BNB’s $600 roadblock – Traders, look out for these targets now!

- Price looked set to move to the high liquidity area identified around $585

- Online discussions about BNB dropped, indicating low interest in the coin

A few days ago, AMBCrypto reported how Binance [BNB] slid from its all-time high. At that time, the coin showed some signs of bouncing back.

Subsequently, that did not happen. Trading at just under $600 at press time, BNB’s price has plummeted by 15% in the last seven days. While it became the first of the top 10 altcoins to surpass its ATH, it has also become one of the worst-performing cryptocurrencies in the top 10 this week, alongside Dogecoin [DOGE] and Cardano [ADA].

Liquidity changes position

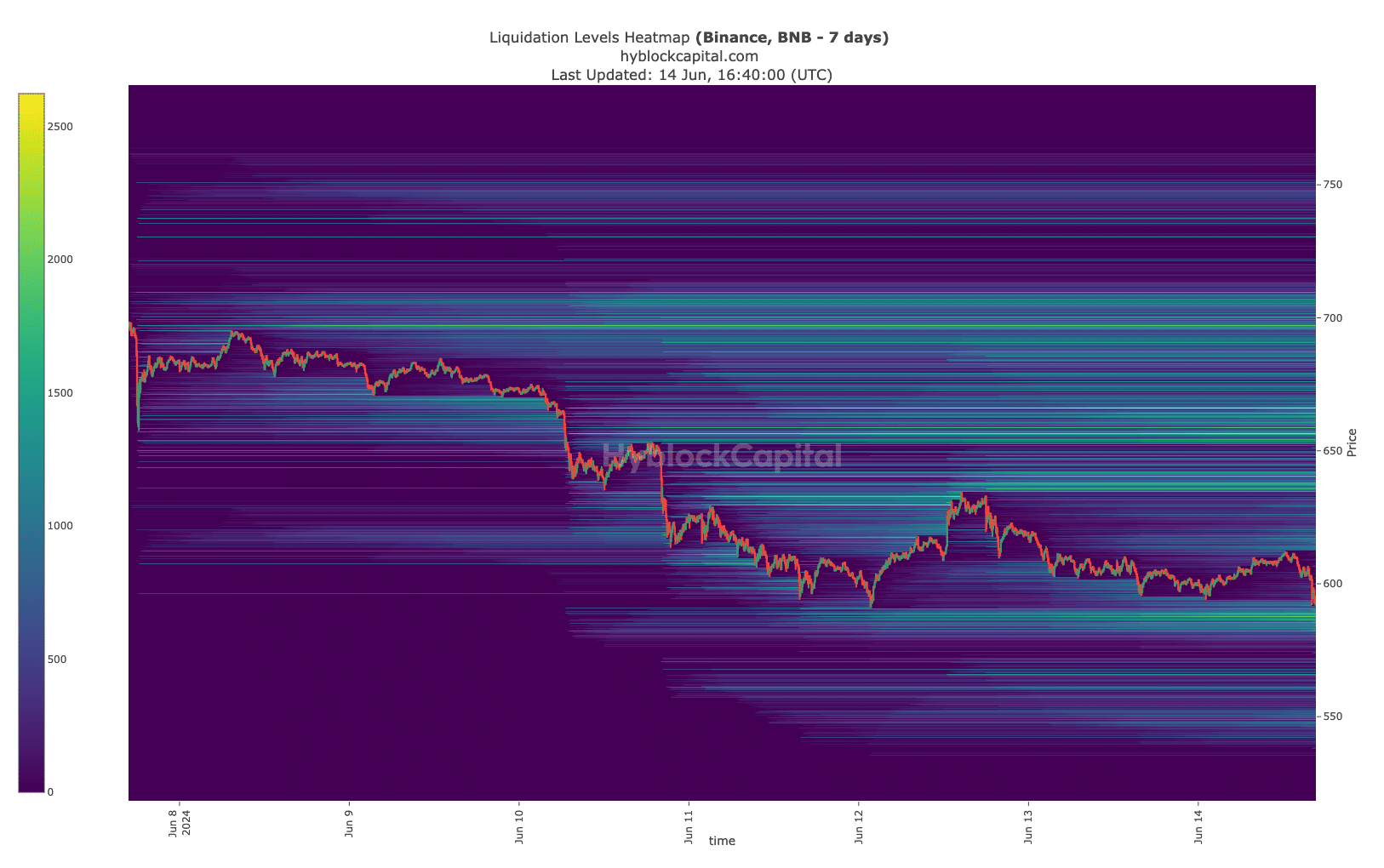

By the look of things, the coin might be in place to trade lower too. To validate this prediction, AMBCrypto analyzed the liquidation heatmap.

