Blast crypto airdrop ignites trading frenzy: This is the result

- BLAST kicked off with a positive price movement after launch.

- The network TVL has continued to decline.

The recent launch of the Blast crypto airdrop marked an impressive start for the asset, with a significant rise in value. However, despite the strong initial activity, the total value locked (TVL) on the network experienced a decline.

Blast crypto launches

The official X (formerly Twitter) handle announced the launch of the Blast crypto airdrop on the 26th of June. According to the announcement, users will have 30 days to claim their airdrop.

In this initial distribution, users of the Ethereum [ETH] layer-2 scaling network are set to receive 17 billion BLAST tokens collectively. The network was created by the developers of the incentivized NFT marketplace, Blur.

Blast crypto in the last 24 hours

Since its launch, Blast crypto has shown a notable increase in activity, according to the data from CoinMarketCap. Initially priced at around $0.20, the token’s value increased to about $0.025 by the end of its launch day.

It saw a slight rise to approximately $0.029 at the beginning of the current trading session before stabilizing around $0.026.

Over the past 24 hours, Blast’s market capitalization has surged by more than 20%, reaching over $441 million. Additionally, the trading volume has been robust, recorded at over $674 million.

This suggests a high level of trader interest and market activity surrounding the new crypto asset.

Blast’s volume spikes

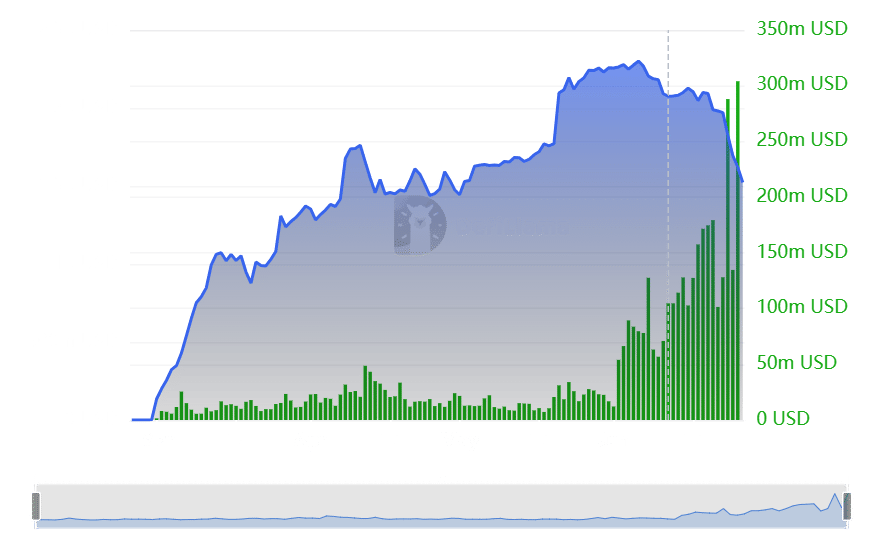

The analysis of the Blast crypto network on DeFiLlama revealed a significant increase in trading volume on 26th June, coinciding with its airdrop launch.

The volume soared to over $304 million, marking the highest in the history of the Layer 2 network. This peak in volume surpassed the previous high on 24th June, when it reached over $288 million.

Despite the surge in trading volume, the Total Value Locked (TVL) in the network has been on a decline. The downward trend in TVL began around the 23rd of June and continued despite the influx of activity from the airdrop.

Initially, on 23rd June, the TVL stood at over $1.9 billion. However, it has since decreased to approximately $1.54 billion.

This decline in TVL suggests that while the launch generated considerable trading interest, it has not translated into a sustained increase in value locked within the network, at least not yet.

![MANTRA [OM] price prediction - Traders, watch out for these retracement levels!](https://ambcrypto.com/wp-content/uploads/2024/11/Mantra-Featured-400x240.webp)