Assessing Uniswap’s price surge: Key on-chain metrics to watch

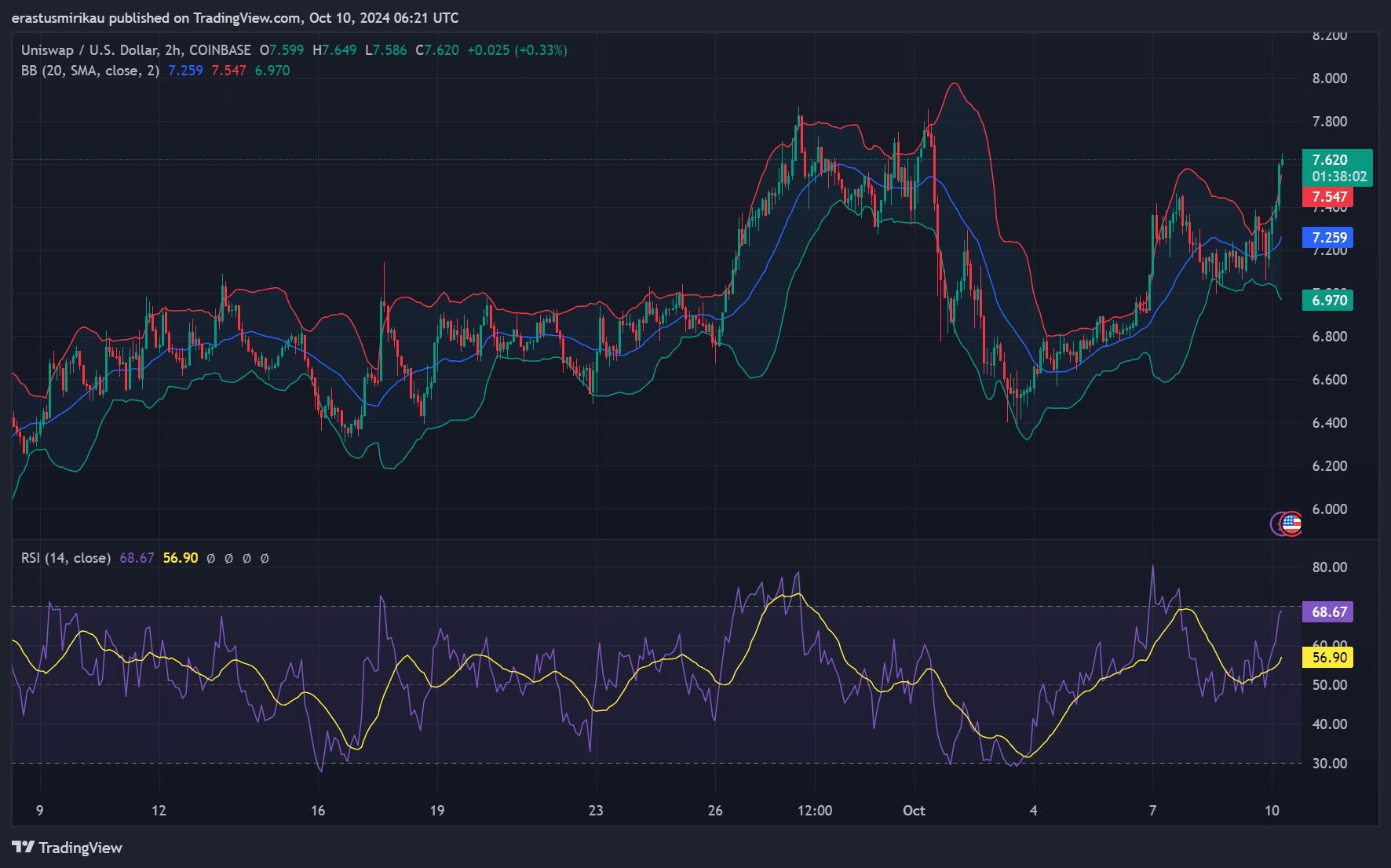

- UNI’s bullish momentum is fueled by rising volume, with RSI nearing overbought levels at 68.67.

- Open interest has surged, but lower exchange reserves signal potential liquidity concerns ahead.

Uniswap [UNI] is riding an impressive wave of market optimism, fueled by strong price action and increased trading activity. At press time, the token was trading at $7.62, with a 6.52% rise.

UNI has shown resilience above key price levels, but can it maintain this momentum, or will market forces push it back?

Strong price action driving market optimism

UNI has experienced significant gains, with its 24-hour trading volume surging by 58.59% to $168.51 million at press time. This increase in volume highlights intensified interest among traders looking to capitalize on UNI’s upward trend.

The technical indicators add further weight to the bullish case. The Relative Strength Index (RSI) currently sits at 68.67, signaling that UNI is approaching overbought territory, though it hasn’t hit the critical 70 level yet.

Additionally, the Bollinger Bands (BB) show that Uniswap is trading near the upper band at $7.62, which often suggests heightened volatility. Consequently, traders should keep an eye on these levels as they might indicate upcoming price consolidation or a breakout.