Liquidation heatmap shows the price levels where liquidation events might take place. The indicator can also show targets where a cryptocurrency might move.

According to Hyblock, BNB had high liquidity around $585.64 to $590.74. Therefore, the price of the coin might move to these levels within the next few days.

However, traders should know that invalidation might occur if the broader market condition changes for better. If this is the case, the price of BNB might hike to $635.40

In a highly bullish scenario, the value could be $656.28. Looking at other metrics like social dominance gave credence to the bearish sentiment though.

What’s the next target?

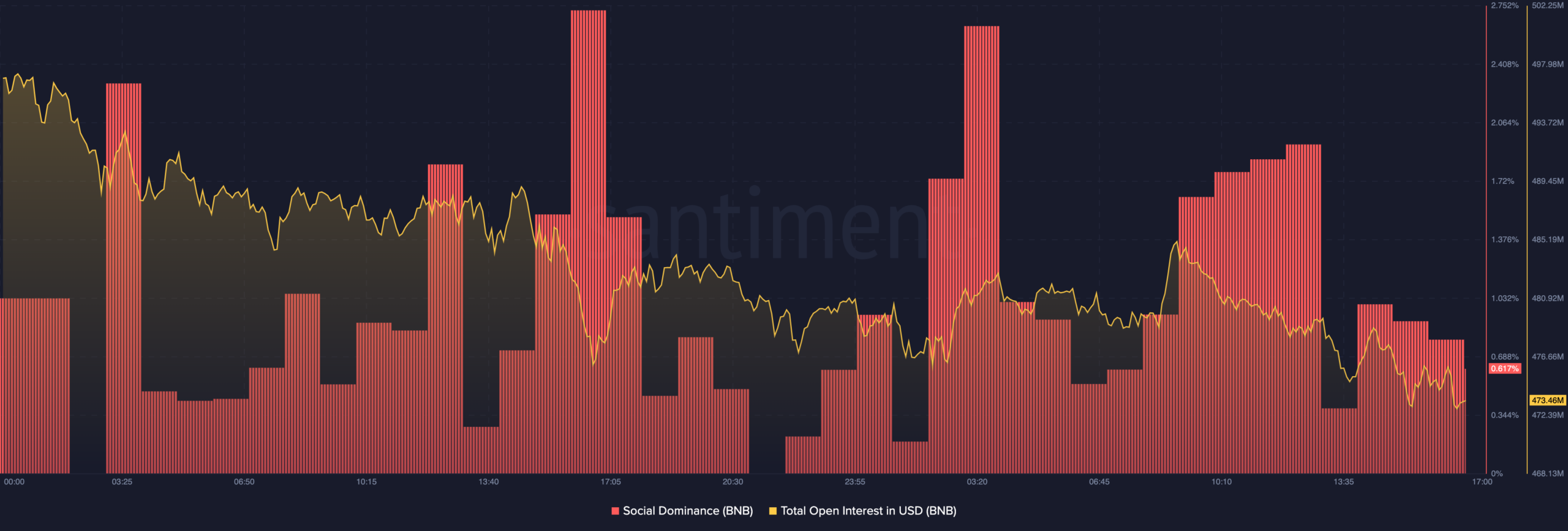

At press time, the altcoin’s social dominance was down to 0.617. This metric tracks interest in a cryptocurrency based on social media and crypto media discussions.

Therefore, the decline implied that community interest in BNB and engagement with the coin had fallen across the board. As such, it could be challenging for the coin to note improved demand that could foreshadow higher prices.

Furthermore, Open Interest (OI) fell to $473.46 million at press time. OI is the value of the sum of all existing contracts related to a cryptocurrency in the market.

If the value increases, it means that there is an increase in speculative activity around the coin. In most cases, this serves as strength for an upswing. On the contrary, a reduction in BNB’s speculative positions imply that it could be challenging for the price to bounce.

As it stands, BNB might continue to drop and break below key support levels. If this happens, it could indicate a continuation of its bearish trend. However, a shift in the trend might be possible if buying pressure hikes.

Realistic or not, here’s BNB’s market cap in BTC terms

If interest online starts to improve, it could be the beginning of a run upwards for the coin. If it recovers, the altcoin could find a range above $600. If not, the next targets for BNB will remain between $585 and $600.