Base beats Ethereum in Uniswap DEX volumes: A shift coming?

- Base became the protocol with the highest Uniswap’s DEX volumes, outperforming Ethereum.

- Ethereum ecosystem stagnated, active addresses on the network declined.

Ethereum [ETH] has been one of the most dominant networks in crypto. However, newcomers have slowly started encroaching in the king of altcoin’s territory.

Ethereum gets overtaken

Base was one of the networks that managed to give Ethereum a run for its money in DEX (Decentralized Exchange) usage.

Per a tweet by Token Terminal, the percentage of daily active users for Uniswap [UNI] (one of the largest DEXes in the crypto space) on the Base network was 36.30%. Ethereum came in second at 23.74%.

Ethereum’s waning popularity across various sectors can have adverse impacts on the Ethereum network. Another area where Ethereum was struggling to gain popularity was the NFT sector.

AMBCrypto’s examination of CryptoSlam’s data revealed that Bitcoin [BTC] was the most dominant network in terms of NFTs.

Ethereum was far behind in second place in terms of both sales volume and number of buyers and sellers. Polygon [MATIC] and Solana [SOL] were quickly catching up to Ethereum as well.

Popular blue chip NFT collections such as Bored Ape Yacht Club [BAYC] and Mutant Ape Yacht Club [MAYC] witnessed a massive decline in overall interest.

Floor prices and sales volumes for both the collections fell over the last few months.

As a result of these factors, the activity on the Ethereum network saw a decline.

AMBCrypto’s analysis of Token Terminal’s data revealed that the daily active addresses on the Ethereum network fell by 5.8% in the last month. Due to this, revenue generated by the Ethereum network collapsed.

ETH remains unfazed

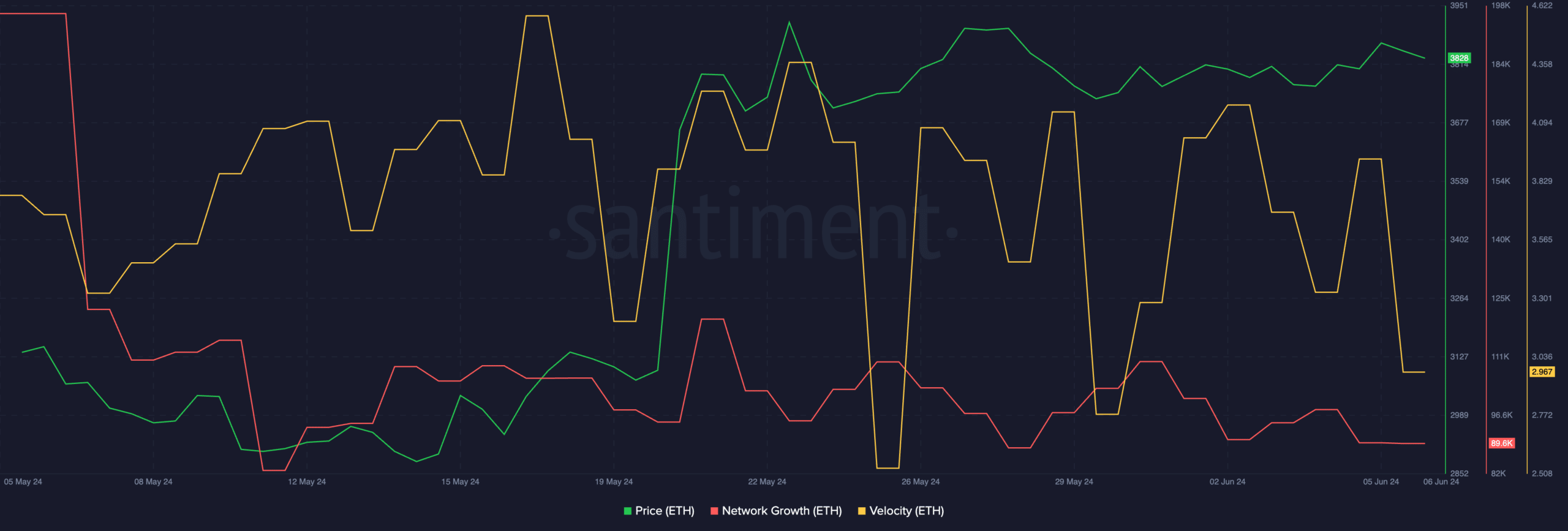

At press time, ETH was trading at $3,688.41 and its price had faced a minor correction of 0.13% in the last 24 hours.

The network growth for ETH also fell materially during this period, implying that new addresses were unwilling to buy new ETH tokens at the press time price.

The velocity at which ETH was being traded plummeted, implying the frequency at which ETH was trading at had fallen significantly.

Read Ethereum’s [ETH] Price Prediction 2024-25

However, as the smoke clears around Ethereum ETFs and more clarity is gained around the approval of the remaining Ethereum ETFs, things could change for the better for ETH.

As institutional money from Wall Street floats in, the potential for another uptick is probable.