Celestia’s next move: Are the odds favoring a breakout soon?

- TIA is attempting to break out of its consolidation range, with technicals showing bullish potential.

- Whale accumulation and rising open interest suggest growing market confidence, but caution is needed.

Celestia [TIA] is gaining significant traction as it continues its efforts to break free from a prolonged consolidation phase that has kept its price movement restrained for months.

Trading at $5.95 at press time, with a 6.85% gain in the past 24 hours, the token is showing bullish potential. Will TIA maintain its upward momentum and push higher, or will resistance levels slow down its rally? Let’s find out.

TIA consolidation range overview: Will it break free?

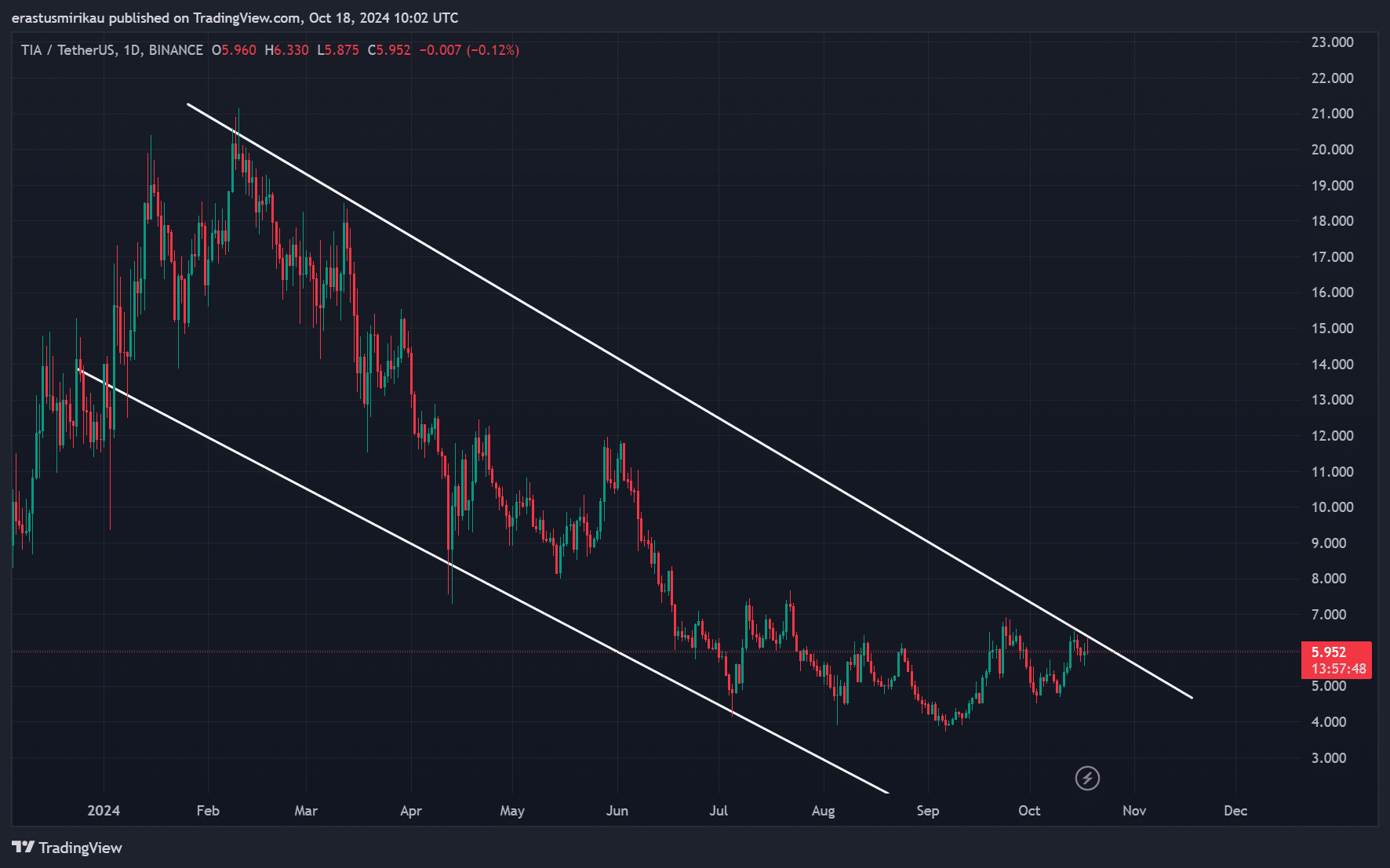

TIA has been trapped within a long-term downtrend, as shown in the descending price channel. For months, the token has struggled to break above critical resistance levels, remaining within this channel.

However, its recent attempt to push toward the upper boundary could signal a potential breakout. Therefore, if TIA successfully clears this key resistance, it may pave the way for further bullish momentum.

TIA technical analysis: What do the indicators show?

