Ethereum whales buy $19M in ETH – Bullish sign?

- Ethereum’s RSI was in oversold territory, signaling a potential bullish reversal.

- CryptoQuant’s Ethereum exchange inflow was at its lowest point in the last 30 days — a buy signal.

Ethereum [ETH], the world’s second-biggest cryptocurrency, has seen a significant price decline following the launch of the spot ETH Exchange Traded Fund (ETF) in the United States.

Amid these market downturns, on the 2nd of September, two whales found the current ETH price as an opportunity. They borrowed stable coins from Aave [AAVE] and purchased 7,767 ETH worth $19.22 million.

Whale activity signals buy the dip sentiment

In a post on X (formerly Twitter), Lookonchain noted that whale wallet “0x761d” had purchased 3,588 ETH worth $8.8 million, while another address purchased 4,180 ETH worth $10.42 million in the last 24 hours.

This significant ETH accumulation during the market downturn signals potential buy opportunities.

Ethereum technical analysis and upcoming levels

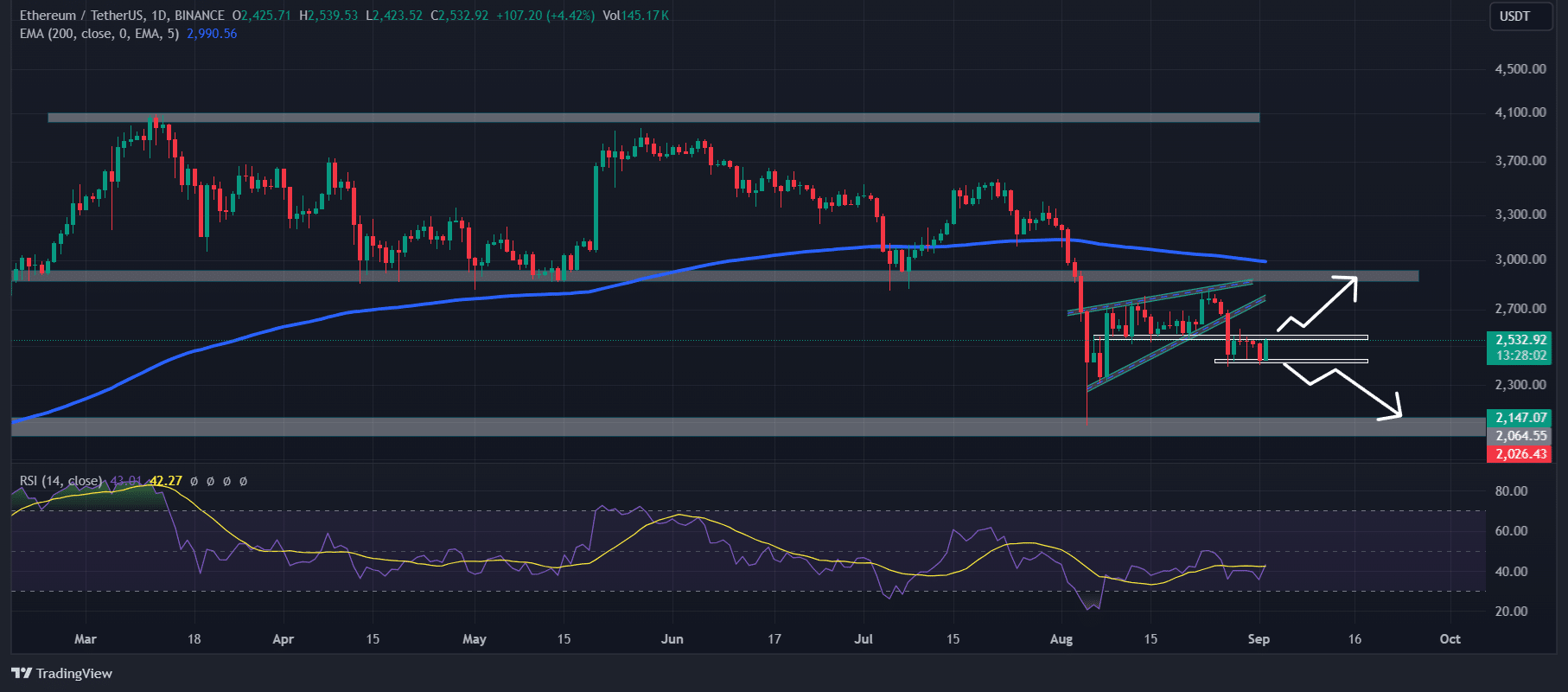

According to the expert technical analysis, ETH was in a downtrend as it is trading below the 200 Exponential Moving Average (EMA) on a daily time frame.

