Render price prediction: Why another 15% hike could be likely

- Render has an optimistic short-term outlook

- The boost in trading volume and keen buying pressure are likely to sustain the uptrend

Render [RENDER] was trending upward over the past few days. The breach of the $5.2 resistance zone was swift and the buyers have not relented in their pace since then. Another 15% upward move appeared likely.

The token was also in the news recently after it saw a large boost to its trading volume as price appreciation began in earnest.

Bullish signals everywhere

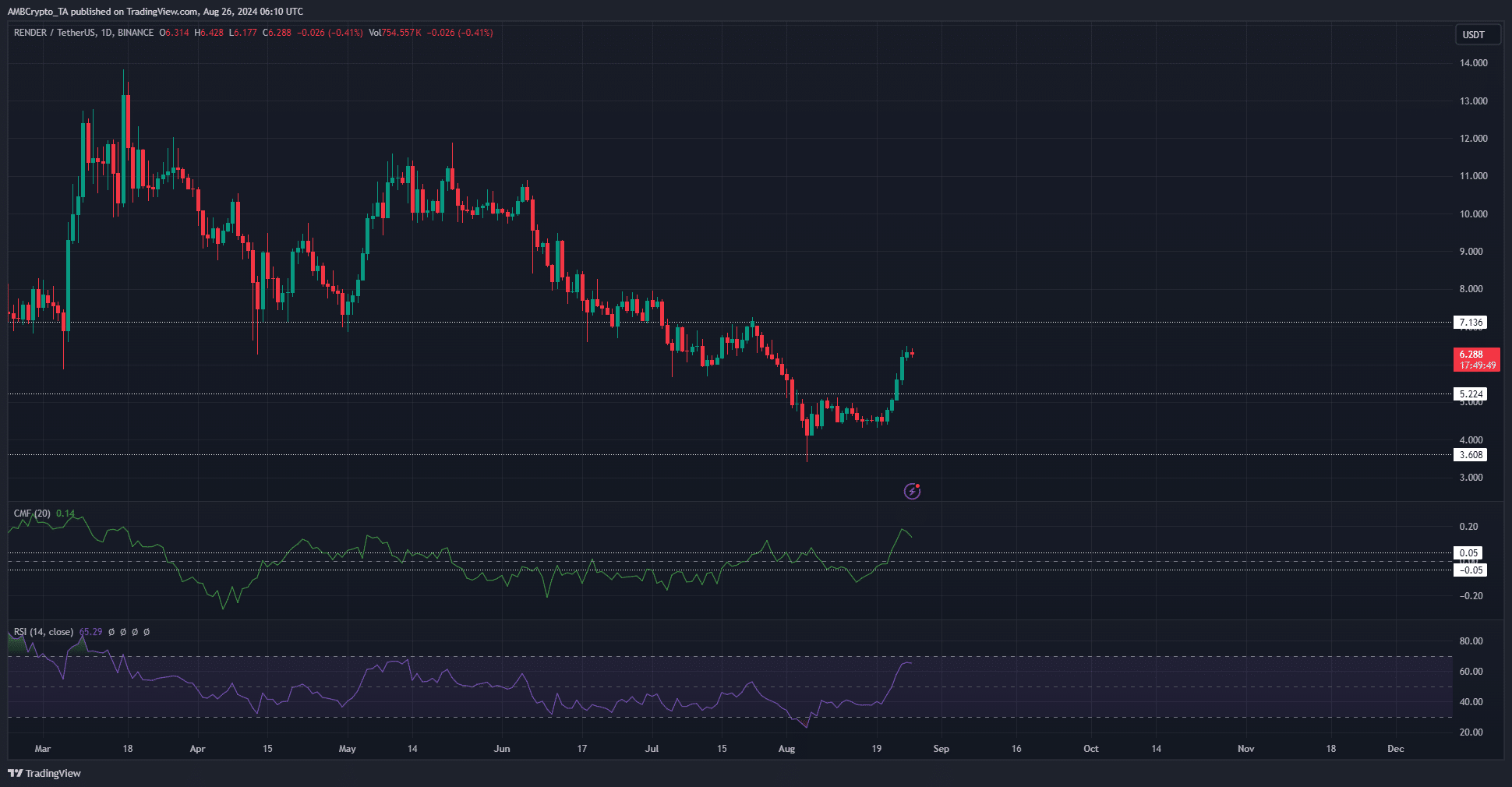

On the daily timeframe, Render has a bullish market structure after climbing past the recent lower high at $5.128. The daily RSI also signaled strong bullish momentum. It appeared likely that the $7.136 resistance would be tested next.

The CMF was at +0.14 to indicate a sizeable capital inflow into the market, bolstering the chances of a price rally. Yet, the $7.1 zone had been a support zone from March to July and was retested as resistance on the 21st of July.

