Nvidia’s Q2 results: A turning point for Artificial Superintelligence Alliance?

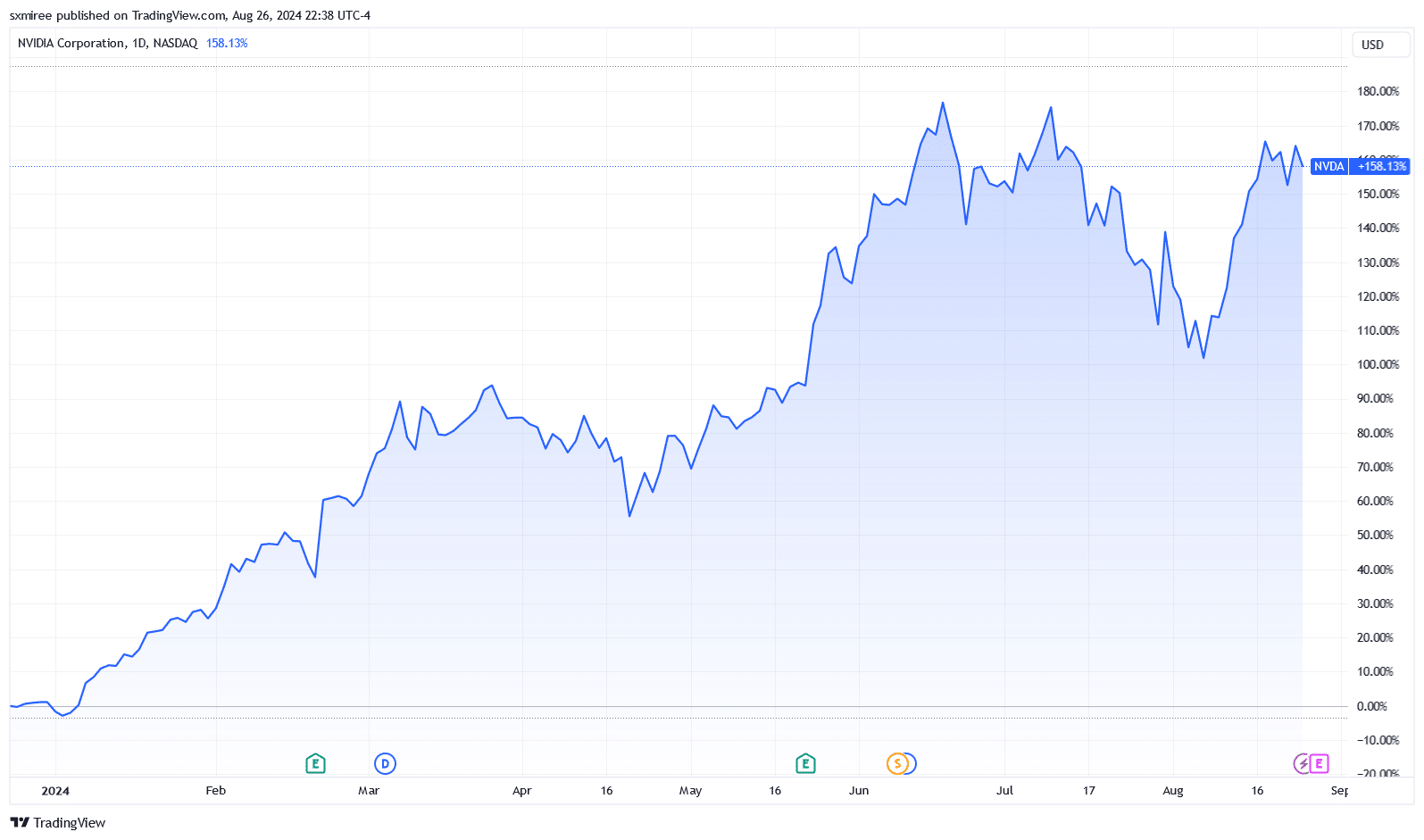

- Nvidia’s success has previously sparked moves in GPU and AI-focused crypto tokens in the spot market.

