SAND explodes 53%: Why $0.807 could be the next big target!

- SAND breaks its long-term downtrend with a 53.39% surge, eyeing the $0.807 target.

- Open interest spikes 134.61%, while bullish on-chain metrics signal sustained upward momentum.

The Sandbox [SAND], a leading metaverse token, has taken the crypto market by storm with a remarkable 53.39% surge in the last 24 hours, climbing to $0.6112. Trading volume has skyrocketed by an incredible 557.67% to $1.87 billion, while its market cap stands at $1.46 billion.

At press time, SAND appears poised for further gains, raising the question: can this metaverse token sustain its momentum and lead the market revival?

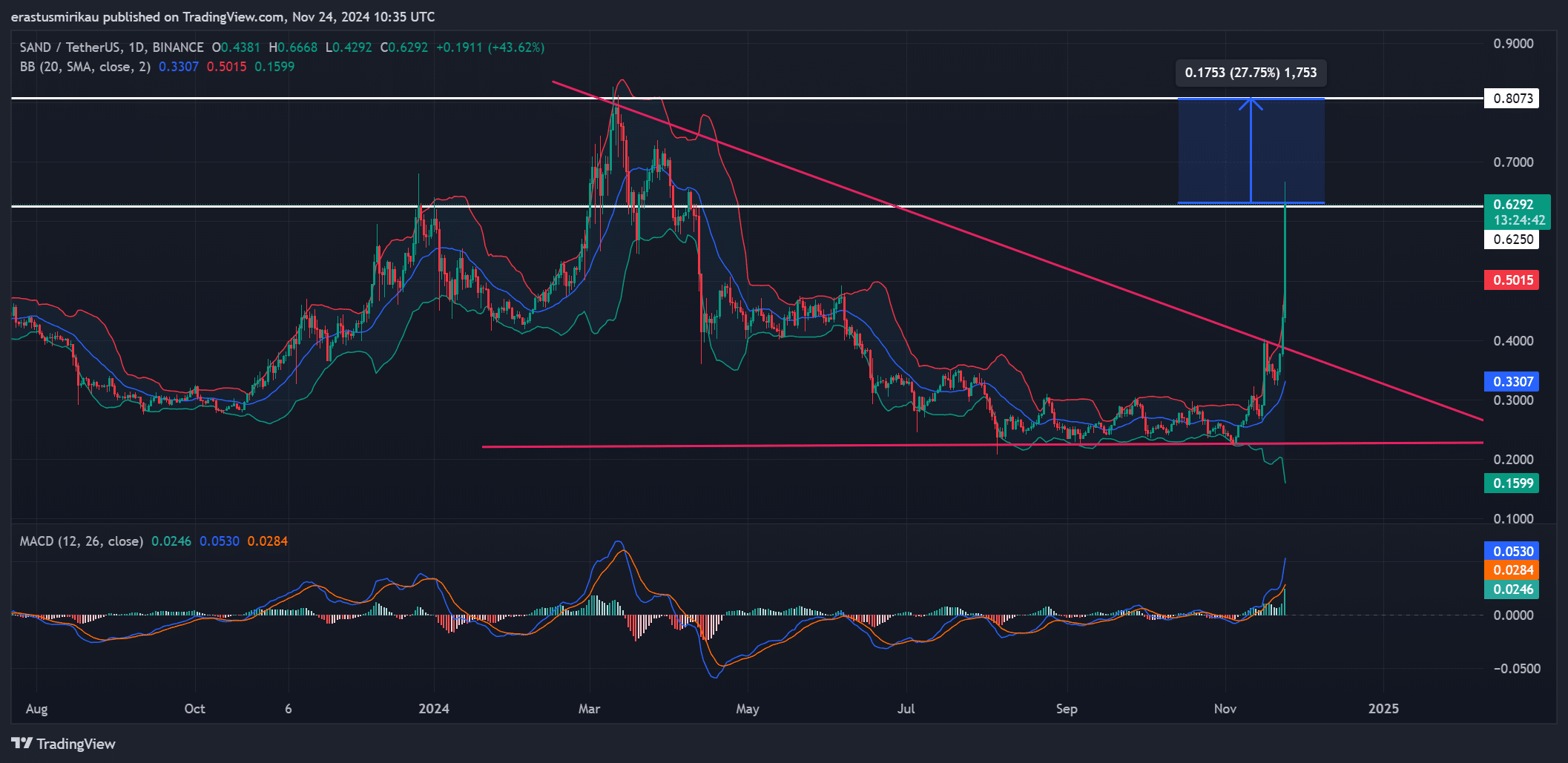

SAND breaks free from the downtrend

SAND has shattered its long-term descending trendline, signaling the end of a months-long bearish cycle. This decisive breakout has been accompanied by strong bullish momentum, as demonstrated by its current trading price of $0.6323.

