FLOKI erases all October gains – How far can the price pullback go?

- FLOKI’s pullback hit 20% ahead of the U.S elections

- Will the pullback extend as FLOKI’s accumulation trend picks momentum?

Although memecoins topped October’s performance charts again, November started off bumpy. They were the first casualty of de-risking ahead of a volatile U.S election week, with FLOKI dumping by 20% and erasing all of October’s gains.

But, how far can the pullback go before a potential recovery attempt?

FLOKI’s pullback

We placed a Fibonacci retracement tool (yellow) between July’s highs and August’s lows. Throughout October, the 78.6% Fib level ($0.00012) has been a key short-term support. The next immediate support was April’s low, which stopped the intense August sell-off.

These two support levels could help stop FLOKI from extra bleeding, especially if Bitcoin [BTC] reverses its recent losses after the U.S elections.

However, in case of a broader market dump after the elections and if FLOKI fails to hold the above support levels, August’s low and $0.00069 could be the next key levels of interest.

The below-average RSI reading showed that bears still had the market edge, and the sluggish OBV (on-balance volume) reinforced the lack of strong spot demand for FLOKI in recent weeks.

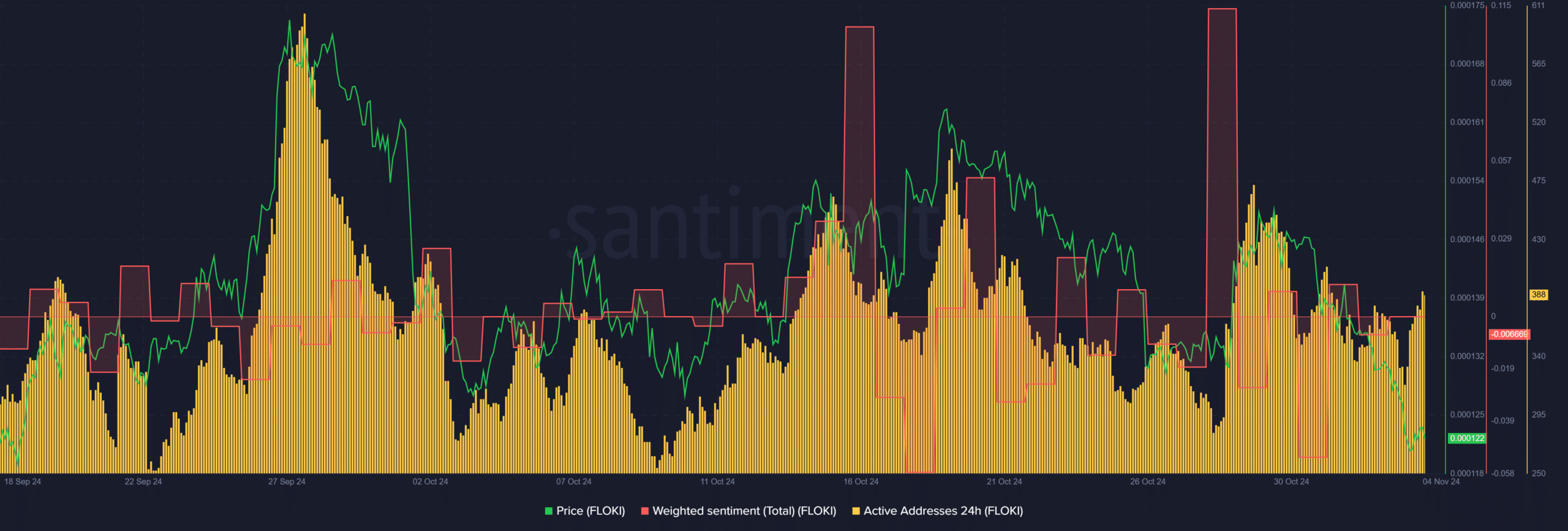

Metrics signal steady accumulation

On-chain metrics suggested a steady accumulation trend, which signaled a potential rebound could be on the cards. At press time, market sentiment was neutral, meaning that FLOKI’s prices could go either down or up.

However, the higher high in daily active addresses suggested renewed market interest after a recent pre-election dip. This could be a build-up of demand that could trigger a likely reversal above the support levels mentioned on the price charts.

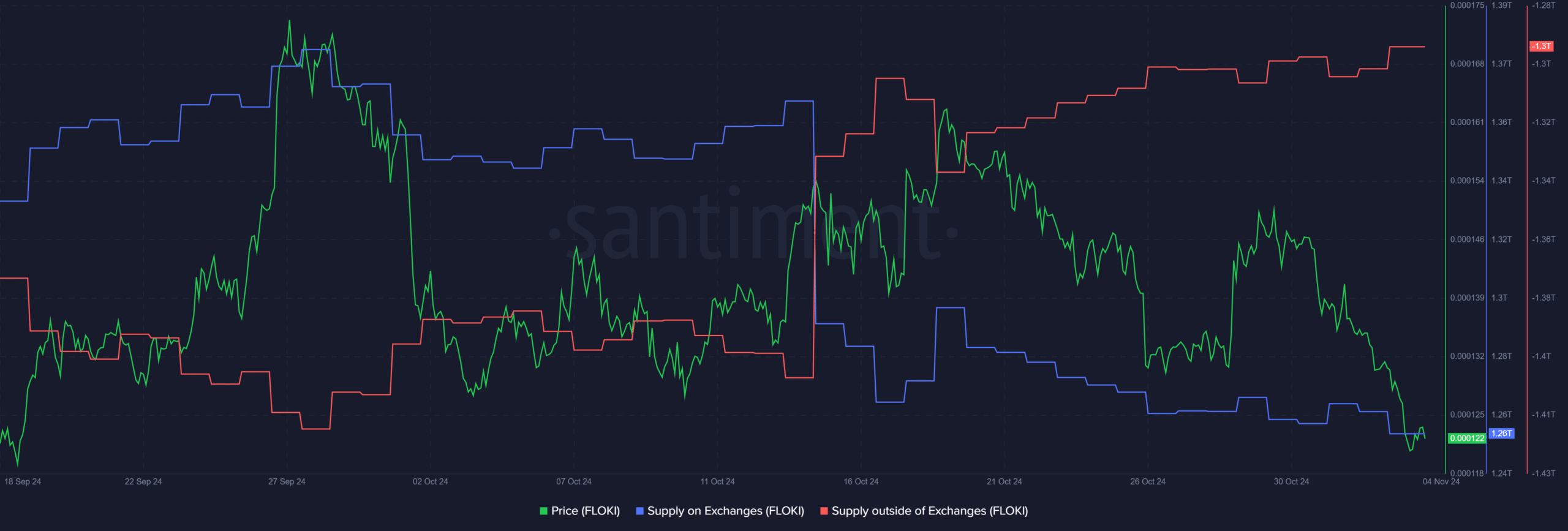

This optimistic outlook was further supported by the steady and rising accumulation of FLOKI tokens, as shown by the gradual uptick in supply outside of exchanges since mid-October.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Perhaps the most important piece was the reduced sell pressure on exchanges, despite the recent 20% dump. Supply on exchanges has been on a downtrend since late September, indicating less FLOKI was available for sale on centralized exchanges.

With the reduced supply overhang, this could offer FLOKI the headroom for recovery. However, the U.S election’s outcome will determine the short-term market sentiment and investors’ reaction to FLOKI.