Can SuperVerse [SUPER] break past $1.60, trigger the next bull run?

![Can SuperVerse [SUPER] break past $1.60, trigger the next bull run?](https://ambcrypto.com/wp-content/uploads/2024/10/Erastus-SUPER-1200x686.png)

- SUPER breaks past $1.11 resistance, but overbought RSI hints at potential short-term pullbacks.

- Rising social dominance and open interest suggest continued momentum, but MVRV ratio poses risks.

SuperVerse [SUPER] has caught the attention of investors by jumping 11.62% in the past 24 hours, trading at $1.39 at press time.

With a market capitalization of $677.28 million and a 54% spike in trading volume, the token is showing strong momentum.

The question remains—can this bullish run push SUPER beyond key resistance levels, sparking a wider rally in the crypto space?

Bullish indicators emerge

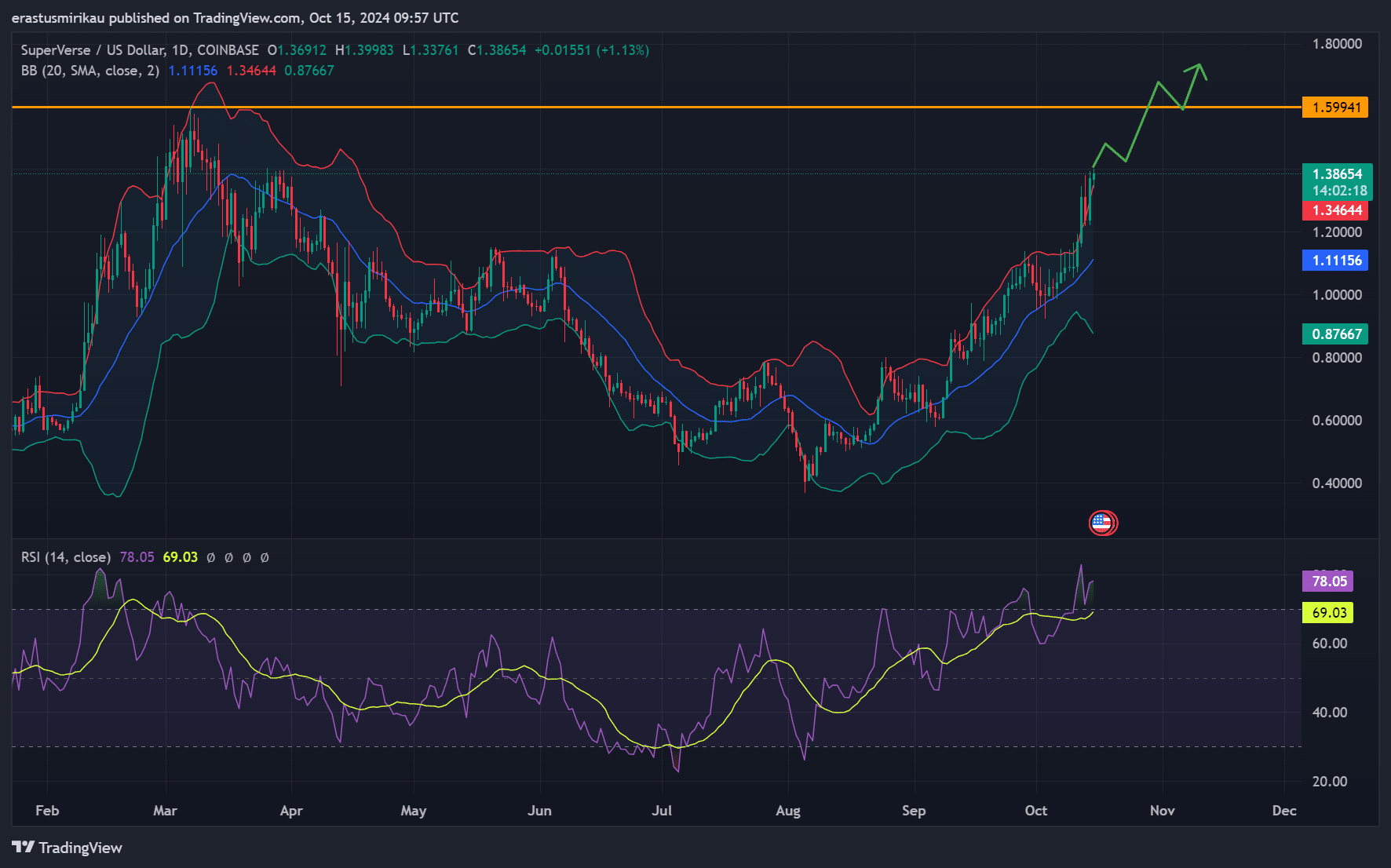

SUPER has broken through its recent resistance at $1.11, moving upwards toward the $1.39 mark. Bollinger Bands indicate growing volatility, suggesting that SUPER could be primed for further price movements.

The next major hurdle is at $1.60, which, if breached, could open the door to a rally toward $1.80 and beyond.

However, it’s important to note that the RSI sat at 78.05 at press time, suggesting that SUPER was in overbought territory.

Consequently, there could be short-term selling pressure as investors looked to take profits. Therefore, while the trend remains bullish, traders should be cautious of potential pullbacks before the next leg up.

