Will Polkadot surge in Q4 2024? Key developments that can help DOT

- Polkadot’s Coretime sales and Plaza Update could drive major demand and adoption in Q4 2024.

- DOT’s falling wedge pattern and reduced unstaking period hinted at a potential bullish breakout.

Polkadot [DOT] has been gaining attention within the crypto market. Inasmuch, analyst Mister Crypto recently pointed to several factors suggesting a significant price increase in Q42024.

Here’s a look at the key elements that could drive DOT’s value higher.

Polkadot’s upgrades signal explosive growth

Polkadot is transitioning from its current parachain auction system to Coretime sales, a move aimed at making it easier for projects to secure Polkadot’s security.

This change will streamline the process, allowing more projects to access the network, which could drive up demand for DOT.

Additionally, the upcoming Plaza Update seeks to enhance user experience by integrating the Asset Hub and Ethereum [ETH] Virtual Machine (EVM) compatibility.

This update aims to create a more unified and user-friendly environment, which could attract more developers and users to the ecosystem.

Also, Polkadot’s governance is considering a proposal to reduce the network’s inflation rate from 10% to as low as 5%.

If implemented, this reduction could help stabilize the value of DOT by decreasing the supply of new tokens entering the market.

A lower inflation rate might make holding DOT more attractive to investors, potentially leading to price appreciation.

Moreover, Polkadot plans to reduce the unstaking period from 28 days to as little as two days.

This change would improve liquidity by allowing stakers to access their funds more quickly, which could incentivize more participants to stake DOT.

The network is also working on trustless bridges like Snowbridge and Hyperbridge to enable seamless interoperability between blockchains.

These bridges will allow assets and data to be transferred across different networks without relying on centralized intermediaries, potentially increasing Polkadot’s appeal as a multi-chain ecosystem.

In addition, Polkadot is positioning itself to take advantage of the growing Web3 gaming sector.

As decentralized gaming continues to gain popularity, Polkadot looks to attract newer users and developers through its infrastructure.

The expansion into Web3 gaming could drive further demand for DOT, as more projects and users engage with the network.

Polkadot’s bullish setup

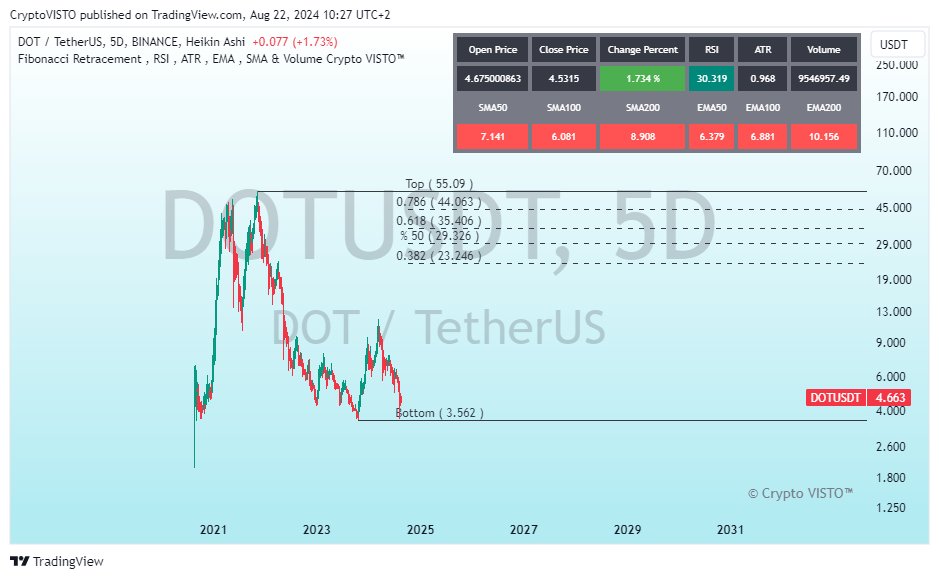

Crypto VISTO™ backed this sentiment, commenting on Mister Crypto’s post that DOT’s technical indicators, including its Fibonacci retracement levels and RSI, pointed to a potential breakout.

With DOT trading at $4.66 at press time, key resistance levels were identified at $23.24, $29.32, $35.40, and $44.06, with the possibility of retesting its all-time high of $55.09.

A recent report from AMBCrypto indicated that Polkadot’s price action was forming a falling wedge pattern on the daily chart, which is often seen as a bullish indicator.

Read Polkadot’s [DOT] Price Prediction 2024 – 2025

Crypto analyst Captain Faibik noted that DOT might have –

“Bottomed out and is ready to bounce back.”

This was because the price was rebounding off the lower trendline of this pattern, suggesting a possible short-term recovery.