XRP whale watch: As 63M tokens move, is a sell-off coming?

- Whales dumped significant XRP to exchanges in the last few days.

- In the meantime, Ripple rejected the SEC’s revised offer, raising more fears about its future.

Whales have been moving massive amounts of Ripple [XRP] to exchanges over the last few days.

As per a tweet by commentator MartyParty, a whopping 63,570,000 XRP had been transferred to exchanges since the 1st of July.

This large movement suggested potential volatility in the market, as whales could be positioning themselves for a price swing.

Whales dump their tokens?

A sudden influx of such a large amount of XRP hitting exchanges could overwhelm existing buy orders and drive the price down.

This is especially true, if there aren’t enough buyers ready to absorb all the tokens at the current price. The market could experience increased volatility as investors react to the whale activity.

Some might see it as a selling opportunity and follow suit, leading to a snowball effect.

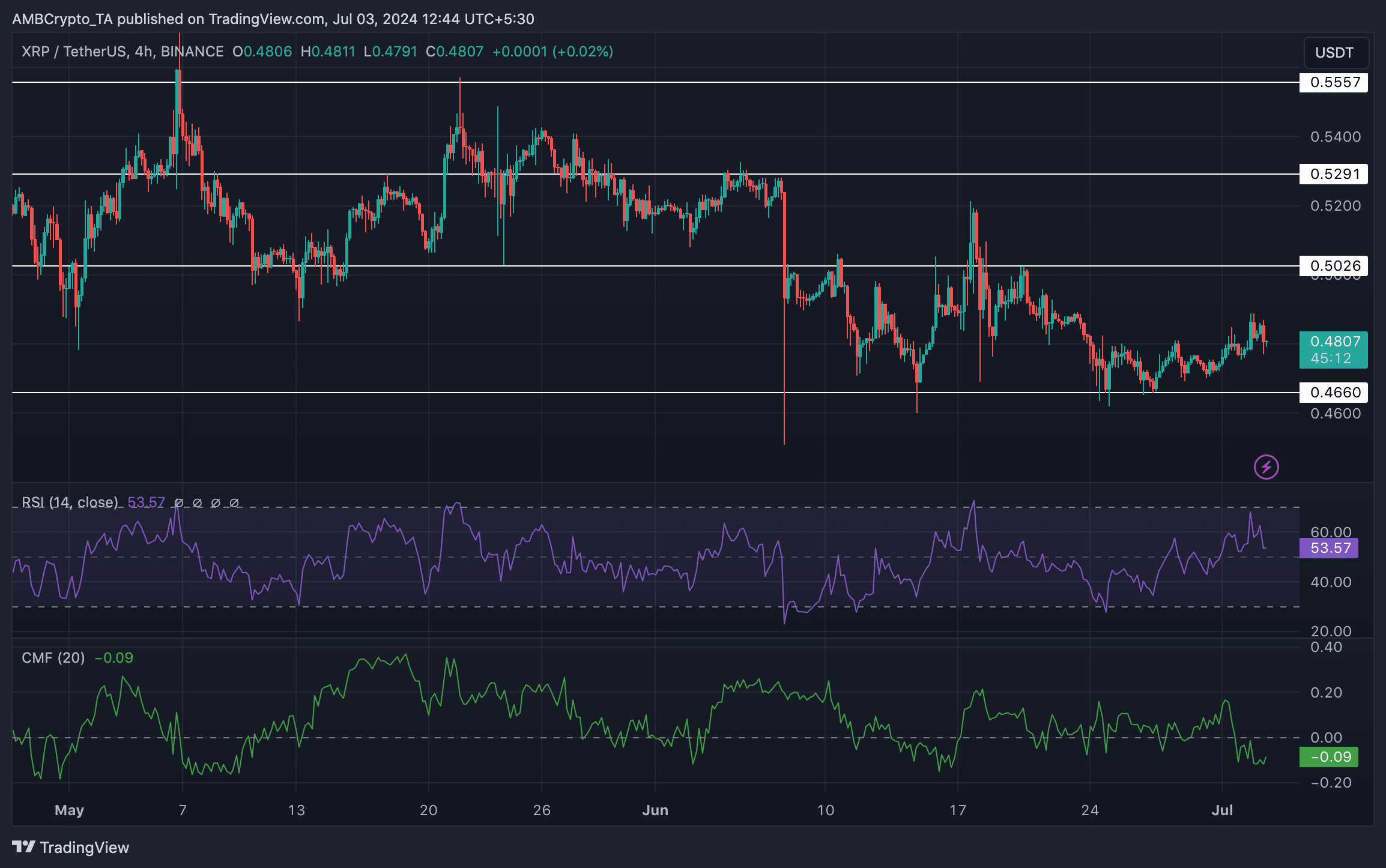

At press time, XRP was trading at $0.4789. After testing the $0.556 level on the 6th of May, the price of the token fell significantly.

During this period, the price exhibited multiple lower lows and lower highs, indicative of a bearish trend. The recent uptick in price of XRP wasn’t significant enough to reverse or weaken the trend.

XRP’s RSI (Relative Strength Index) remained high, indicating a surge in bullish momentum for the token.

However, the same couldn’t be said about the CMF (Chaikin Money Flow) which had decreased significantly over the last few days, which implied that the money flowing into the XRP token had waned.

XRP’s whale movements could be a result of investors’ dwindling confidence, brought about by Ripple’s handling of its case against the SEC.

Battles against the SEC

The SEC initially came down hard on Ripple, seeking a hefty $2 billion fine for alleged security violations. But in a recent move, the regulatory body softened its stance, proposing a significantly reduced fine of $102 million.

However, Ripple has declined this offer, as the firm seems posited to win instead of just opting to settle. Investors, though, may lose more confidence the longer the case carries on.

This will naturally impact XRP’s future prospects, drastically.

Is your portfolio green? Check out the XRP Profit Calculator

This move has also drawn criticism against the SEC — primarily, that the regulatory body is stifling innovation in the crypto space.

The legal entanglement has proven costly for Ripple as well, with the firm having spent over $200 million so far.