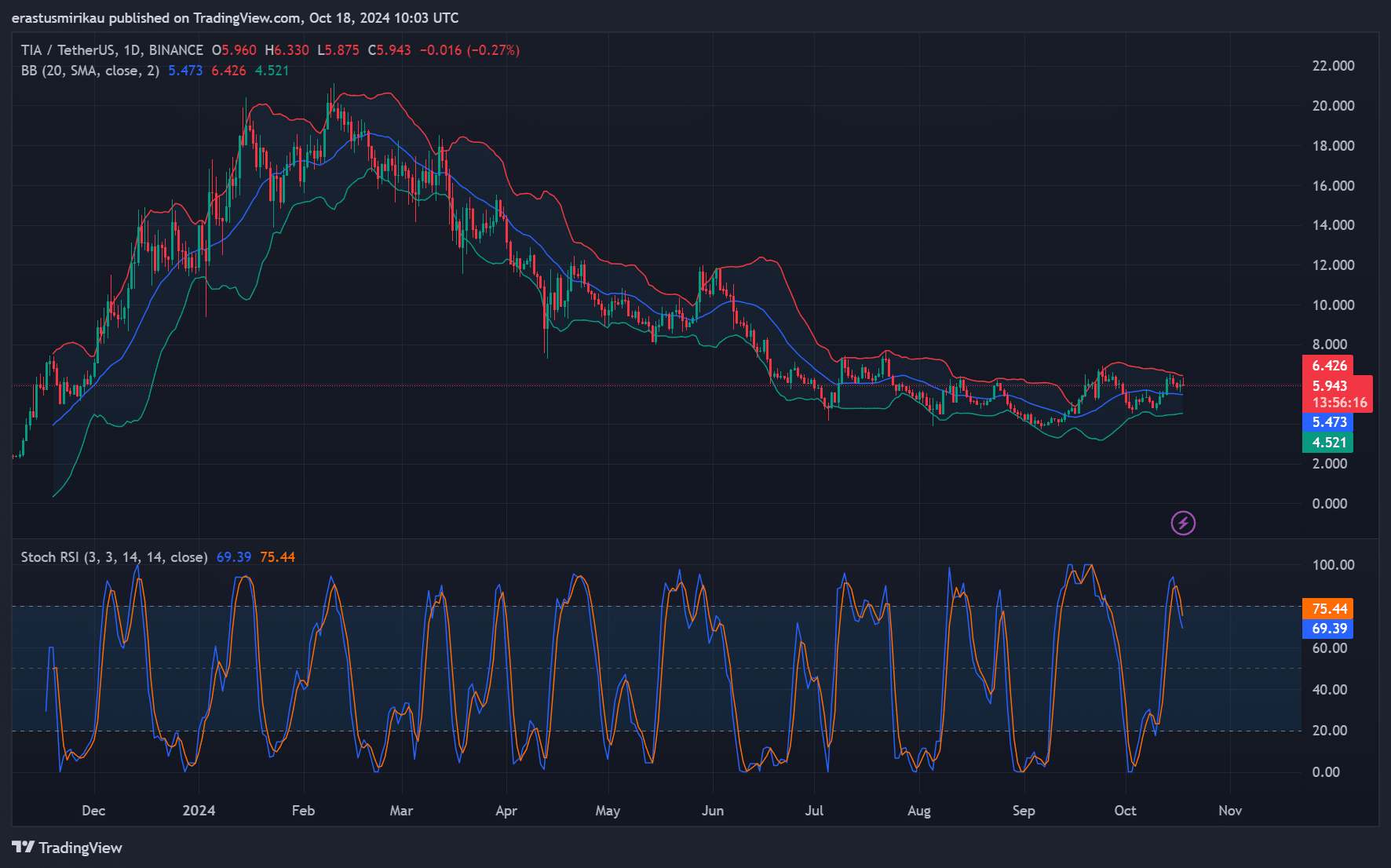

The technical indicators offer a mixed outlook. The Bollinger Bands (BB) on the daily chart reveal that TIA is testing the upper band, hinting at increased volatility.

Additionally, the Stochastic RSI is sitting near overbought territory, with readings of 75.44. While buyers currently dominate the market, there is a risk of a short-term pullback.

However, the overall trend suggests that if TIA manages to overcome immediate resistance, it could trigger a strong rally. Therefore, traders should watch for key levels before making decisions.

Top holders analysis: Are whales accumulating?

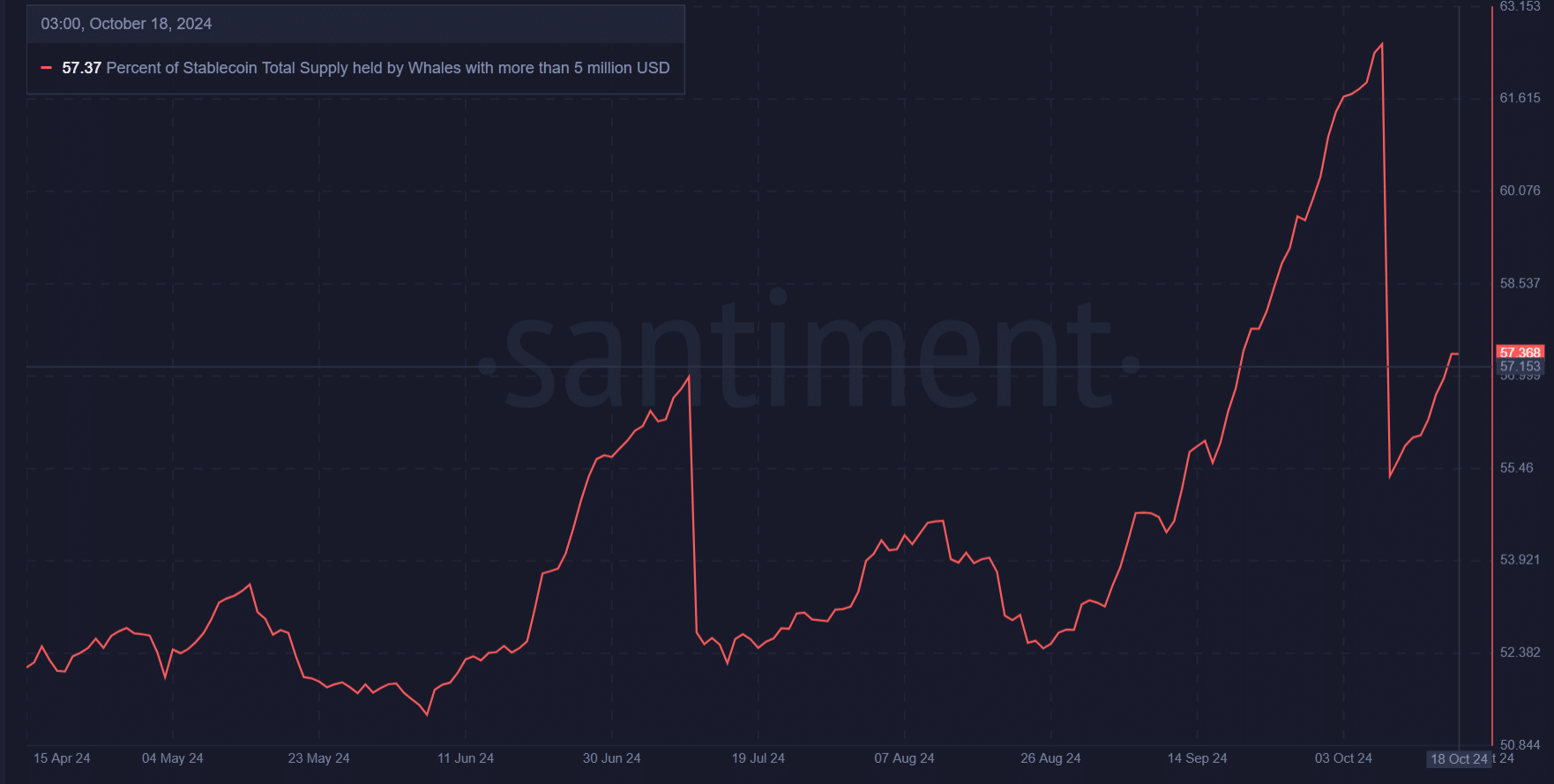

Analyzing the top holders provides valuable insights into market sentiment. Currently, 57.37% of the stablecoin supply is held by whales, those with large holdings of over $5 million. This level of accumulation suggests significant confidence in the asset’s potential for future growth.

However, recent fluctuations in whale activity hint that large holders might be in a distribution phase. Therefore, close monitoring of these key players will be crucial in assessing TIA’s future price action.

Open interest surge: Is bullish sentiment building?

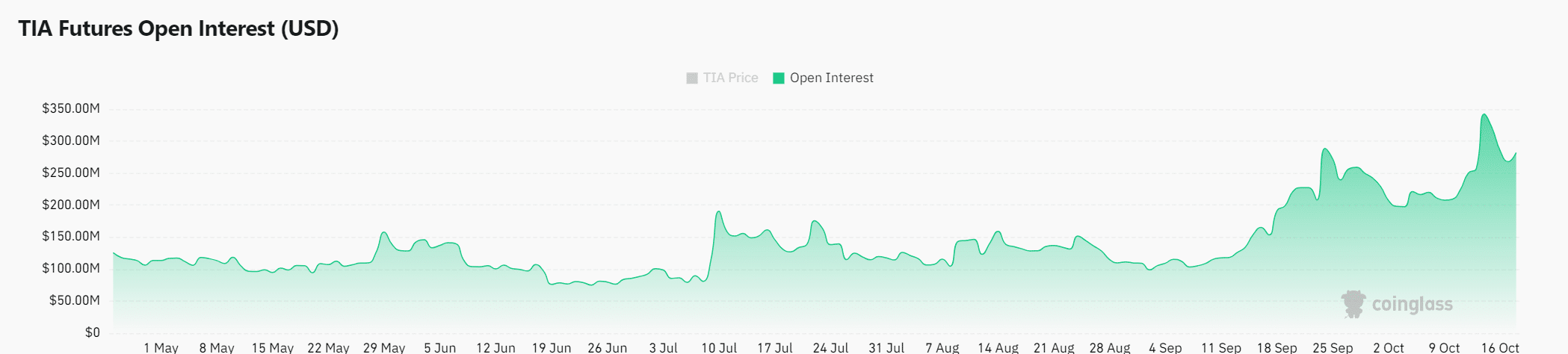

Open interest, which has surged by 11.02%, now sits at $294.21 million. This increase signals heightened investor interest, suggesting that traders are positioning for a significant price move. Consequently, rising open interest often indicates increased volatility, and for TIA, this could translate into a breakout soon.

Is your portfolio green? Check out the TIA Profit Calculator

Conclusively, Celestia (TIA) shows promising signs of breaking its consolidation range. With strong whale support and rising open interest, market sentiment leans bullish. However, technical indicators suggest caution as overbought conditions could trigger a pullback.

If TIA can clear its resistance levels, a strong upward rally may follow. However, investors should remain cautious due to the potential for short-term corrections.