THIS supports SUPER’s growth

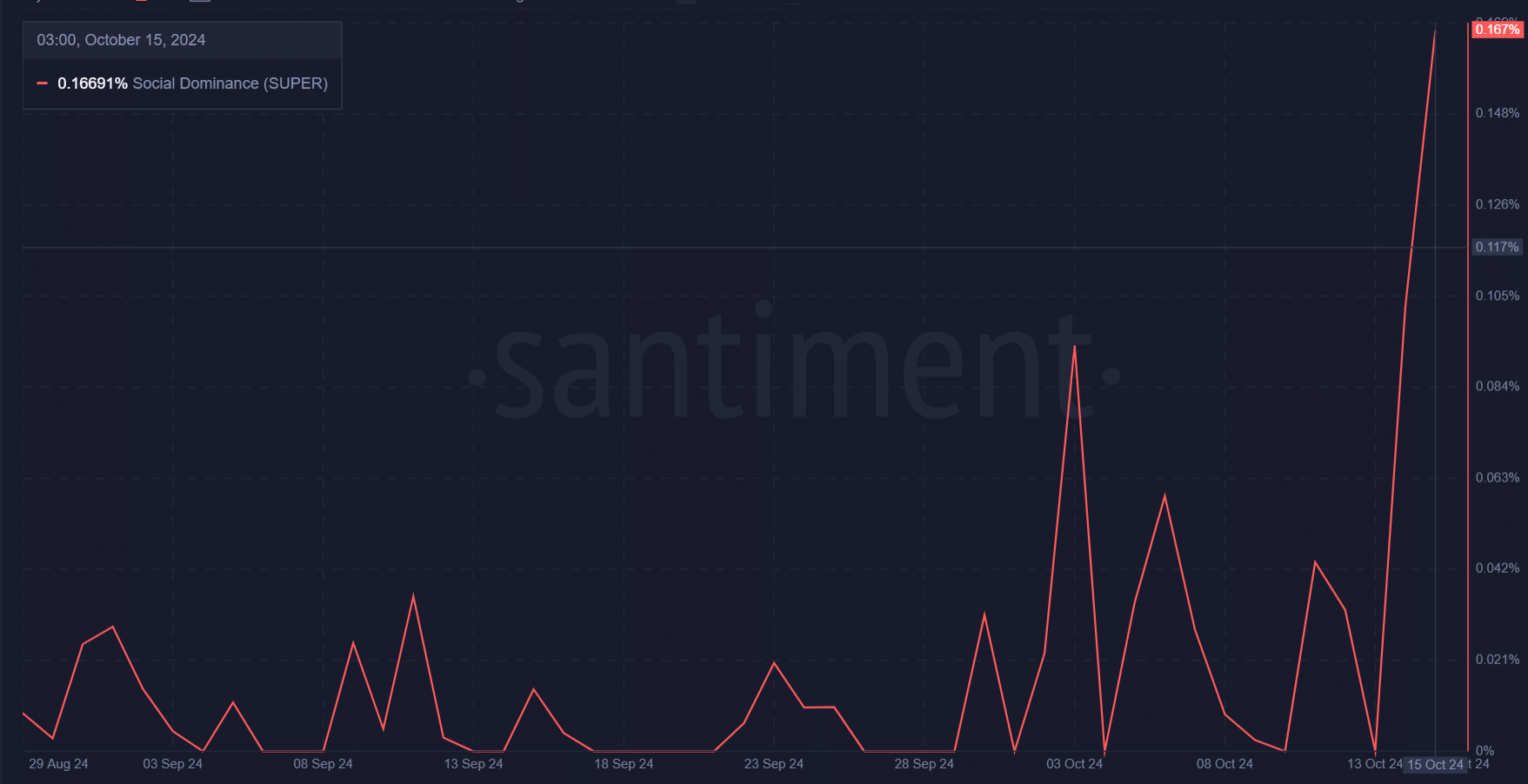

Additionally, SUPER’s Social Dominance has spiked to 0.167%, indicating that it is becoming a trending topic across social media platforms.

This increase in attention from the crypto community can often correlate with further price movements. As hype builds, more retail investors are likely to enter the market, potentially driving the price higher.

However, Social Dominance alone may not be enough to sustain the momentum. Therefore, investors should monitor social trends to gauge whether SUPER can maintain its newfound attention.

