Is $200 next for AAVE in Q4 of 2024? Here’s what you should know!

- At press time, AAVE was up by more than 7% in the last 24 hours

- Altcoin seemed to form a double bottom as longs flipped shorts accounts

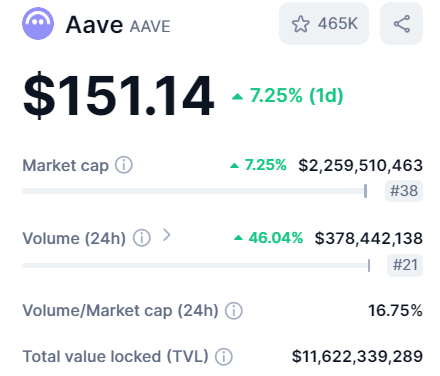

Aave (AAVE) is one of the market’s top decentralized finance (DeFi) platforms, showcasing significant strength lately. In fact, earlier this year, AAVE broke out of a range, and at press time, was among the biggest gainers, up over 7% in the last 24 hours.

This surge also pushed its market capitalization by the same percentage. Additionally, trading volume rose by 46%, leading to a volume-to-market cap ratio of 16.75%.

This ratio points to a strong investment opportunity, especially as it suggests that AAVE has sufficient liquidity to prevent frequent price swings. The total value locked (TVL) on the platform has been impressive too, with $11 billion in assets secured within Aave.

AAVE’s potential bottom and prediction

In light of these developments, examining the price movement of AAVE/USDT revealed a bullish trend throughout the year. The altcoin’s price has consistently made higher highs and higher lows since breaking out of its previous range.

A double bottom formed at the $140 price level, suggesting that the crypto could achieve further gains. It can potentially reclaim the $200-mark in the last quarter (Q4) of the year.

Trading above the $150 level at press time, traders are now optimistic about it closing above its recent highs. This closing could strengthen the likelihood of reaching the $200 target as overall market conditions continue to improve.

AAVE’s Long/Short account flips bullish

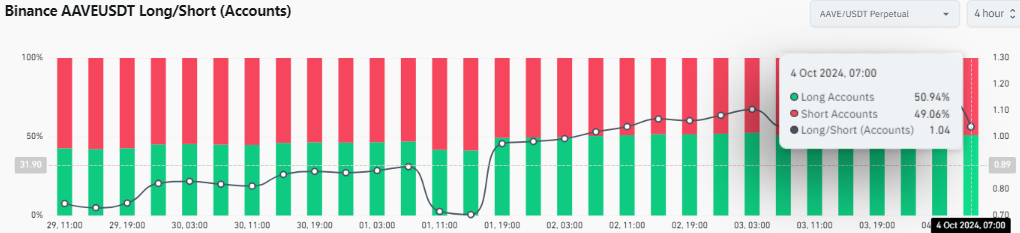

To further analyze the altcoin’s potential, we can explore the long and short account metrics. At the time of writing, the percentage of long accounts had increased to nearly 51%, while short accounts sat at 49%.

This shift indicated that buyers are regaining control after a period where short positions dominated during market corrections.

As shorts begin to lose influence, the ratio will likely to continue favoring longs, reinforcing the idea that AAVE is on track to hit the $200 target the next time it moves up.

Buy volume and funding rates in recovery

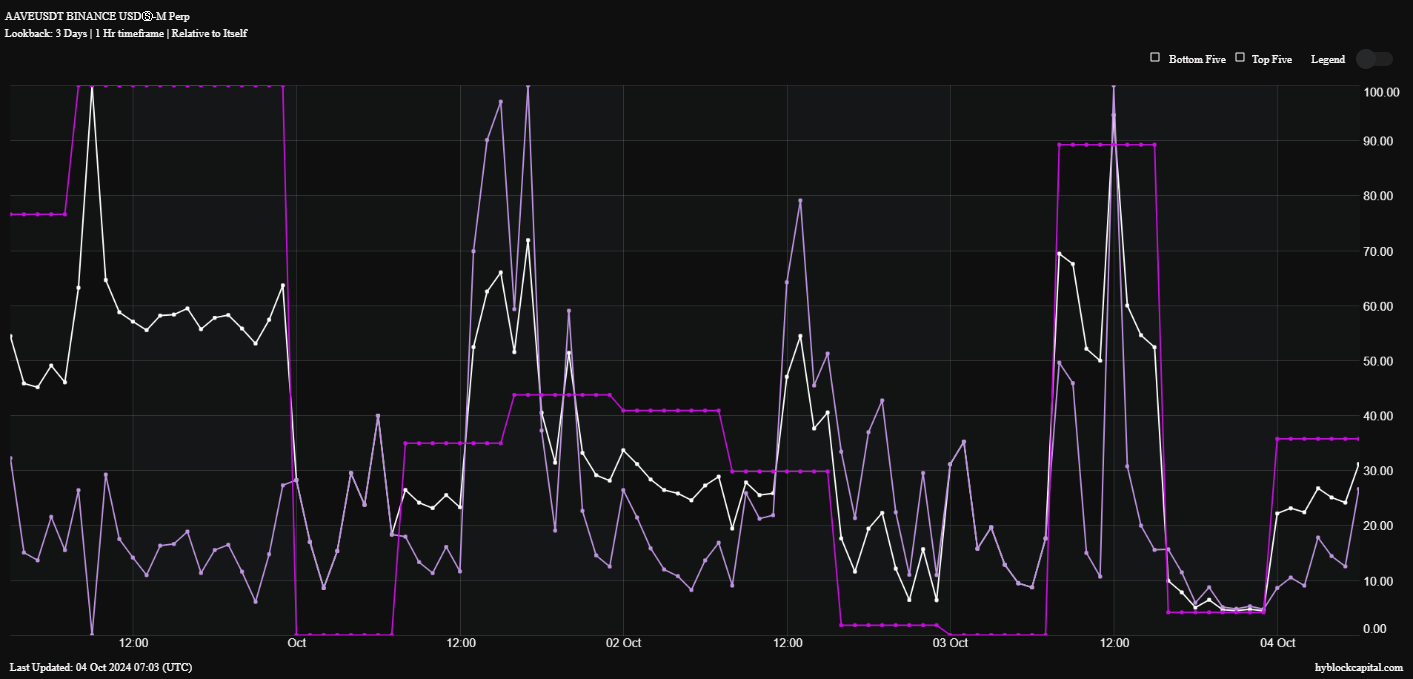

Finally, observing the buy volume and funding rates revealed that both metrics are starting to rise from previous lows caused by market corrections. These metrics seemed to be approaching the 30th percentile, contributing to a global average of 30%.

The improvement in these metrics further supported the notion of an upward movement, one that could lead to reclaiming the $200-level for AAVE. The crypto’s recent performance and key indicators, together, mean that the cryptocurrency may be in a strong position for future growth.

With sufficient liquidity, a bullish price action, and positive long-short account dynamics, AAVE may be well-equipped to reach higher price targets in the near future.

As always, investors should remain cautious, keeping an eye on market conditions and broader trends to make informed decisions.