Additionally, the recent breakdown of the bearish rising wedge price action pattern indicates that ETH could fall to the $2,200 level, in the coming days unless it closes a daily candle above the $2,600 level.

However, ETH’s technical indicator Relative Strength Index (RSI) was in oversold territory, signaling a potential price reversal in the coming days.

On-chain metrics support bullish outlook

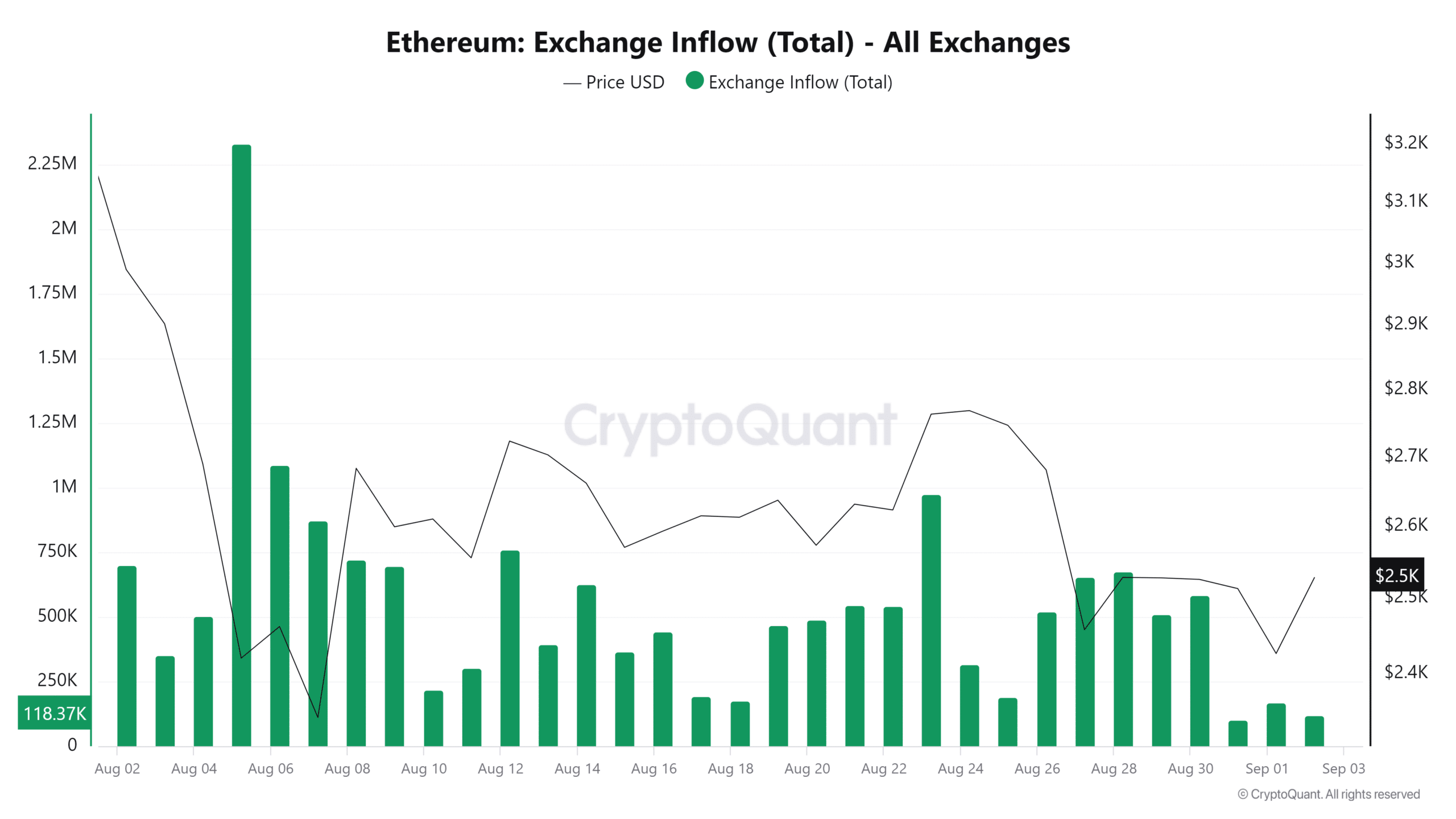

The on-chain metrics also supported ETH’s bullish outlook. CryptoQuant’s Ethereum exchange inflow was currently at the lowest point in the last 30 days — a buy signal.

High inflow indicates higher selling pressure in the spot exchange or vice versa.

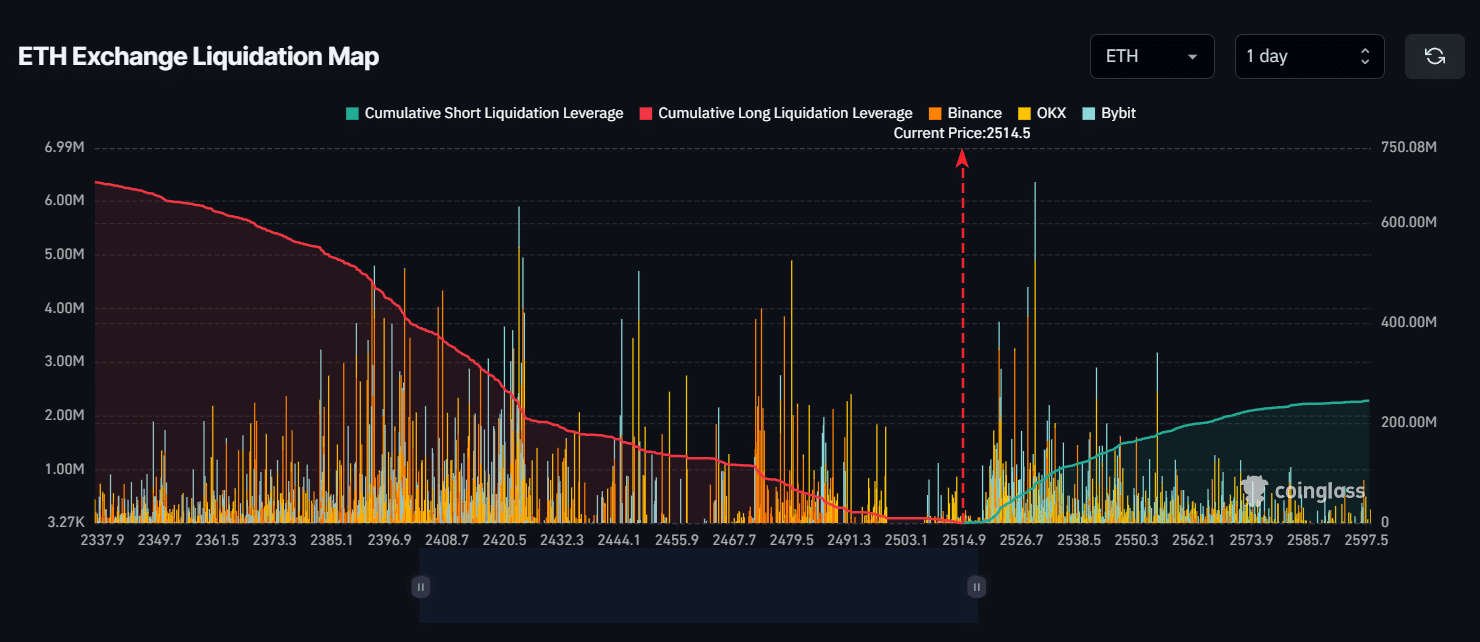

Meanwhile, CoinGlass’s ETH exchange liquidation map indicated that bulls were dominating the asset and potentially liquidating short positions.

The major liquidation levels were near the $2,420 level on the lower side and $2,530 on the lower side, as traders are over-leveraged at these levels.

If the sentiment remains bearish and the ETH price falls to the $2,420 level, nearly $230 million worth of long positions will be liquidated.

Conversely, if the sentiment shifts and the price rises to the $2,430 level, approximately $70 million worth of short positions will be liquidated.

Read Ethereum’s [ETH] Price Prediction 2024–2025

At press time, ETH was trading near the $2,510 level, having experienced a price surge of over 1.3% in the last 24 hours. Meanwhile, its Open Interest grew, having risen by 1% in the past hour and 1.5% in the last four hours.

This rising Open Interest signals growing investor and trader interest amid the recent price drops.