- Upcoming US economic data could fuel prevailing sentiment and add uncertainty to the broader digital asset landscape.

Global markets are anticipating a critical quarterly earnings report alongside crucial US economic data releases this week. Crypto speculators are closely monitoring these external factors, which could generate turbulence in a pivotal week, bringing August to an end.

Nvidia Q2 earnings

Nvidia’s quarterly report card for the period ending July 31 is expected this week on August 28. The earnings details could, in particular, profoundly impact GPU and AI-related crypto tokens, which have mainly been thriving on the hype around their underlying technologies.

The California-based company designs, manufactures, and supplies GPUs for crypto mining and other intensive applications.

Its dominance in high-performance computing solutions has positioned it at the intersection of accelerated computing, artificial intelligence, and blockchain.

A robust Q2 earnings report from the tech giant will likely boost investor optimism surrounding these technologies. Market participants may also view positive earnings as a sign of continued growth in the sectors leveraging the technologies ultimately bolstering the respective narratives.

Such positive sentiment would bolster prices of tokens like Artificial Superintelligence Alliance [FET], RENDER and TAO due to increased speculation.

A report delivering weaker-than-expected earnings would conversely hurt investor confidence in AI’s role in the future of tech. This could dampen market sentiment, potentially leading to a sell-off across tech stocks and related crypto assets.

Case for Artificial Superintelligence Alliance, Render

The Artificial Superintelligence Alliance token, ASI, has charted an impressive course in August, rebounding steadily to reclaim $1.05 last week.

