AAVE aims for breakout amid GHO launch: Will it succeed?

- AAVE price action shows potential, but remains constrained within its ascending channel, with neutral RSI levels.

- Rising exchange reserves and seller dominance could dampen bullish momentum despite the GHO token launch.

Aave’s [AAVE] launch of the GHO token has captured attention across the decentralized finance space, as it secures $31.2 million and becomes the second-largest asset on Chainlink CCIP.

With GHO aiming to facilitate seamless cross-chain liquidity, the big question remains: can this development trigger a price rally for Aave [AAVE], or will the market need more momentum to sustain bullish growth?

AAVE price action: Can the rally continue?

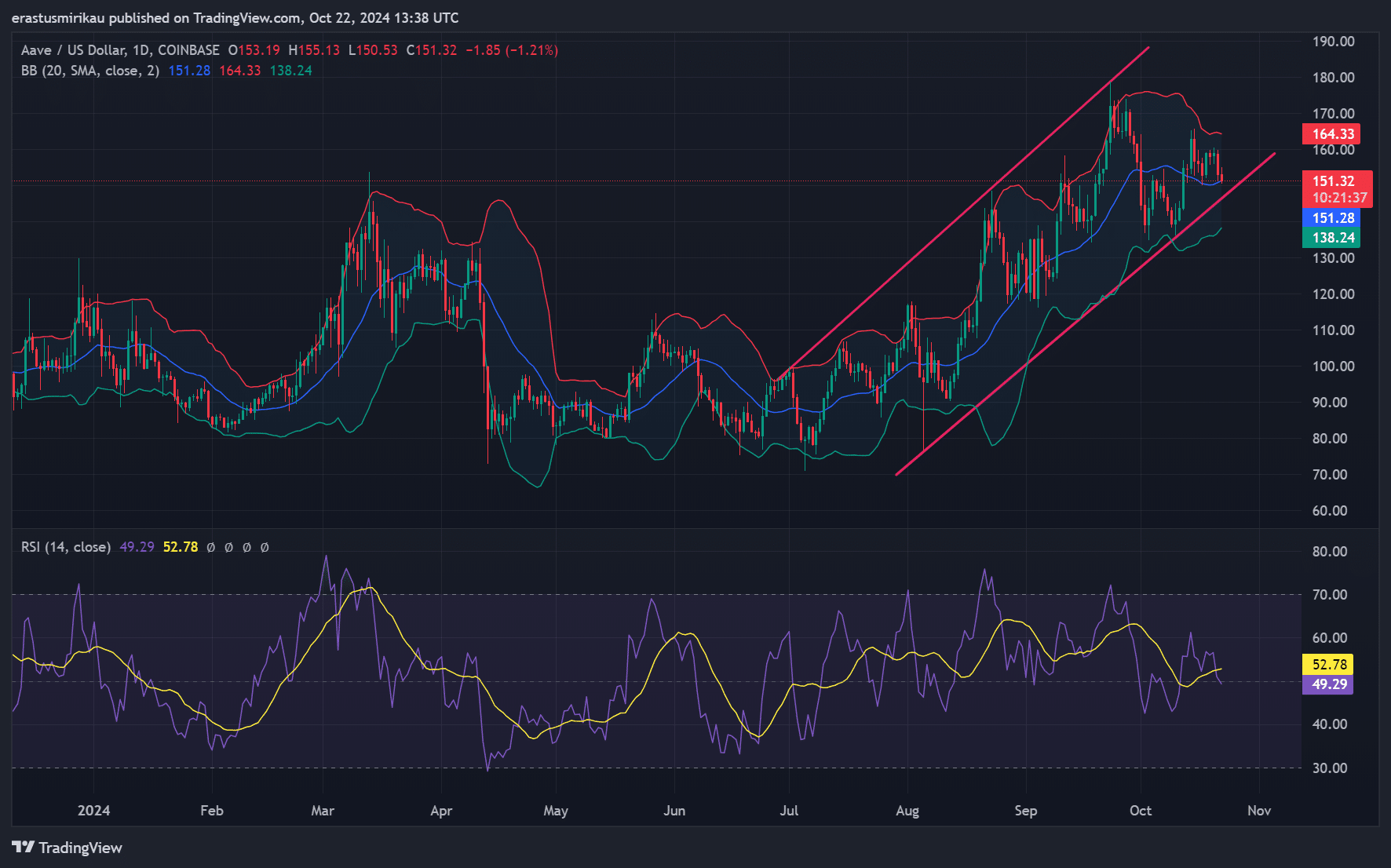

AAVE currently trades at $151.13, down by 1.55% at press time. The price hovers in the middle of its Bollinger Bands, indicating consolidation.

