Injective: Why INJ’s latest surge is not enough for a rally

- INJ has surged by 3.86% in the last 24 hours.

- Despite the price rise, the market lacks strong bullish momentum implying a consolidation.

In the last seven days, the altcoin market cap declined from $1.18 trillion to $1.16 trillion. According to Coingecko, the global cryptocurrency market cap has declined by 0.23% to $2.38 trillion.

Despite these dips in the crypto market, Injective [INJ] has proven to be resilient. At press time, INJ was trading at $23.54, a 3.86% rise in 24 hours.

The current market conditions are a cumulation of various factors. Firstly, increased demand resulted in the scarcity of INJ tokens following massive burns. @Injective team shared on X about a recent and scheduled burn, stating that,

“With rising protocol revenue across injective dApps, the burn auction has increased by an average of 9.64% every week over the past 3 months. This equates to over a 124% growth in INJ burned. The INJ burn later today is also set to be one of the largest ever”.

The Injective team further shared that,

“Injective has reached a new ATH in staked $INJ, Reached 727 Million total transactions, Crossed $34 Billion across its DEXs”.

Undoubtedly, the developments, transactions, and burns indicate factors driving INJ’s recent market condition when most altcoins are in dips.

Is INJ moving upward or is it in consolidation?

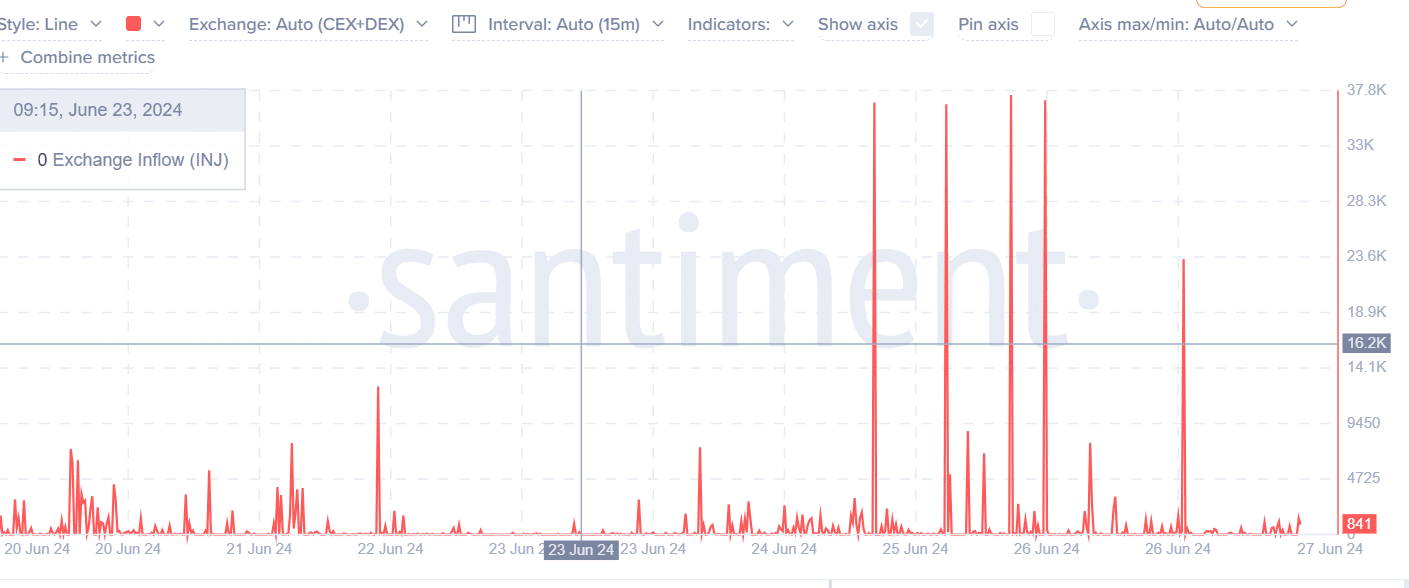

AMBCrypto’s analysis of Santment data shows that the market is currently in a consolidation phase.

According to Santiment, INJ’s exchange inflow has declined in the last seven days from a high of 38k to a low of 841 at the time of writing.

Generally, low exchange inflow shows market stability. Therefore, holders are hoping to make a profit in the short run.

