FLOKI price prediction – A breakout could be coming thanks to this pattern!

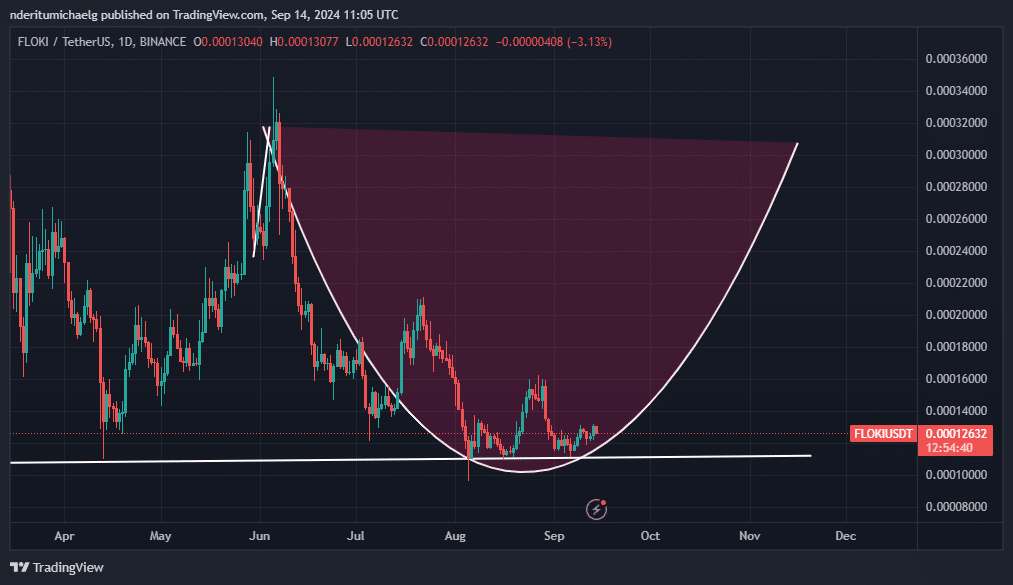

- FLOKI is half way into a cup and handle pattern, ONE which has been playing out since June

- FLOKI whales appear to be accumulating, likely in preparation for the second half of the price pattern

FLOKI memecoin might be on the verge of another bull run. It kicked off September with signs of accumulation and recent observations suggest that it may be entering the second phase of its cup and handle pattern.

In fact, FLOKI has been moving in an overall bearish trend from its June highs. It recently levelled out within the $0.0001 price range, indicating that the bearish momentum had run its course. However, zooming out also revealed a curve in its price action, more akin to the cup and handle pattern.

The memecoin’s recent bottom range, coupled with the cup and handle pattern, suggested that it could be on the verge of another rally. In other words, its recent price lows were likely the bottom of the price pattern. If that is the case, then it would mean that FLOKI will deliver an overall bullish price action in the next 2 or 3 months.

The latest price level in the cup and handle pattern also suggested that the price was in the best accumulation zone, at time of writing. Hence, AMBCrypto looked into whether demand has been building up. Needless to say, the results were quite interesting.