MVRV ratio signals potential risks

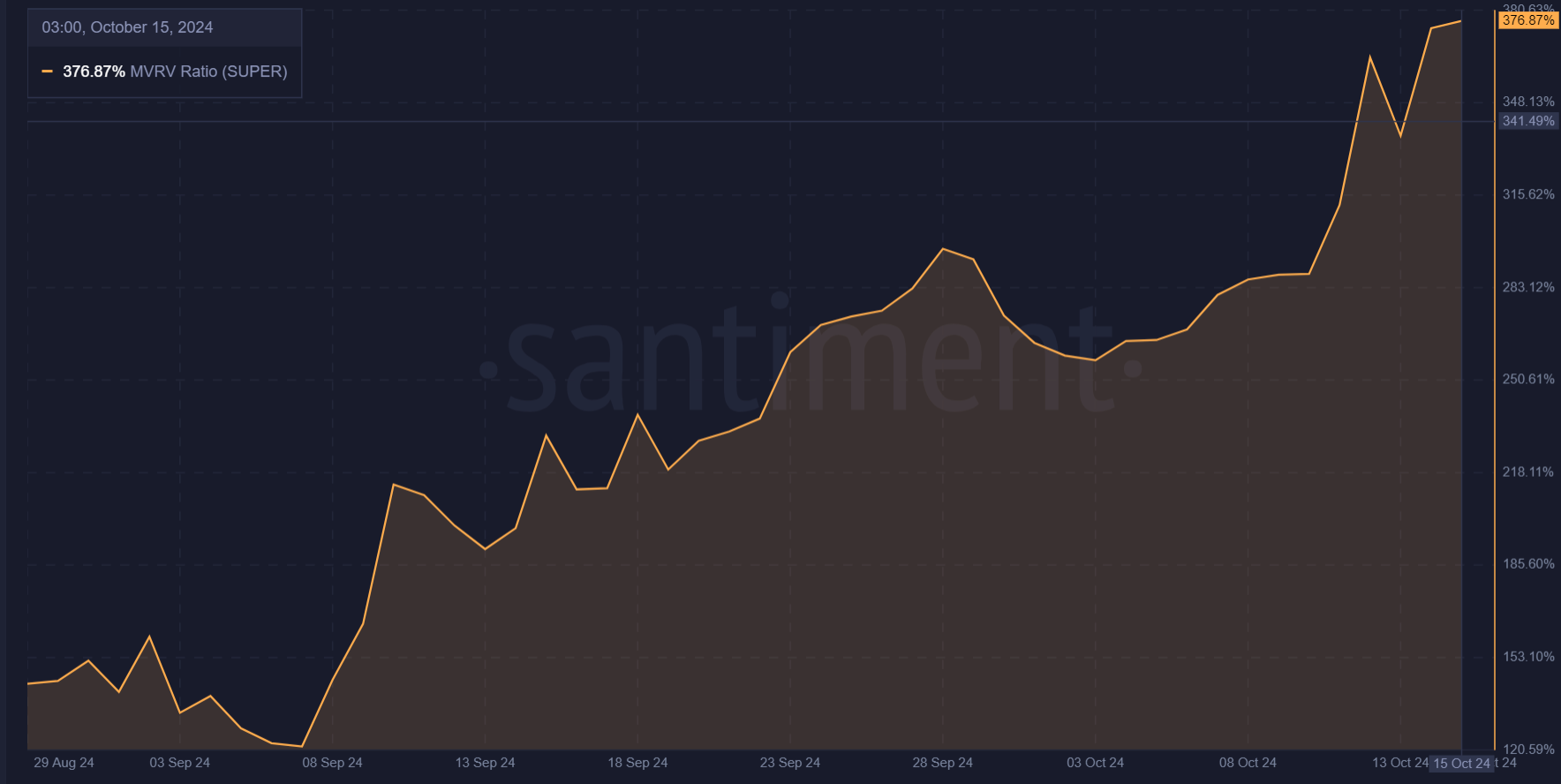

Another critical metric to consider is SUPER’s MVRV ratio, which has climbed to 376.87%. This means that many holders are sitting on significant unrealized gains, which could lead to selling pressure.

Consequently, SUPER might experience a short-term correction before resuming its upward trend.

Institutional involvement

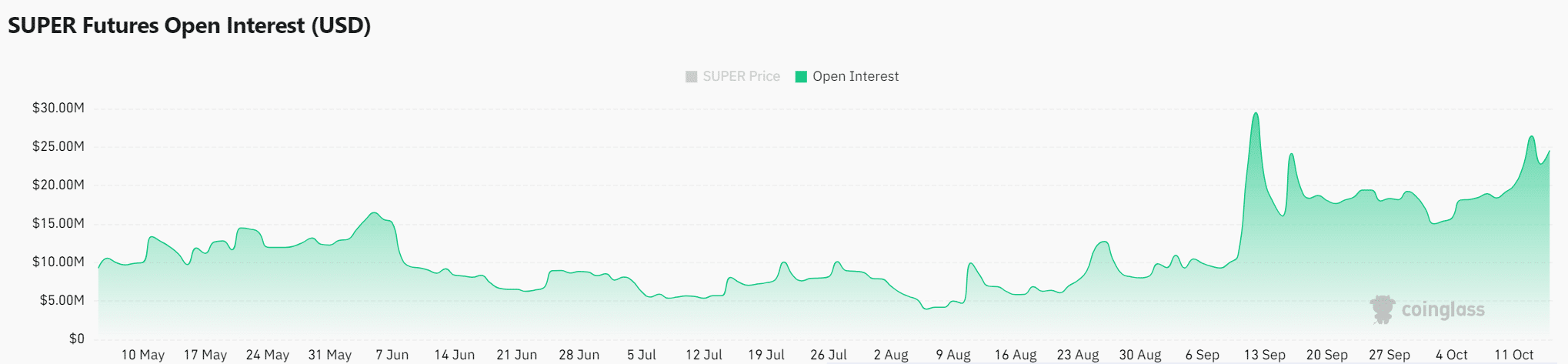

Furthermore, Open Interest for SUPER has jumped by 18.97% to $25.40 million. This rise suggested that institutional players may be showing increased interest in the token.

This inflow of capital could provide the necessary support for a continued rally, even if short-term corrections occur.

Read SuperVerse [SUPER] Price Prediction 2024–2025

Conclusively, while SUPER’s current momentum is promising, the elevated MVRV ratio and overbought RSI indicate potential pullbacks.

However, the rising Social Dominance and growing Open Interest could fuel a breakout past $1.59, potentially triggering the next phase of its bull run.