UNI on-chain indicators: Are they supporting the bullish case?

In addition to price action, on-chain metrics further reinforce UNI’s strong market performance as per CryptoQuant data. Active addresses have increased by 1.35%, totaling 65.04K in the last 24 hours.

This uptick suggests more participants are engaging with the Uniswap protocol, a key indicator of network health.

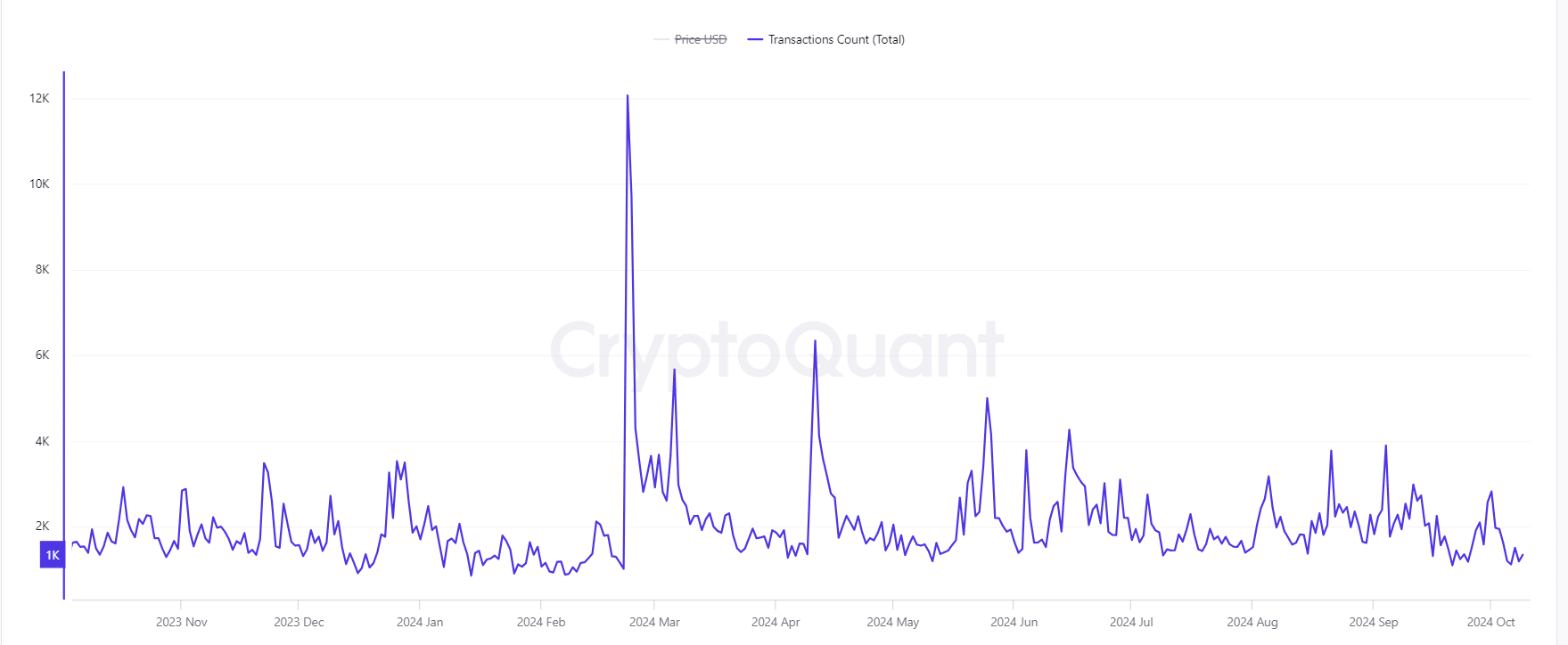

Furthermore, the transaction count has risen by 1.6%, with 1.691K transactions processed during the same period. Therefore, the rise in both active addresses and transactions indicates a healthy, active user base that could support continued growth.