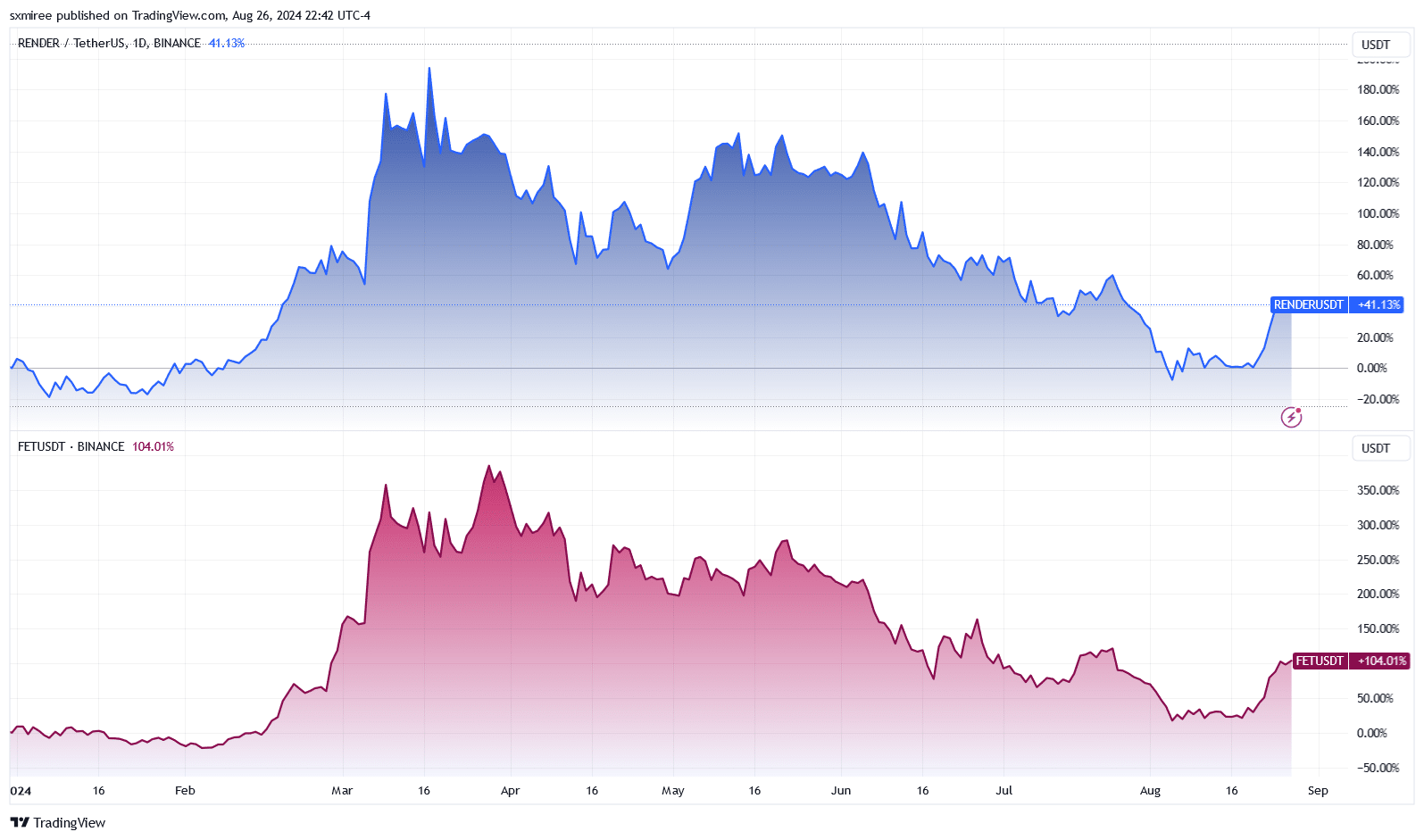

TradingView data shows ASI has gained 45% in the last 7 days, standing out among top-performers alongside RENDER, up 33.81% in the same period.

In mid-March, Render price rose from $6.89 to a 2024 high above $13 during a window coinciding with the five-day NVIDIA’s GTC 2024 AI conference, which concluded on March 21.

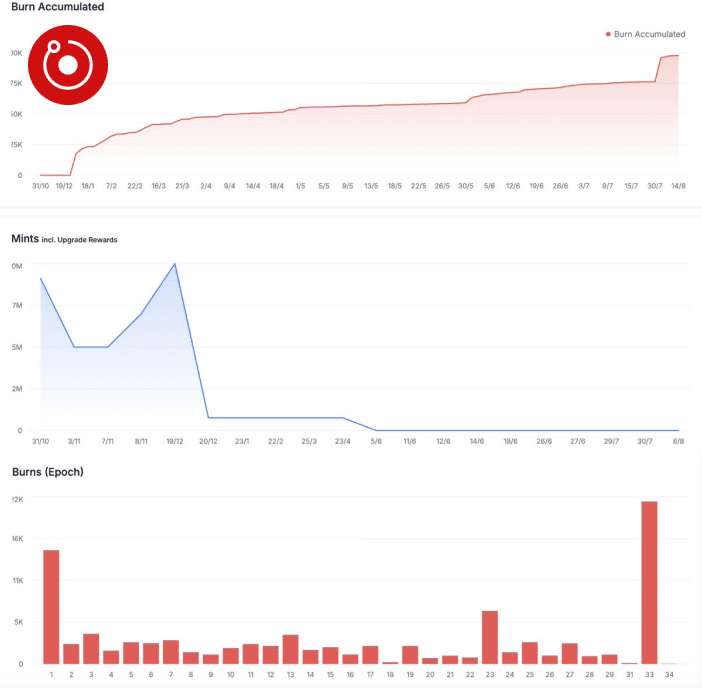

Though RENDER has endured dipping phases since, protocol data hints at encouraging levels of utility.

Source: X

Overall, the two have maintained a robust market presence and remain promising, particularly for speculators betting on the potential of their underlying technologies.

US economic data to shape market’s next move

Beyond the corporate earnings reports, key events on this week’s US economic calendar could set the stage for heightened volatility.

The crypto retail market has been susceptible to economic pressures and political plays in August – a theme expected to remain unchanged.