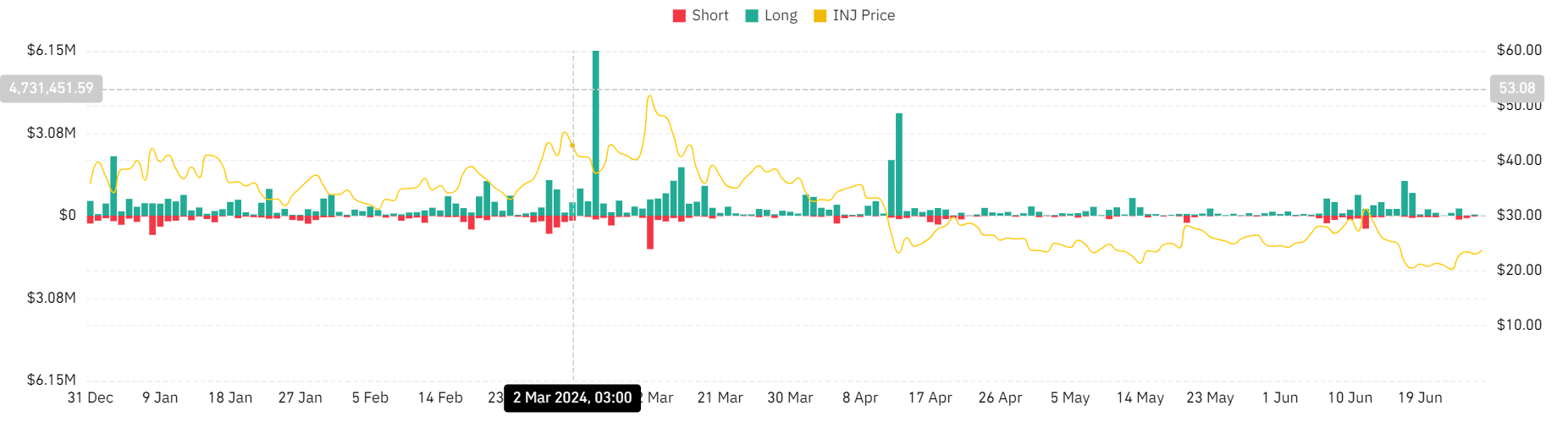

Also, analysis of Coinglass data shows positive market sentiment with lower liquidation for long and short positions.

In the last seven days, long position liquidation has declined from a high of $235k to a low of 9k at press time. Short positions declined from a high of $57k to a low of 3k. The decline for both positions shows market stability, and there are few forced sell-offs.

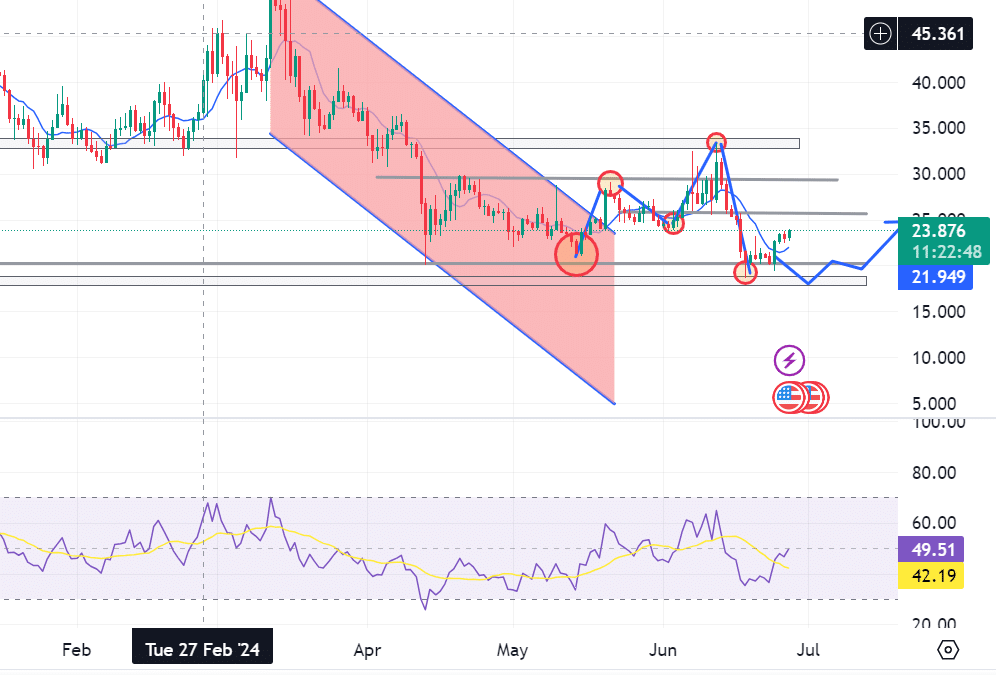

Additionally, INJ reported an RSI of 49 at press time. The RSI near the neutral zone balances buying and selling pressure. This shows the market lacks a clear direction and a strong upward or downtrend.

Source: TradingView

What next: Bulls or Bears?

INJ prices have surged because of buying pressure and anticipation of selling in the future with profit. Speculative buying means prices will rise quickly and then start declining.

Realistic or not, here’s INJ’s market cap in BTC terms

However, the current market sentiment is mixed with that of bears and bulls fighting for control, thus leading to a consolidation phase.

If the bulls emerge from the battle, INJ prices will rise to the next resistance level of around $25.605 and $29.360 in a highly bullish scenario. However, if the bears win, INJ will lose its recent gains and retrace at $20.217.