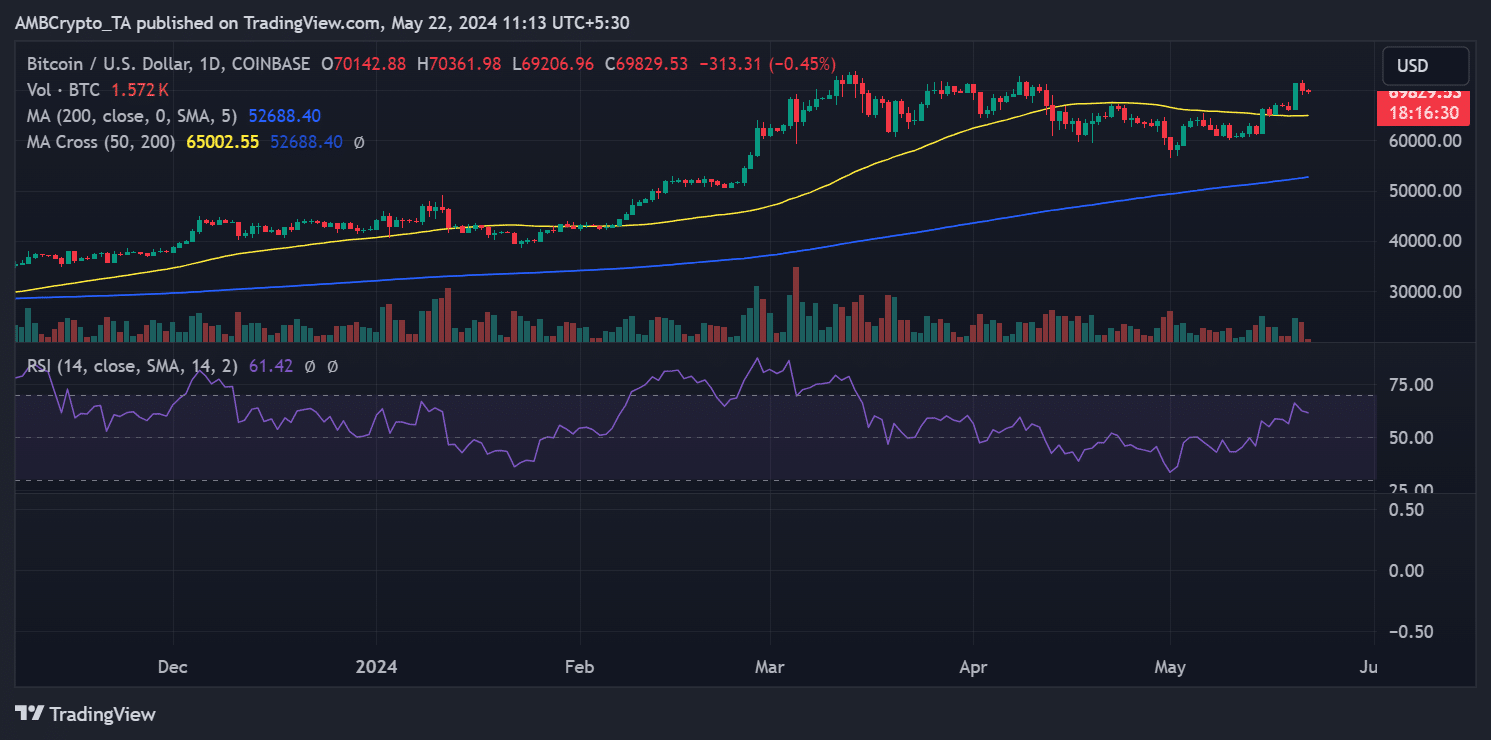

According to AMBcrypto’s analysis of Bitcoin on a daily time frame, BTC fell from the $71,000 range by the end of trading on 21st May. The chart indicated a decline of approximately 1.8%, bringing the price to around $70,142.

Read Bitcoin (BTC) Price prediction 2024-25

As of this writing, BTC was trading at about $69,830, reflecting a decline of less than 1%. Short sellers might see this as an opportunity to bet against Bitcoin, but many will still be observing the trend.

BTC has managed to rise above its short Moving Average (yellow line) and turned it into support around $66,000. If this support holds, BTC might soon test the $75,000 price zone.