FLOKI whales on the hunt

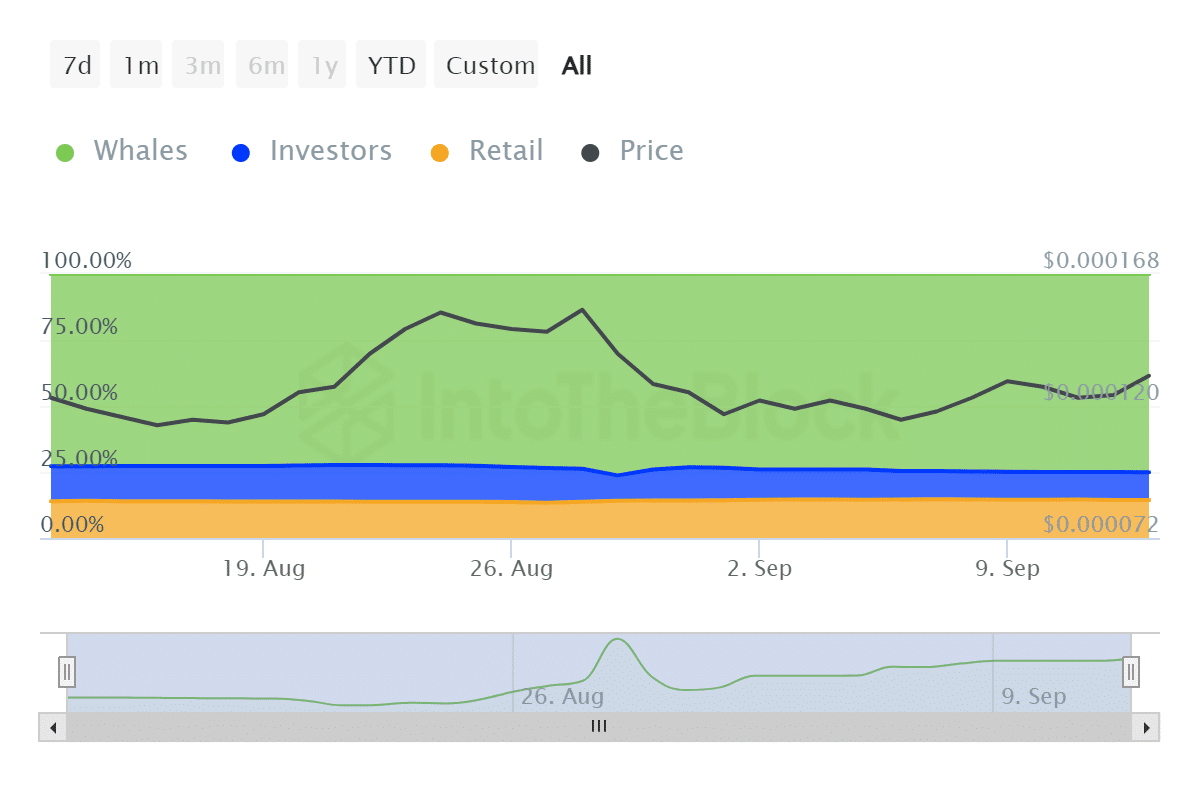

On-chain data revealed that FLOKI whales have been accumulating. According to the memecoin’s historical concentration data, whales concluded August with 7.32 trillion FLOKI. Their balances, by 13 September, had gone up to 7.51 trillion FLOKI.

Retail holder balances also went up from 1.42 trillion coins at the end of August to 1.44 trillion coins by 13 September. Despite the gains in the whale and retail categories, we also saw outflows from the investor class. Investor balances fell from 1.26 trillion tokens to 1.05 trillion tokens during the same period.

The historical concentration data confirmed growing interest, especially from whales. This can be translated as a bullish observation, especially accounting for the memecoin’s current price level. FLOKI exchange flows also aligned with the historical concentration data.

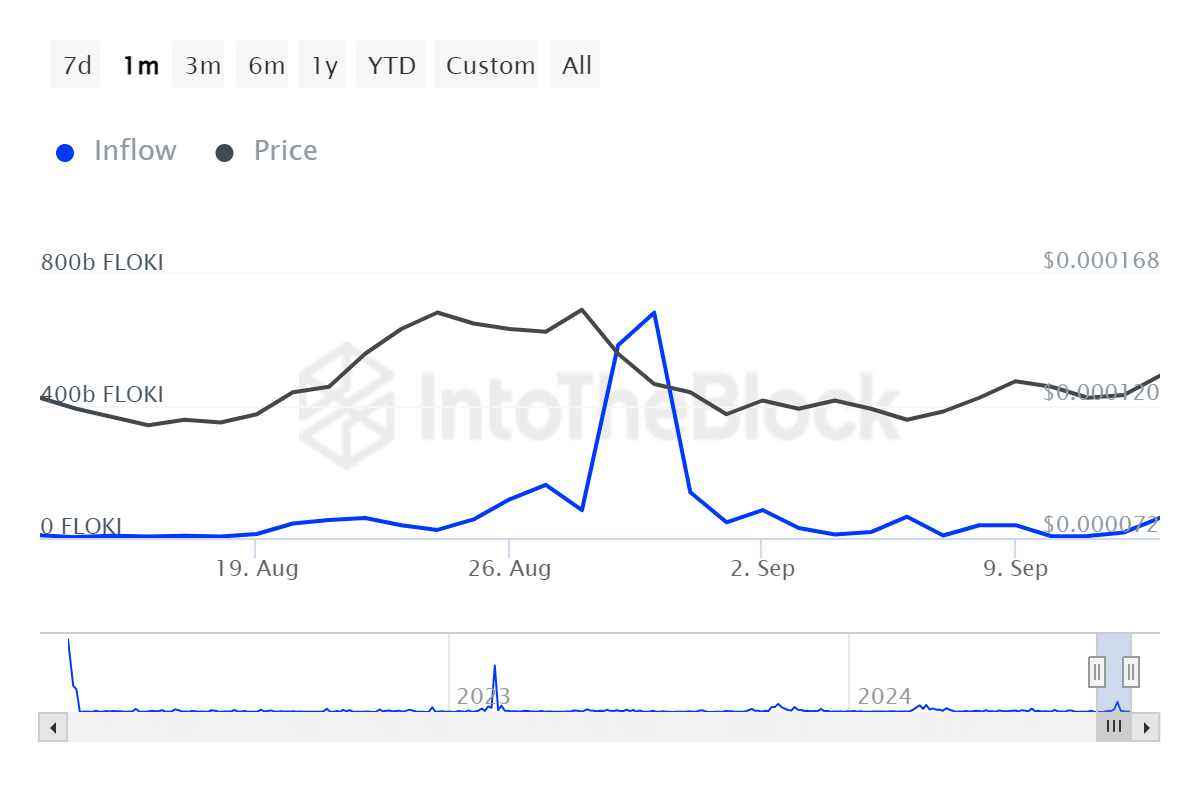

Finally, large holder flows demonstrated a perspective of growing demand. For example, FLOKI had 5.4 billion in large holder inflows on 10 September. Figures for the same quickly rose rapidly by 13 September.

Meanwhile, the memecoin’s large holder outflows dropped from 7.75 billion coins on 10 September to 7.3 billion coins on 13 September. FLOKI’s large holder flows offered further confirmation that demand from whales has been ballooning.