Stellar: What’s next for XLM after 220% surge? Assessing…

- XLM’s incredible rally indicated intense buying pressure despite the altcoin season not fully kicking in.

- A short-term pullback from the overbought levels cannot be ruled out, given the overbought levels.

Stellar [XLM] has been on a parabolic rise as bullish sentiment around Bitcoin [BTC] fueled a rally, pushing Stellar to touch its multi-yearly highs.

At the time of writing, XLM traded at $0.3027 after witnessing a 26% increase in the last 24 hours. With the RSI resting above 86 and the market being heavily overbought, a potential pullback could be on the horizon.

However, the market remains in a bullish phase, so any change in broader market sentiment could significantly impact XLM’s path.

Can XLM bulls hold on after 220% surge?

While the altcoin season was yet to arrive (given Ethereum’s [ETH] weak performance), XLM stood out among most altcoins after witnessing an over 220% jump in the past 17 days.

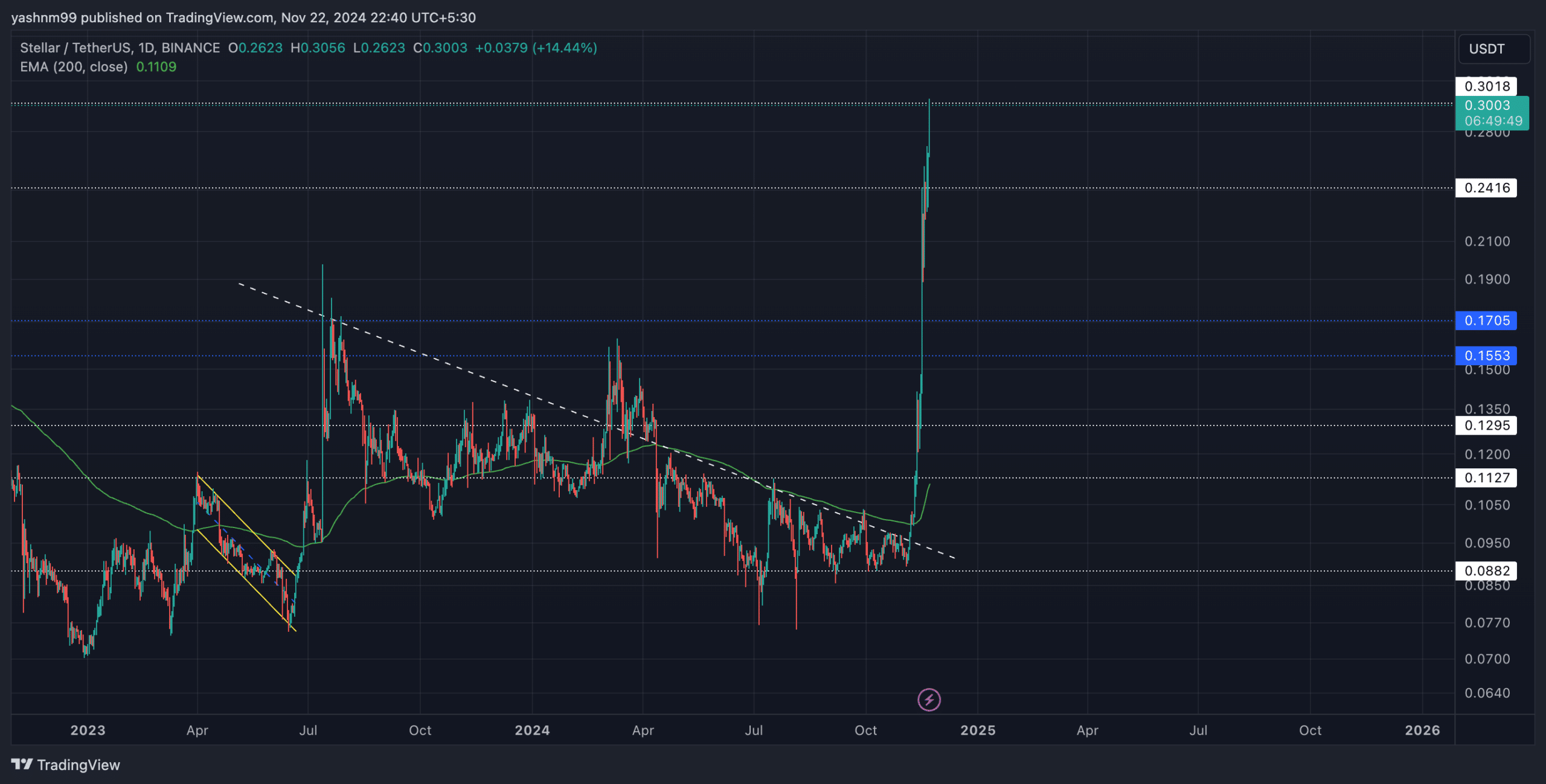

This surge came after finding support at the $0.08 level, leading the bulls to push above the critical 200-day EMA (at $0.1109 at press time).

As a result, XLM touched its 35-month high on the 22nd of November to test resistance at the $0.3 mark. The current price action has set XLM near this resistance zone.

Any close above this level can set the stage for bulls to march toward the $0.4 resistance in the coming weeks.

A near-term failure to breach this level might lead to a retracement toward the $0.24 support, which aligns with the previously breached trendline resistance.

The ongoing rally, backed by Bitcoin’s historic climb to new all-time highs, gives hope for continued upward momentum. However, the overbought RSI could trigger a possible consolidation or retracement soon.

Key levels to watch

Resistance: The $0.3 level is a major resistance level for bulls. A successful break above this can take XLM to the next resistance level, $0.4.

Support: On the downside, immediate support is positioned around $0.24. An unlikely fall below this could lead XLM to revisit the $0.17 region.

XLM derivatives data analysis

Trading volume has surged by 92.97% to reach $2.32 billion—a significant uptick implying strong interest in the ongoing rally.

Open Interest rose by 56.83% to $174.74 million, suggesting traders are increasingly placing positions and possibly expecting major moves.

The 24-hour long/short ratio for XLM stood at 0.9743, indicating a reasonably balanced sentiment.

Read Stellar’s [XLM] Price Prediction 2024–2025

However, the Long/Short Ratio for accounts and top traders on Binance was more optimistic at 1.0186 and 1.0346, indicating a slight edge for bulls.

Buyers should still monitor Bitcoin’s movement and assess the overall market sentiment before opening a long or short position.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion