Solana traders, look out for these levels to identify a bull run!

- Solana’s recent price action broke through key levels, trading above its 50-day and 200-day moving averages

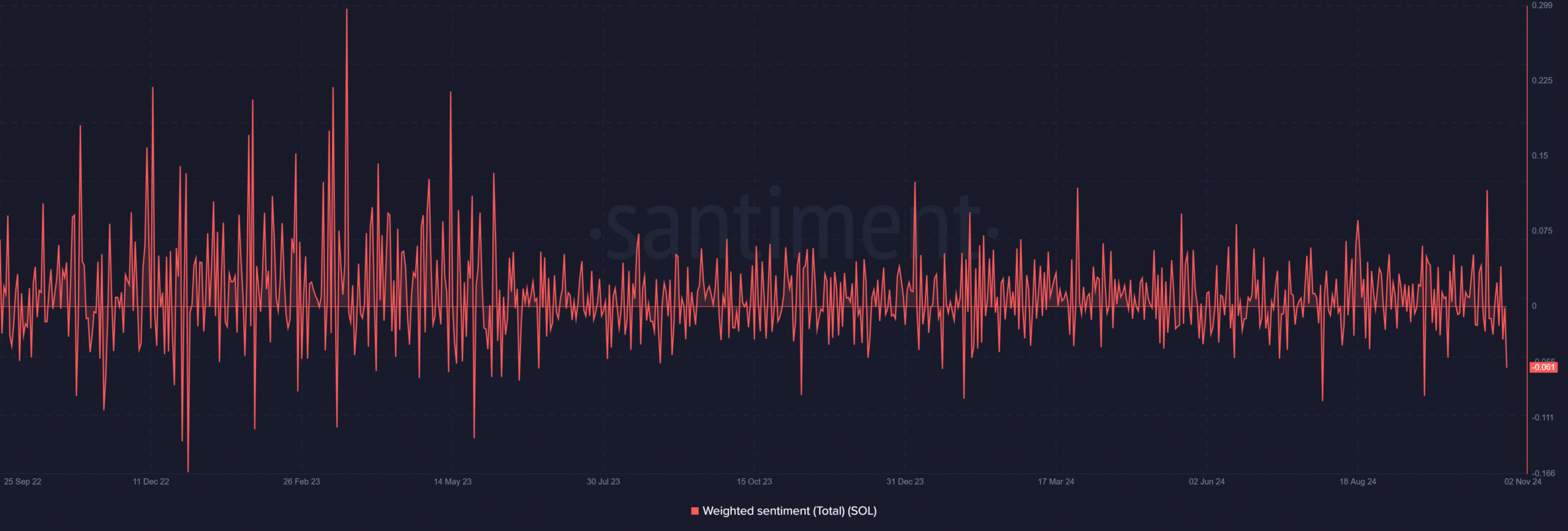

- Sentiment remained cautious, with SOL’s weighted sentiment in slightly negative territory

With Solana [SOL] gaining traction among investors, many are eager to see if it has entered a new bull phase or not. However, while its recent price action did hint at some upward momentum at press time, its technical indicators weren’t all in agreement.

Hence, it’s worth analyzing Solana’s technical and sentiment data to understand whether we’re on the verge of a true Solana bull run.

Technical indicators show strong momentum

At press time, SOL was trading at $166.71. This suggested that Solana’s recent movements have pushed it past important levels on the charts. In fact, its ongoing trend puts it above its 50-day Moving Average (MA) of $153.22 and the 200-day MA at $151.11.

Taken together, these levels indicated solid support, potentially boosting bullish sentiment.

Additionally, the Bollinger Bands have begun to widen too, suggesting a possible hike in volatility. Such a finding often accompanies major price movements. The MACD indicator recently noted a bullish crossover too, underscoring the upward trend.

With the RSI at 53.61, SOL appeared to be far from overbought. What this meant was that there may be room for growth if momentum sustains itself.

While the technical indicators seemed to be promising, they fell short of confirming a long-term bull trend.

For Solana to establish a sustained bull market, it would need to hold this momentum consistently. Also, it would need to break the psychological $200-mark. This is a level that could strengthen investor confidence in the altcoin.

Solana’s outlook among traders

Investor sentiment around Solana has remained mixed lately.

In fact, Santiment’s data highlighted recent dips into negative territory, with the sentiment index at -0.061 at press time. This finding can be seen as a sign of caution among market participants, given the broader market’s uncertain environment.

On the contrary, it’s worth pointing out that the altcoin’s price action suggested that Solana has been battling early resistance levels – Typical of a new bull market.

If Solana continues to climb, optimism could spread. This could attract more interest from both retail and institutional investors

Key levels to watch for Solana’s bull run

For now, Solana’s bull run potential remains unconfirmed.

The next significant test for SOL is sustaining its position above $170. After that, it must break through the $180-$200 resistance range, as this range has been a historically tough barrier.

Successfully maintaining these levels would likely trigger further investor interest and support a bullish outlook.

– Is your portfolio green? Check out the Solana Profit Calculator

At the time of writing, Solana appeared to be poised for growth, with technical indicators favoring a positive trend.

While market sentiment remained cautious, a breakthrough in key psychological levels could solidify confidence and push SOL into a confirmed bull phase. If SOL sustains its momentum and crosses critical resistance points, the stage could be set for a major bull run.