Importantly, the price has surged past the $0.625 resistance level, now turning it into critical support. Consequently, the next major target lies at $0.807, a move that could represent a further 27.75% gain.

Additionally, if the token fails to maintain its upward trajectory, $0.625 will serve as a crucial floor to watch. A pullback to this level could allow for consolidation before the next move higher.

From a technical perspective, the MACD shows growing bullish momentum, with the MACD line at 0.0530 surging above the signal line at 0.0284, indicating strong buying activity. This widening gap highlights the continuation of upward momentum.

Furthermore, Bollinger Bands demonstrate increased volatility, with the price at $0.6323 trading well above the upper band at $0.5015, reflecting heavy buying pressure.

Therefore, while the momentum remains strong, traders should prepare for potential price swings near the critical $0.807 resistance level.

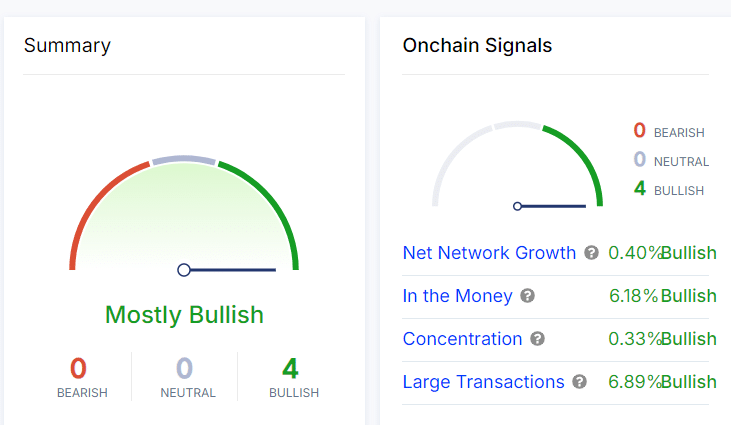

On-chain metrics point to confidence

Interestingly, on-chain metrics further bolster the bullish case for SAND. Net network growth has risen by 0.40%, reflecting growing adoption.

Meanwhile, 6.18% of addresses are now in profit, and large transactions have surged by 6.89%, signaling increasing interest from institutional players. Additionally, a 0.33% increase in concentration points to growing confidence among key holders.

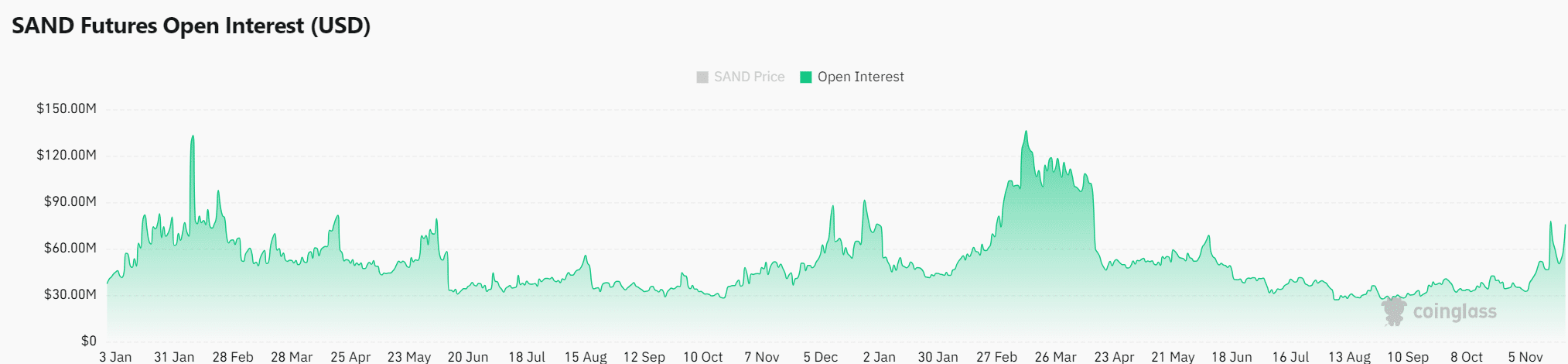

Open interest surges as market bets big

The derivatives market has seen a dramatic 134.61% spike in open interest, now totaling $151.89 million. This increase indicates that traders are heavily betting on SAND’s sustained bullish momentum.

Consequently, this surge in speculative interest strengthens the likelihood of continued upward movement.

Realistic or not, here’s SAND market cap in BTC’s terms

Conclusion: Can SAND lead the next rally?

SAND’s breakout above its downtrend, coupled with bullish on-chain metrics and soaring open interest, signals that the token is well-positioned for further gains.

Therefore, as long as it holds above $0.625, SAND is likely to test $0.807 in the coming days. It appears the metaverse rally has just begun, with SAND leading the charge.