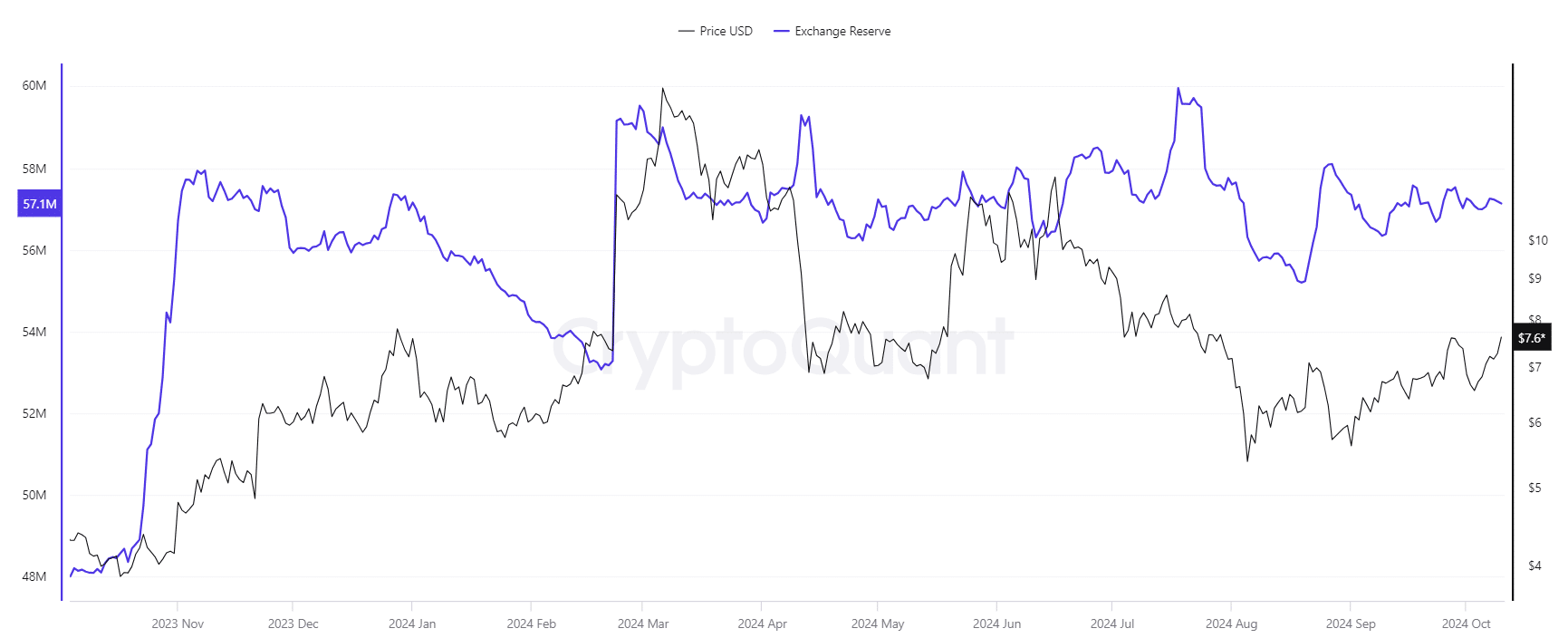

UNI exchange reserves: A warning sign?

However, exchange reserves tell a slightly different story. With a 0.17% decline in reserves over the last 24 hours, currently standing at 57.136M, the reduced selling pressure could indicate a potential supply shock.

While this often correlates with bullish sentiment, traders should exercise caution. Lower reserves can limit liquidity, making it harder for Uniswap to sustain its current rally if demand spikes suddenly.

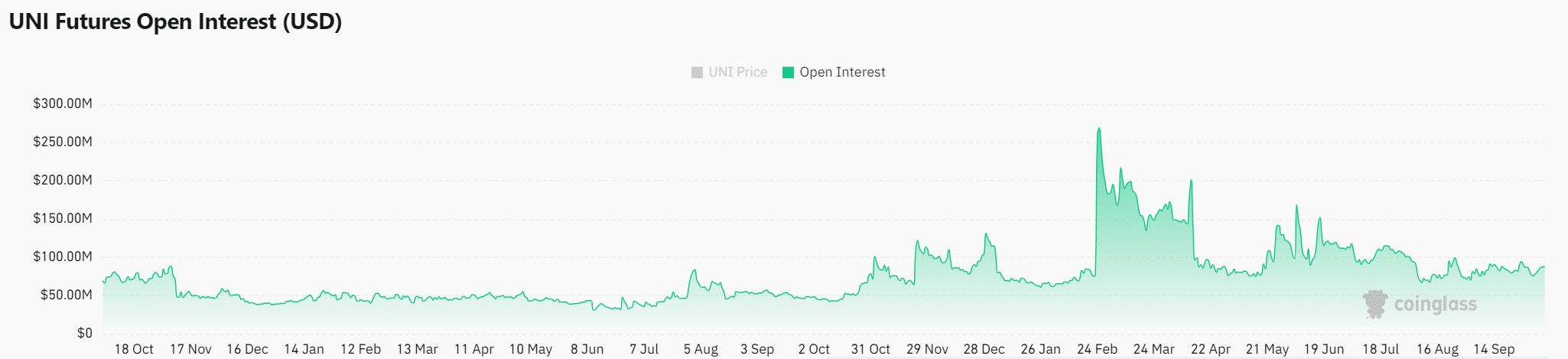

Open interest: Growing trader confidence

Additionally, UNI’s open interest has surged by 7.11%, reaching $91.96 million.

Is your portfolio green? Check out the UNI Profit Calculator

This increase in open interest shows that more traders are entering the market, betting on further price gains. As a result, this reinforces the broader bullish narrative.

UNI’s bullish momentum, supported by rising trading volume and healthy on-chain metrics, suggests it could push past resistance. However, liquidity concerns may temper this outlook.