Thereafter, the price embarked on a strong downtrend. Hence the bulls could face severe resistance around the $7.1 zone.

The lower timeframe Render indicators were optimistic

Source: Coinalyze

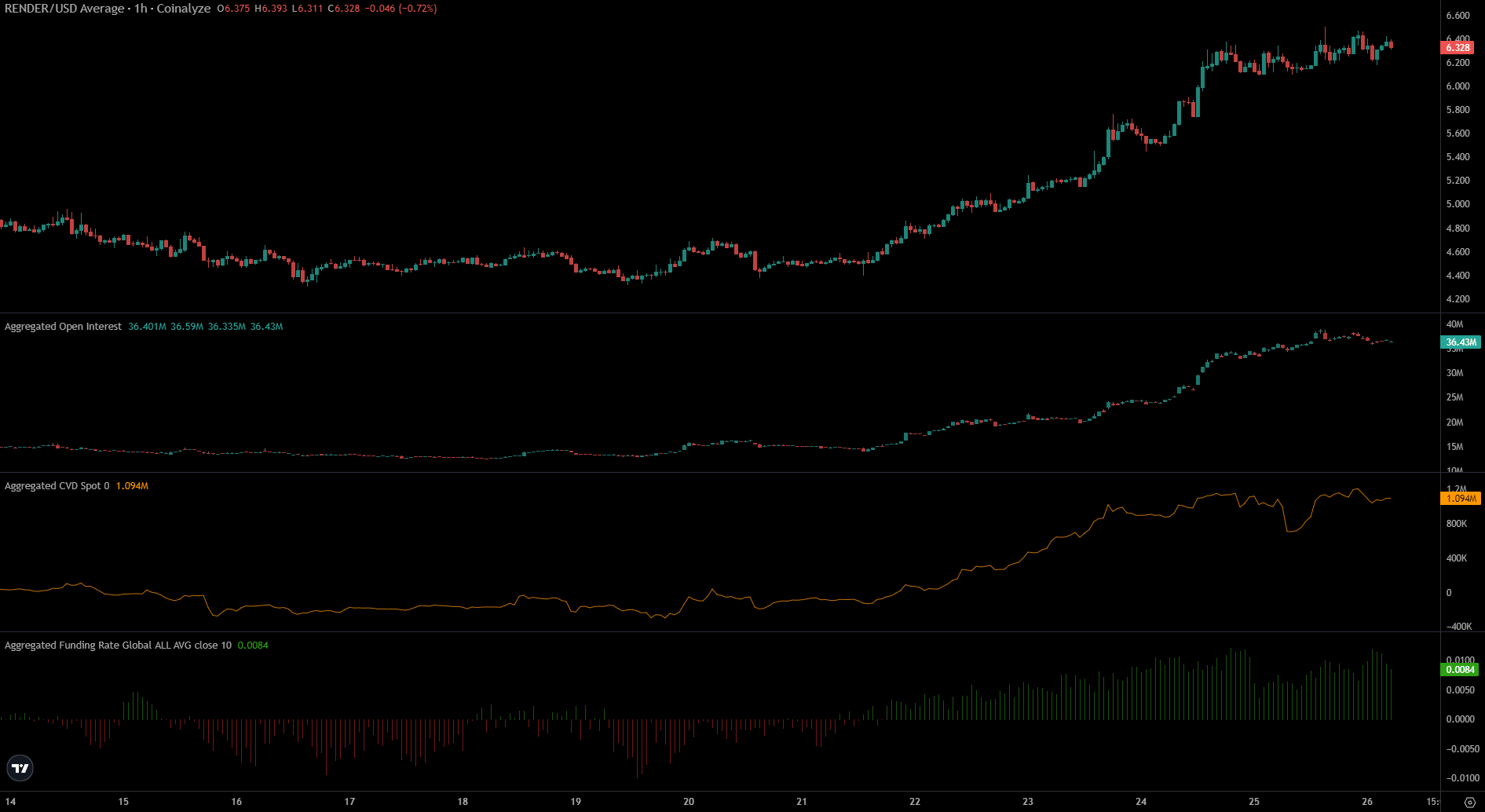

The Open Interest has risen strongly in recent days as the price shot higher. This indicated firm bullish sentiment and conviction that the token would rally hard. The funding rate was also highly positive to show traders were eager to go long.

Read Render’s [RENDER] Price Prediction 2024-25

The bulls would also take heart from the spot CVD’s uptrend. Not only were the speculators willing to go long, but the spot traders also believed in sustained price gains.

On the higher timeframe charts such as weekly, RENDER was in a firm downtrend. Hence, a retest and a minor dip from $7.1 is likely before the bulls can reclaim the level for good.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion