Chainlink eyes breakout: Social dominance surges amid reversal signs

- LINK has moved closer to breaking its short-term resistance.

- More discussions have been seen around LINK in the last 48 hours.

After nearly two weeks of declines, Chainlink [LINK] shows signs of a potential reversal, forming a positive uptrend. This recent shift in momentum is accompanied by a notable increase in social dominance, which has risen to a record high.

The heightened social activity around Chainlink suggests growing attention and optimism within the community, indicating that a bullish trend could be on the horizon.

Chainlink sees a rise in dominance

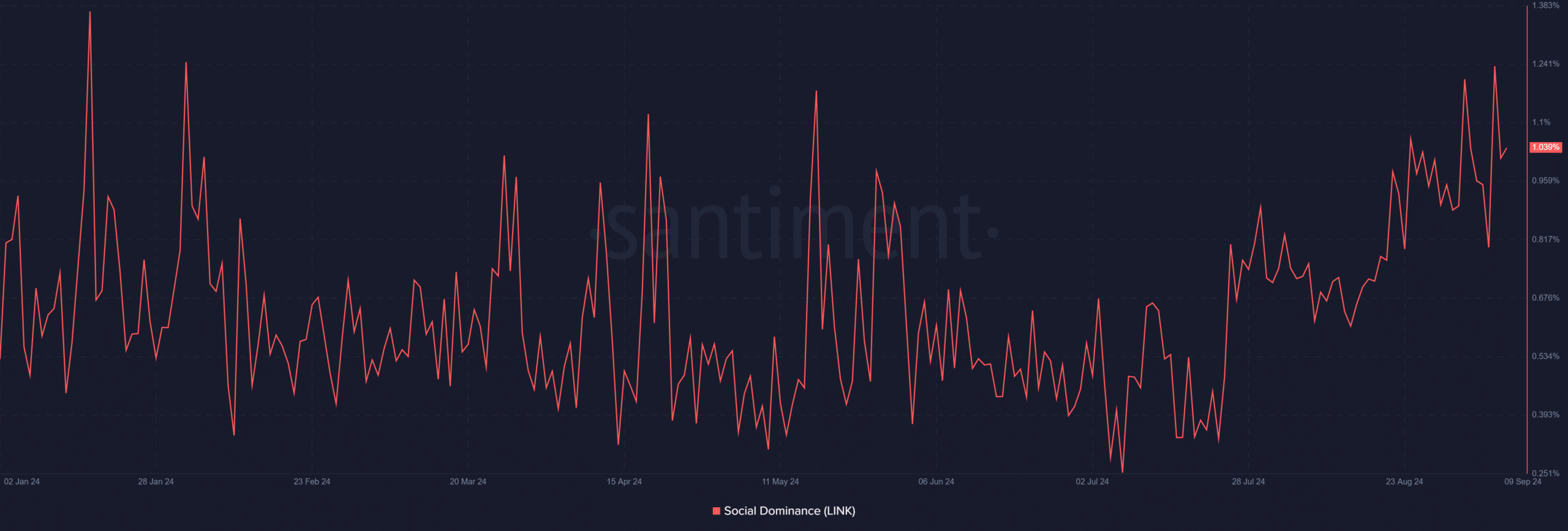

According to data from Santiment, Chainlink [LINK] recently experienced a surge in social dominance, which climbed to approximately 1.24%.

This is significant because the last time LINK reached such a dominance level was in January, making it the second-highest social dominance for the year.

This increase suggests that Chainlink held over 1% of the overall crypto discussion, indicating heightened attention and interest within the community. Such a rise in social dominance is often seen as a positive indicator, as increased visibility and engagement can attract more investors and traders, potentially contributing to further price gains.

The growing social presence around LINK could be an early sign of a bullish trend developing for the asset.

Total LINK holders see a slight decline

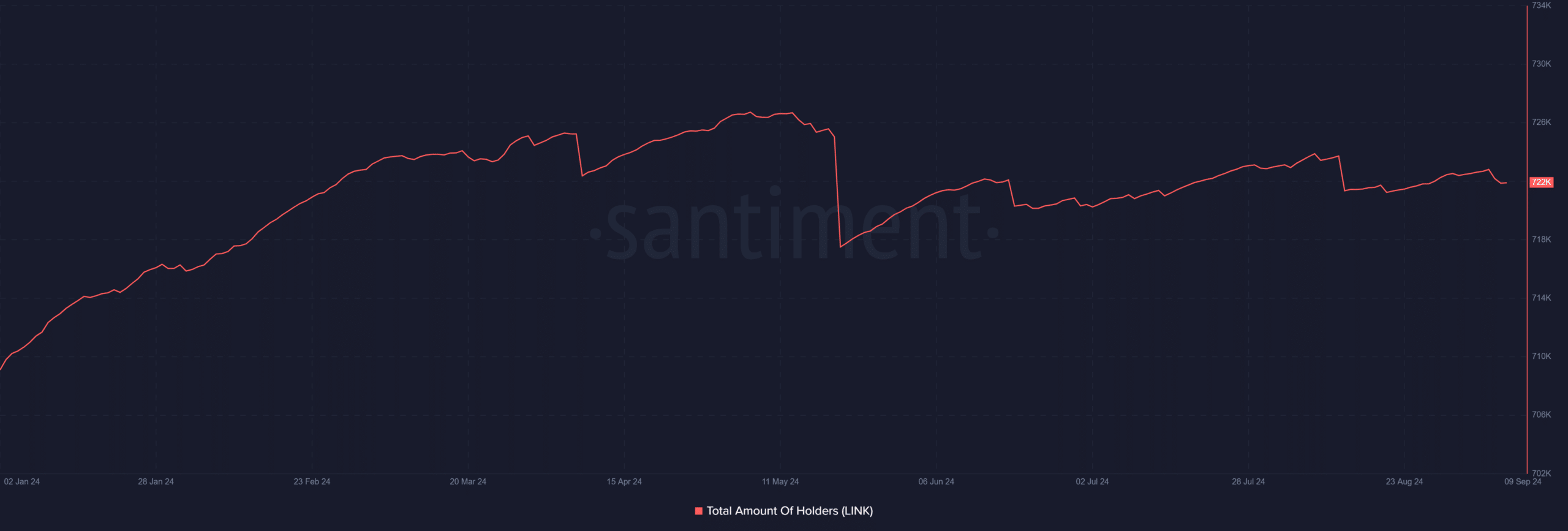

An analysis of Chainlink holders on Santiment reveals a slight decline in the total number of holders over the past few days. As of 6th September, the number of holders was around 723,000, but this has decreased to approximately 722,000 as of this writing.

This reduction in non-zero accounts suggests that some holders have sold off their LINK holdings in the last few days.

While a decline in holders might initially seem like a negative signal, the simultaneous surge in social dominance and the positive price reaction indicate a bullish market signal.

The fact that the market absorbed the selling pressure without a significant negative impact suggests underlying strength and resilience in LINK’s market.

The rise in social discussions and sustained price momentum despite the sell-offs could mean that Chainlink is poised for further gains, signaling growing confidence in the asset’s future potential.

Chainlink sees a positive setup

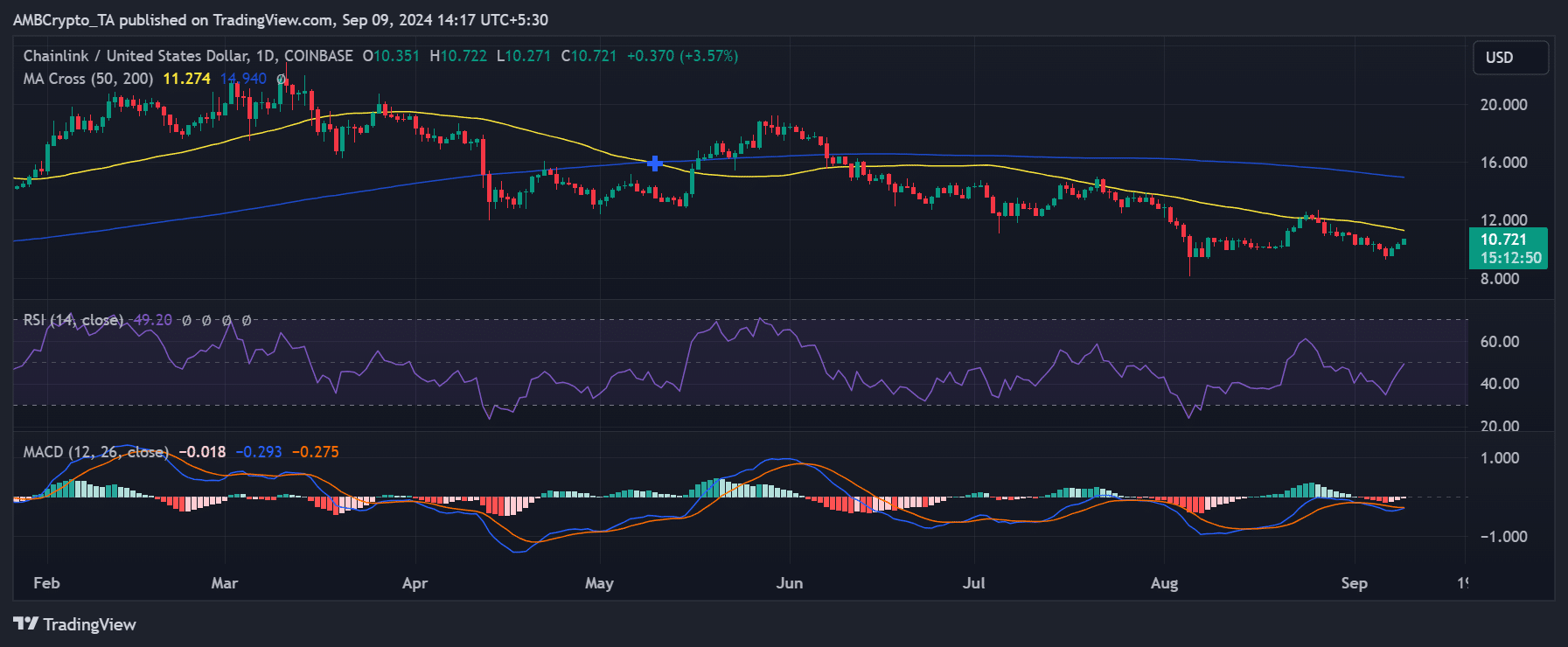

An analysis of Chainlink’s (LINK) daily time chart shows that its short-moving average (yellow line) has acted as resistance around the $11 mark. Over the past three days, LINK has experienced positive price trends.

As of this writing, it was trading at approximately $10.7. While it has yet to break through the current resistance level, the trend suggests the possibility of a more bullish move if LINK can overcome this barrier.

Is your portfolio green? Check out the Chainlink Profit Calculator

Additionally, the Relative Strength Index (RSI) analysis shows that it is approaching the neutral line, indicating that if the RSI crosses above this level, it could signal a stronger bullish trend.

A break above the $11 resistance and an RSI move into bullish territory could lead to further upward momentum for Chainlink.