The RSI is neutral at 49.29, not signaling overbought or oversold conditions. Therefore, while AAVE shows potential for a breakout, the price may retrace before any significant rally.

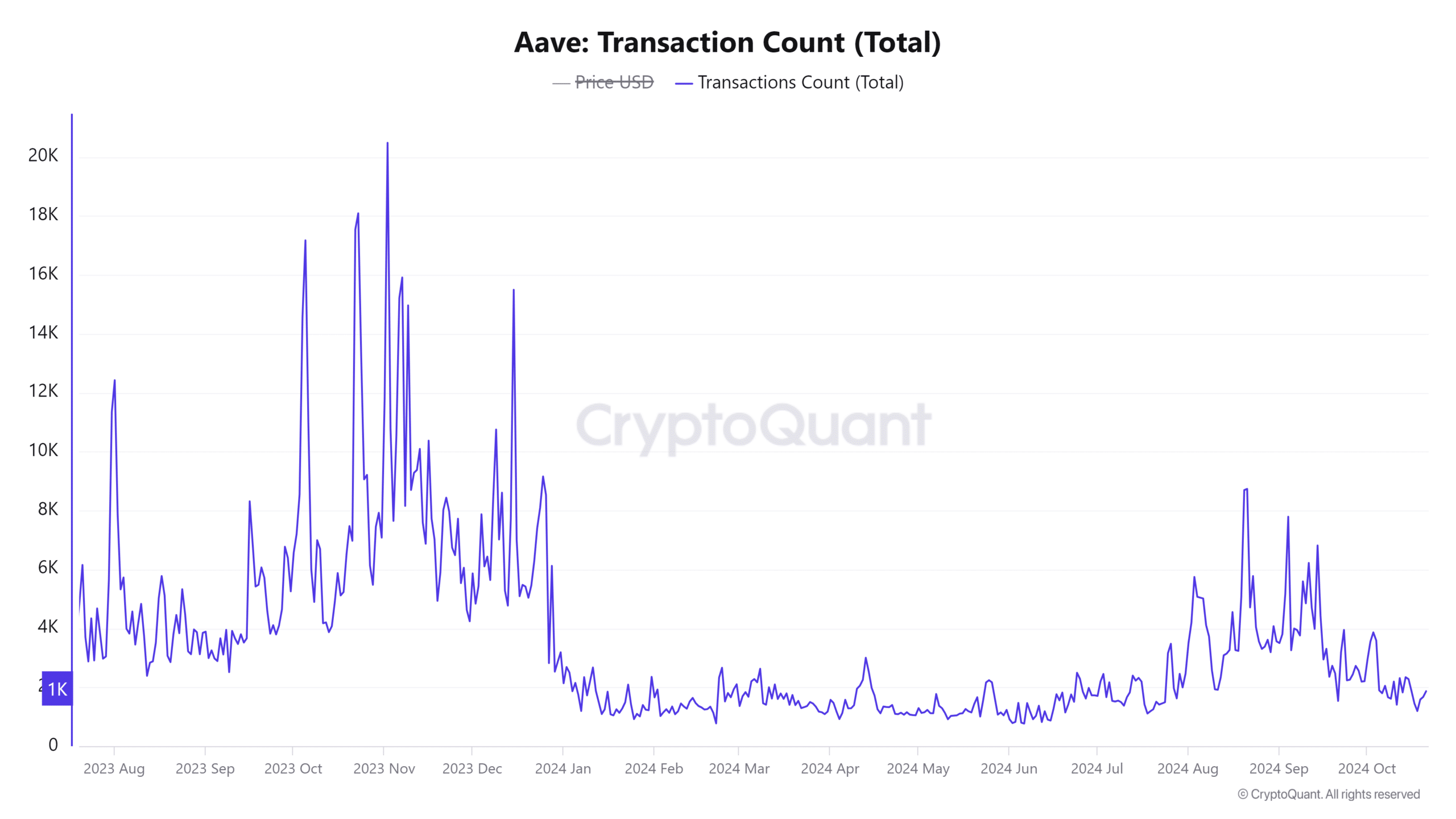

Transaction count hints at growing activity

Interestingly, AAVE’s transaction count has seen a slight uptick, growing by 0.84% to 1.662K transactions over the past 24 hours. This rise indicates that despite the minor price decline, activity on the network is holding steady.

If this continues, particularly as more users adopt the GHO token, it could act as a bullish catalyst for the token. Consequently, sustained growth in transaction volume may be essential for maintaining any bullish sentiment.

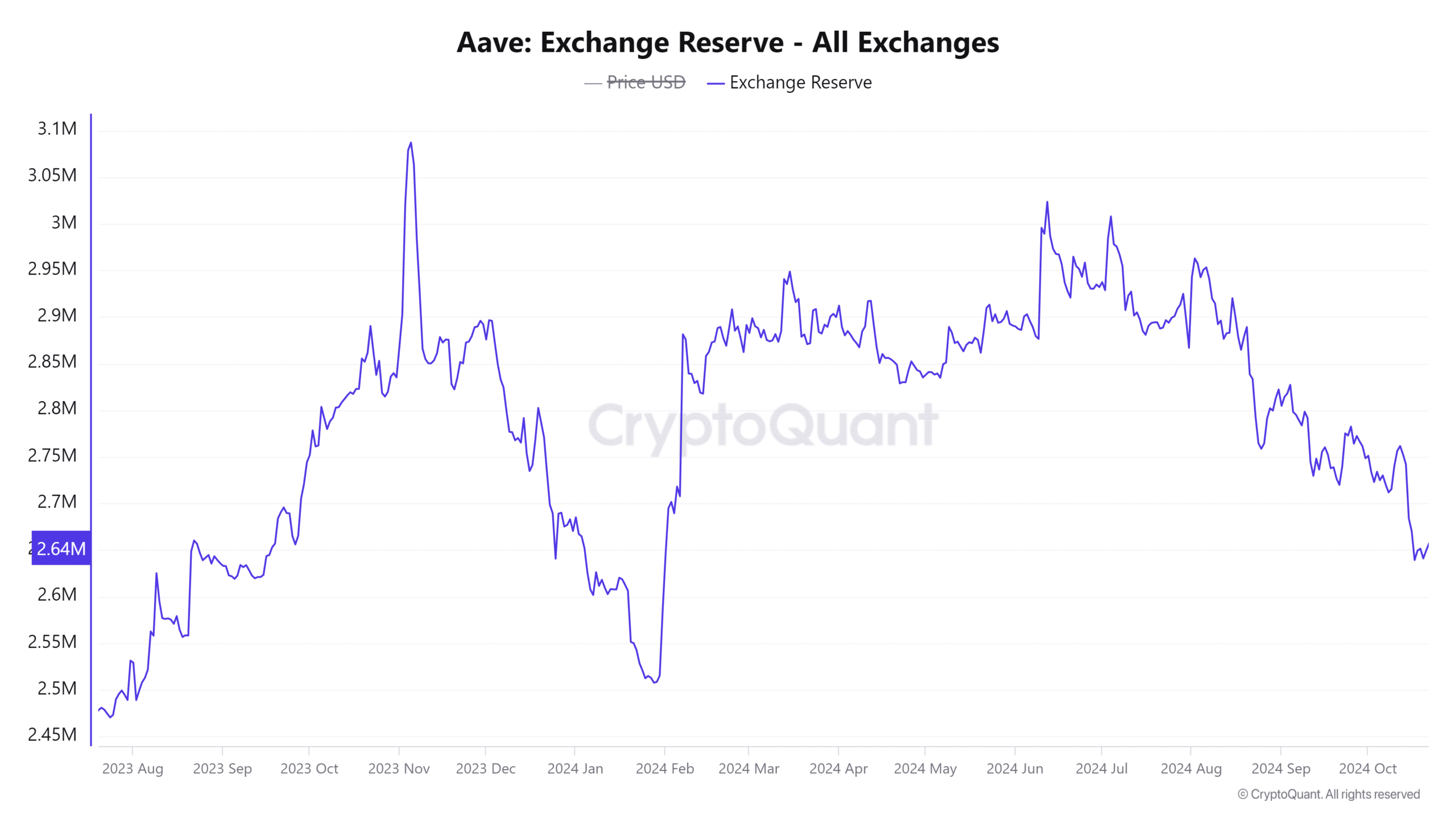

Exchange reserves: Higher selling pressure looming?

Additionally, AAVE’s exchange reserves have increased by 0.55%, now standing at 2.6578M tokens. Higher reserves typically signal an increase in selling pressure, as more tokens are held on exchanges, likely in preparation for liquidation.

As a result, this trend may counteract any potential price rally. If reserves continue to rise, the risk of increased selling pressure could dampen any immediate bullish breakout.

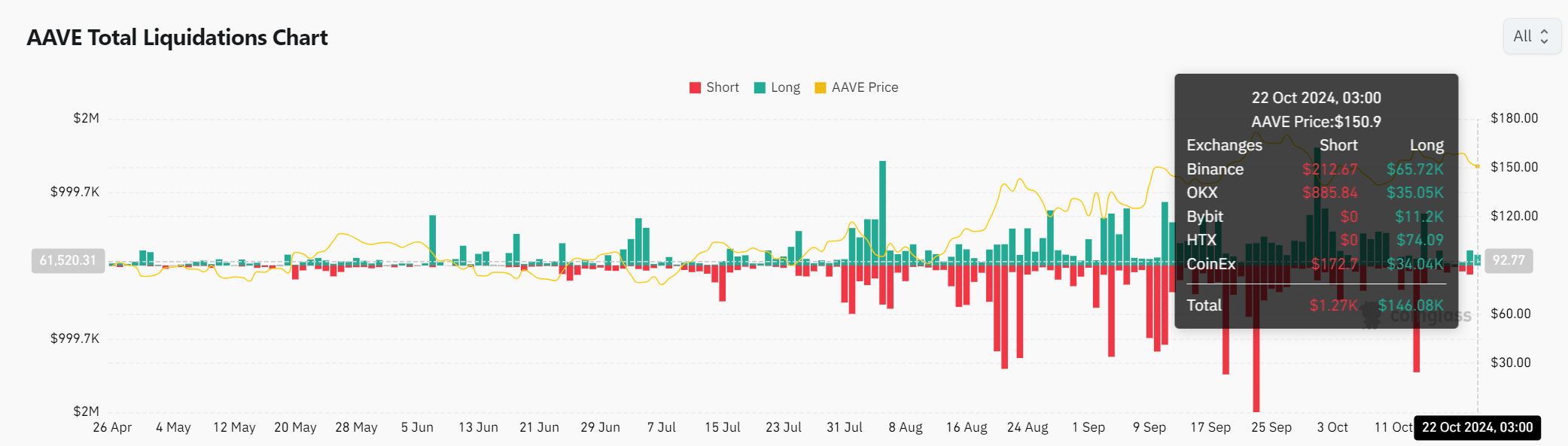

Liquidation data: Bears taking the lead?

Looking at liquidation data, a notable $1.27M in short positions have been liquidated compared to $146.08K in long positions. This imbalance shows that sellers currently hold more control in the market.

However, if buyers begin to close the gap, particularly on larger exchanges like Binance, this could shift momentum in favor of a price rally.

Read Aave’s [AAVE] Price Prediction 2024–2025

Aave’s GHO launch presents a promising opportunity for bullish momentum, but several factors like rising exchange reserves and short-term selling pressure could hold back an immediate rally.

Therefore, while AAVE shows potential, market conditions must improve for a sustained upward breakout to occur.